Region:Europe

Author(s):Geetanshi

Product Code:KRAA2749

Pages:83

Published On:August 2025

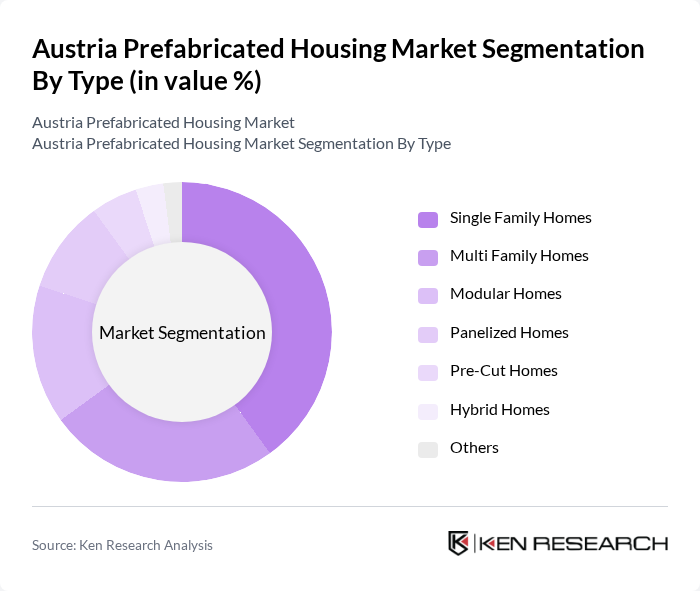

By Type:The prefabricated housing market can be segmented into various types, including Single Family Homes, Multi Family Homes, Modular Homes, Panelized Homes, Pre-Cut Homes, Hybrid Homes, and Others. Among these, Single Family Homes remain the most popular choice due to their appeal to individual homeowners seeking customizable and efficient living spaces. Modular Homes are gaining traction, particularly among younger buyers looking for modern designs, flexible layouts, and sustainable options. The demand for Multi Family Homes is increasing as urban areas face persistent housing shortages, leading to a rise in multi-unit developments and collective housing projects. Panelized and hybrid systems are also seeing adoption for their speed and adaptability in urban infill and redevelopment projects .

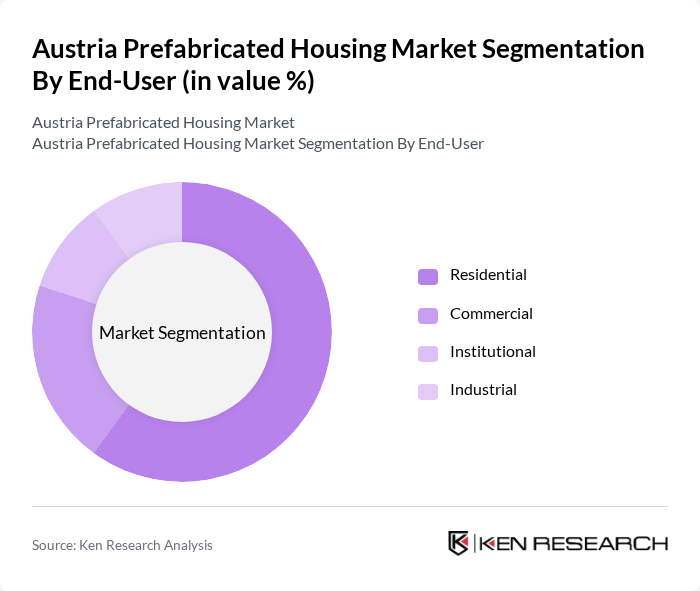

By End-User:The market can be segmented based on end-users into Residential, Commercial, Institutional, and Industrial. The Residential segment is the largest, driven by the increasing need for affordable and energy-efficient housing solutions. The Commercial segment is also significant, as businesses seek prefabricated structures for offices, retail spaces, and hospitality projects due to their quick assembly and cost-effectiveness. Institutional and Industrial segments are growing, with schools, healthcare facilities, and factories adopting prefabricated solutions for their construction needs, especially where speed and flexibility are critical .

The Austria Prefabricated Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ELK Fertighaus GmbH, Swietelsky AG, Wimberger Holding GmbH, Kieninger Gesellschaft m.b.H., Georg Fessl GmbH, Hartl Haus Holzindustrie GmbH, Griffnerhaus GmbH, Hanlo Haus GmbH, Vario Haus Fertighaus GesmbH, Wolf Systembau Gesellschaft m.b.H., Haas Fertigbau Holzbauwerk Ges.m.b.H., ZENKER Hausbau GmbH, Glorit Bausysteme GmbH, Buchner Holzbau GmbH, and WOLF Haus GmbH contribute to innovation, geographic expansion, and service delivery in this space .

The future of the prefabricated housing market in Austria appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As cities expand, the demand for efficient housing solutions will likely rise, with prefabricated homes offering a viable alternative. Additionally, advancements in technology will continue to enhance construction processes, making them more efficient and cost-effective. The market is expected to evolve, focusing on customization and smart home integration, catering to the preferences of modern consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Family Homes Multi Family Homes Modular Homes Panelized Homes Pre-Cut Homes Hybrid Homes Others |

| By End-User | Residential Commercial Institutional Industrial |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low-End Mid-Range High-End |

| By Application | Single-Family Homes Multi-Family Units Commercial Buildings Hospitality Office Retail |

| By Material Used | Wood Steel Concrete Aluminium Glass Other |

| By Region | Vienna Lower Austria Upper Austria Styria Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Prefabricated Housing | 100 | Homeowners, Architects, Builders |

| Commercial Prefabricated Structures | 60 | Real Estate Developers, Project Managers |

| Government Housing Initiatives | 40 | Policy Makers, Urban Planners |

| Consumer Preferences in Housing | 80 | Potential Homebuyers, Market Analysts |

| Sustainability in Prefabricated Housing | 50 | Sustainability Consultants, Environmental Engineers |

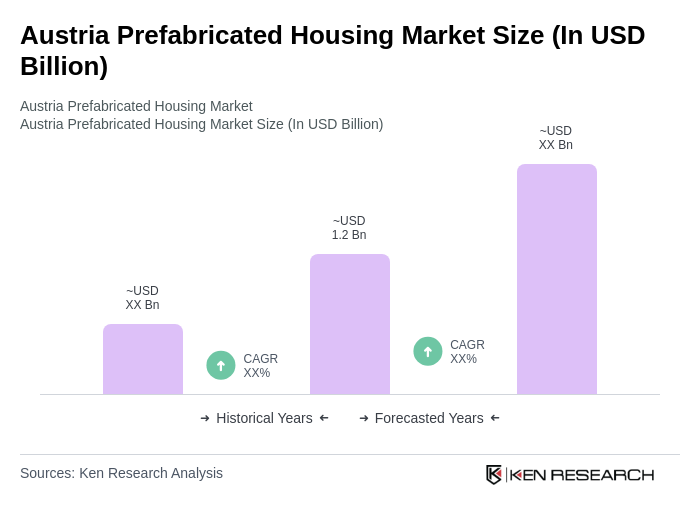

The Austria Prefabricated Housing Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for affordable housing, urbanization, and advancements in construction technology.