Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4183

Pages:87

Published On:December 2025

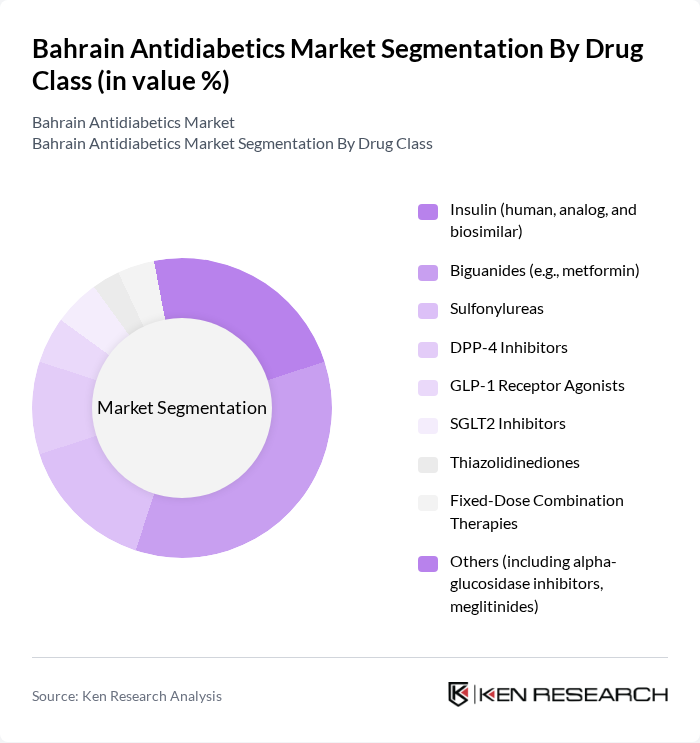

By Drug Class:The drug class segmentation includes various categories of antidiabetic medications that cater to different patient needs. The subsegments are Insulin (human, analog, and biosimilar), Biguanides (e.g., metformin), Sulfonylureas, DPP-4 Inhibitors, GLP-1 Receptor Agonists, SGLT2 Inhibitors, Thiazolidinediones, Fixed-Dose Combination Therapies, and Others (including alpha-glucosidase inhibitors, meglitinides). Among these, Biguanides, particularly metformin, dominate the market due to their widespread use as first-line therapy for Type 2 diabetes, driven by their efficacy, safety profile, and cost-effectiveness.

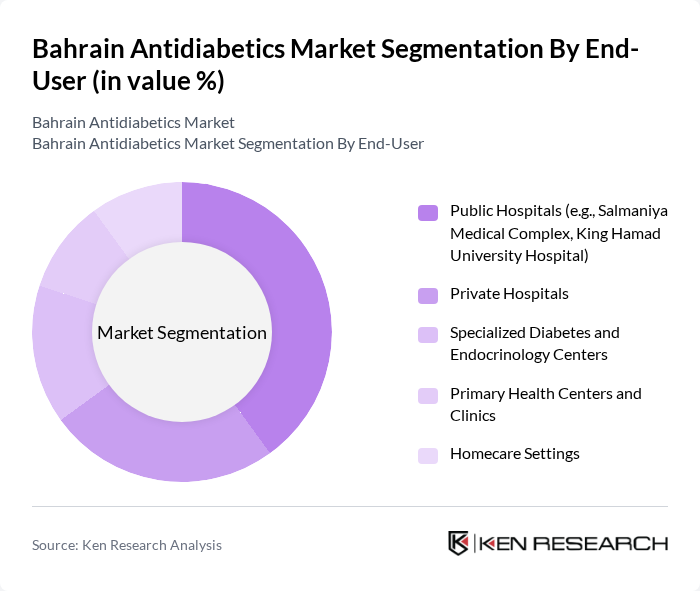

By End-User:The end-user segmentation encompasses various healthcare settings where antidiabetic medications are utilized. This includes Public Hospitals (e.g., Salmaniya Medical Complex, King Hamad University Hospital), Private Hospitals, Specialized Diabetes and Endocrinology Centers, Primary Health Centers and Clinics, and Homecare Settings. Public hospitals are the leading segment due to their extensive patient base, integration with Bahrain’s primary care referral system, and government funding that ensures the availability of essential diabetes medications and treatment services at low or no cost for citizens.

The Bahrain Antidiabetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Sanofi S.A., Merck & Co., Inc. (Merck Sharp & Dohme), Eli Lilly and Company, Boehringer Ingelheim International GmbH, AstraZeneca plc, Bayer AG, Johnson & Johnson (Janssen Pharmaceuticals), GlaxoSmithKline plc, Takeda Pharmaceutical Company Limited, Hikma Pharmaceuticals PLC, Julphar – Gulf Pharmaceutical Industries PSC, Abbott Laboratories (including Abbott Diabetes Care), Roche Diabetes Care (F. Hoffmann-La Roche Ltd), Local & Regional Distributors (e.g., Kooheji Pharma, Behzad Medical Establishment) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain antidiabetics market is poised for significant transformation as healthcare policies evolve and technology integration accelerates. With a focus on preventive healthcare and personalized medicine, stakeholders are likely to invest in innovative solutions that enhance patient engagement and adherence. The anticipated growth in telemedicine and digital health platforms will further facilitate access to diabetes management resources, ultimately improving health outcomes and expanding market potential in future.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Insulin (human, analog, and biosimilar) Biguanides (e.g., metformin) Sulfonylureas DPP-4 Inhibitors GLP-1 Receptor Agonists SGLT2 Inhibitors Thiazolidinediones Fixed-Dose Combination Therapies Others (including alpha-glucosidase inhibitors, meglitinides) |

| By End-User | Public Hospitals (e.g., Salmaniya Medical Complex, King Hamad University Hospital) Private Hospitals Specialized Diabetes and Endocrinology Centers Primary Health Centers and Clinics Homecare Settings |

| By Patient Demographics | Type 1 Diabetes Patients Type 2 Diabetes Patients Gestational Diabetes Patients Pre-diabetic / High-Risk Population |

| By Distribution Channel | Hospital Pharmacies Retail Community Pharmacies Online Pharmacies and E-Health Platforms Government Central Tender & Bulk Procurement |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| By Therapy Regimen | Monotherapy Dual Combination Therapy Triple or Higher Combination Therapy |

| By Payer Type | Public Funding and Government Insurance Private Insurance Out-of-Pocket (Self-Pay) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists and Diabetes Specialists | 40 | Healthcare Providers, Clinical Researchers |

| Pharmacists in Retail Settings | 50 | Pharmacy Managers, Community Pharmacists |

| Diabetes Patients | 120 | Type 1 and Type 2 Diabetes Patients |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Public Health Experts |

| Diabetes Educators and Nutritionists | 50 | Dietitians, Diabetes Educators |

The Bahrain Antidiabetics Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of diabetes and rising healthcare expenditures in the region.