Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1195

Pages:92

Published On:November 2025

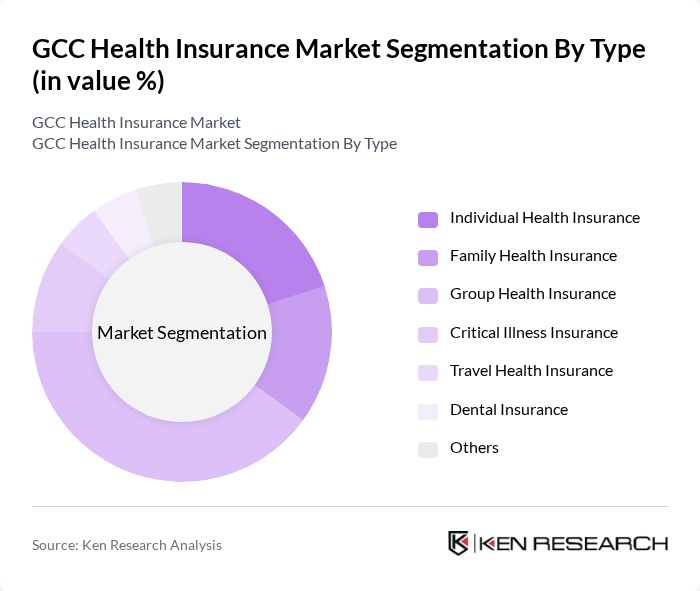

By Type:The segmentation by type includes various health insurance products tailored to meet the diverse needs of consumers. The subsegments are Individual Health Insurance, Family Health Insurance, Group Health Insurance, Critical Illness Insurance, Travel Health Insurance, Dental Insurance, and Others. Each of these subsegments caters to specific demographics and consumer preferences, reflecting the growing demand for personalized health coverage. Group Health Insurance and Individual Health Insurance are the most prominent segments, with Group Health Insurance particularly favored by corporates for employee benefits, and Individual Health Insurance appealing to self-employed and expatriate populations .

The Group Health Insurance subsegment is currently dominating the market due to the increasing number of corporates providing health benefits to their employees. This trend is driven by the need for companies to attract and retain talent, as well as to comply with government regulations mandating health coverage. Additionally, the rising costs of healthcare have prompted organizations to invest in comprehensive group plans that offer extensive coverage, making them a preferred choice for many businesses. The prominence of group policies is further supported by public and private sector mandates in countries such as the UAE and Saudi Arabia .

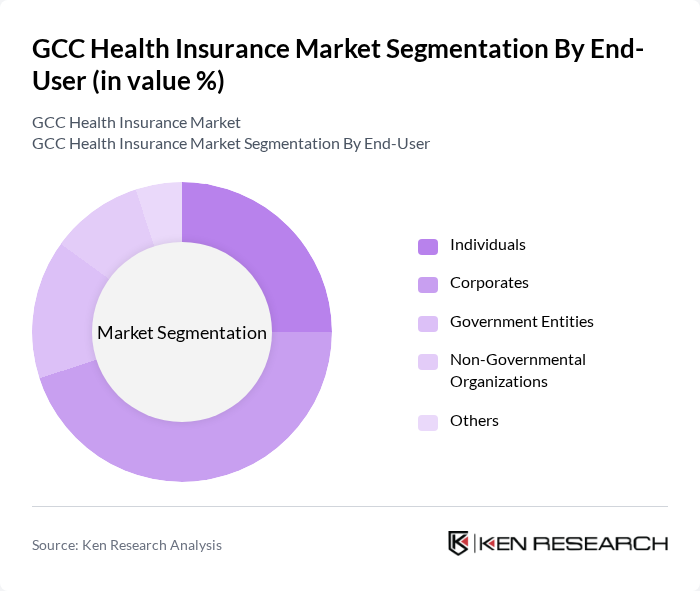

By End-User:The segmentation by end-user includes Individuals, Corporates, Government Entities, Non-Governmental Organizations, and Others. This classification helps in understanding the different consumer bases and their specific health insurance needs, which vary significantly across sectors. Corporates and government entities represent the largest segments due to widespread employer-sponsored and public sector health insurance schemes, while individual and family plans are increasingly popular among self-employed and expatriate populations .

Corporates are the leading end-user segment in the GCC Health Insurance Market, primarily due to the increasing trend of employers providing health insurance as part of employee benefits packages. This is further fueled by the competitive job market, where companies seek to enhance their value proposition to attract skilled talent. Additionally, corporates often opt for group health insurance plans, which provide comprehensive coverage at a lower cost per employee, making it a financially viable option. Government mandates in the UAE and Saudi Arabia further reinforce the importance of corporate and public sector health insurance .

The GCC Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daman Health Insurance (National Health Insurance Company – Daman), AXA Gulf (now GIG Gulf), Bupa Arabia for Cooperative Insurance, Qatar Insurance Company (QIC), Oman Insurance Company (now Sukoon Insurance), Abu Dhabi National Insurance Company (ADNIC), Al Ain Ahlia Insurance Company, MetLife Gulf, Saudi Arabian Cooperative Insurance Company (SAICO), Emirates Insurance Company, National Health Insurance Company (Daman), Al Sagr Cooperative Insurance Company, Gulf Insurance Group (GIG), United Cooperative Assurance Company (UCA), Trust International Insurance & Reinsurance Company (Trust Re) contribute to innovation, geographic expansion, and service delivery in this space .

The GCC health insurance market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. The integration of digital health solutions and telemedicine is expected to enhance service delivery, making healthcare more accessible. Additionally, the focus on preventive care will likely reshape insurance offerings, encouraging insurers to develop innovative products that cater to the changing needs of consumers. As the market evolves, strategic partnerships and investments in technology will be crucial for insurers to remain competitive.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Critical Illness Insurance Travel Health Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Governmental Organizations Others |

| By Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Others |

| By Coverage Type | Comprehensive Coverage Basic Coverage Supplemental Coverage Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Others |

| By Geographic Coverage | Urban Areas Rural Areas International Coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policyholders | 100 | Policyholders aged 25-60, diverse income levels |

| Corporate Health Insurance Buyers | 80 | HR Managers, Finance Directors from SMEs and large corporations |

| Healthcare Providers | 60 | Hospital Administrators, Clinic Managers |

| Insurance Brokers | 50 | Licensed insurance brokers with experience in health insurance |

| Regulatory Bodies | 40 | Officials from health ministries and insurance regulatory authorities |

The GCC Health Insurance Market is valued at approximately USD 18.5 billion, driven by factors such as rising healthcare costs, population growth, and increased awareness of health insurance benefits among consumers.