Region:Middle East

Author(s):Shubham

Product Code:KRAA1053

Pages:100

Published On:August 2025

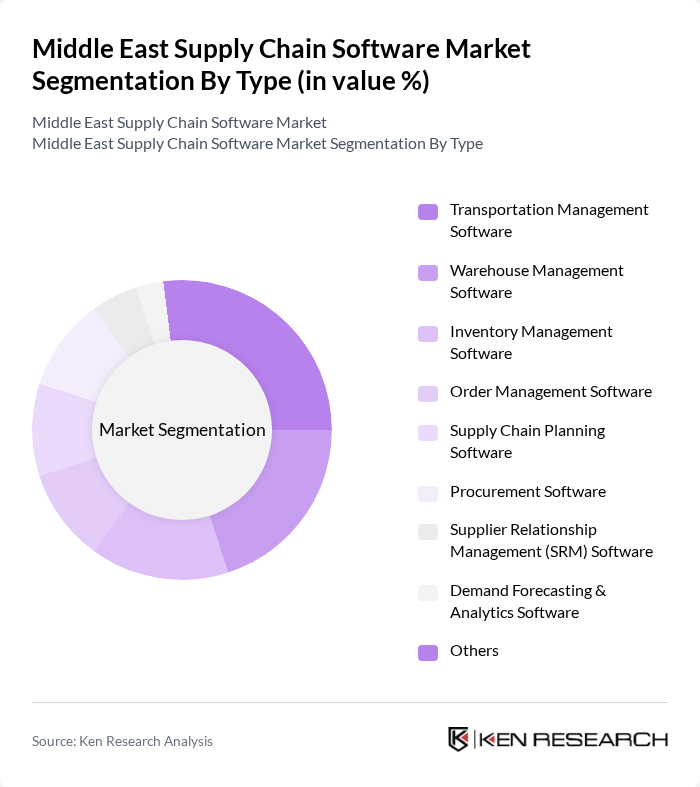

By Type:The market is segmented into several software solution categories that address distinct supply chain functions. Key subsegments include:

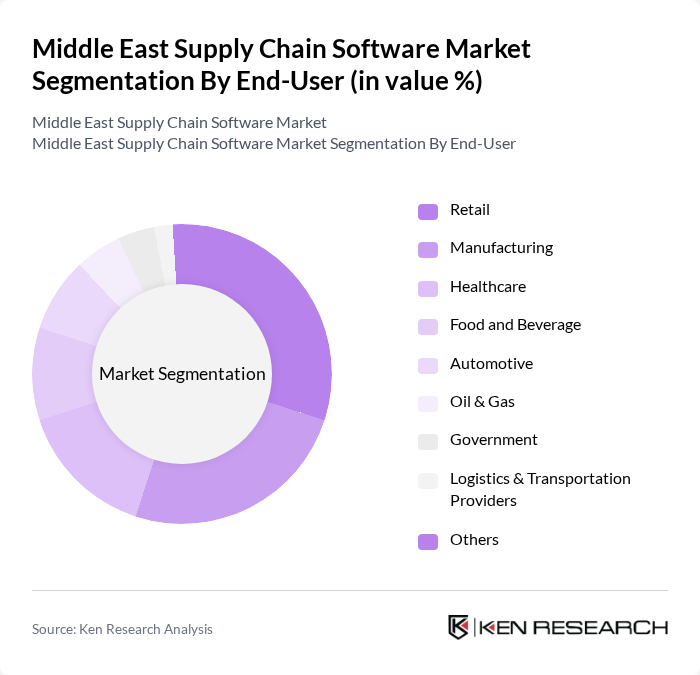

By End-User:The market is also segmented by end-user industries that leverage supply chain software solutions to streamline operations and improve efficiency. Key subsegments include:

The Middle East Supply Chain Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP, Oracle, Microsoft, Infor, Blue Yonder (formerly JDA Software), Manhattan Associates, Kinaxis, IBM, Epicor, Coupa Software, IFS, E2open, Logility, Oracle NetSuite, Sary (Saudi Arabia), OMP, Softeon, Infor Nexus, SAP Ariba, and FourKites contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East supply chain software market appears promising, driven by technological advancements and increasing investments in digital infrastructure. As companies prioritize automation and data analytics, the demand for innovative software solutions is expected to rise. Additionally, the ongoing development of smart cities and the integration of AI technologies will further enhance operational efficiencies, enabling businesses to adapt to changing market dynamics and consumer expectations effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Inventory Management Software Order Management Software Supply Chain Planning Software Procurement Software Supplier Relationship Management (SRM) Software Demand Forecasting & Analytics Software Others |

| By End-User | Retail Manufacturing Healthcare Food and Beverage Automotive Oil & Gas Government Logistics & Transportation Providers Others |

| By Component | Software Services Hardware |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Cloud-based On-premises |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Software | 100 | Supply Chain Managers, IT Directors |

| Manufacturing Operations Software | 80 | Operations Managers, Production Supervisors |

| Logistics Management Solutions | 60 | Logistics Coordinators, Warehouse Managers |

| E-commerce Fulfillment Software | 70 | eCommerce Managers, IT Specialists |

| Transportation Management Systems | 50 | Transport Managers, Fleet Coordinators |

The Middle East Supply Chain Software Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficient logistics and supply chain management solutions across the region.