Region:Middle East

Author(s):Dev

Product Code:KRAD5201

Pages:97

Published On:December 2025

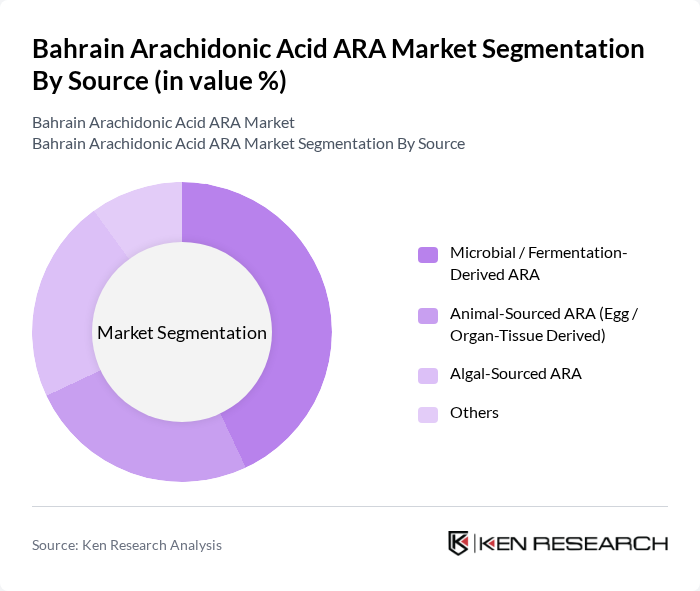

By Source:The market is segmented into four primary sources: Microbial / Fermentation-Derived ARA, Animal-Sourced ARA (Egg / Organ-Tissue Derived), Algal-Sourced ARA, and Others. Among these, the Microbial / Fermentation-Derived ARA segment is currently leading the market due to its widespread use in infant formulas and dietary supplements, driven by cost-effectiveness and scalability of production. The demand for ARA derived from microbial sources is bolstered by its established efficacy in promoting infant growth and development, making it a preferred choice among manufacturers.

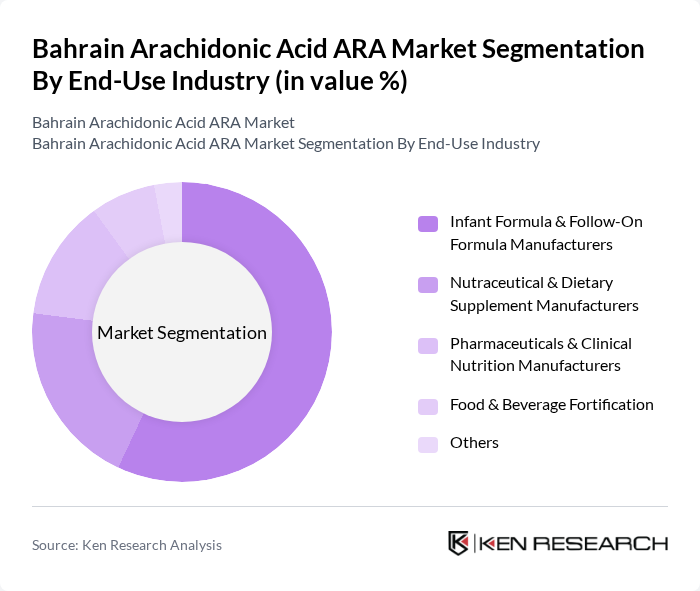

By End-Use Industry:This segmentation includes Infant Formula & Follow-On Formula Manufacturers, Nutraceutical & Dietary Supplement Manufacturers, Pharmaceuticals & Clinical Nutrition Manufacturers, Food & Beverage Fortification, and Others. The Infant Formula & Follow-On Formula Manufacturers segment is the dominant player in this market, driven by the increasing birth rates and rising awareness of the importance of ARA in infant nutrition. This segment's growth is further supported by the growing trend of parents seeking high-quality nutritional products for their children, leading to a surge in demand for ARA-fortified formulas.

The Bahrain Arachidonic Acid ARA Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Koninklijke DSM N.V. (DSM-Firmenich), Cargill, Incorporated, Evonik Industries AG, Croda International Plc, Cayman Chemical Company, Guangdong Runke Bioengineering Co., Ltd., Suntory Wellness Limited, Wuhan HHD Biotechnology Co., Ltd., Cabio Bioengineering (Wuhan) Co., Ltd., Abbott Laboratories (Infant Nutrition Division), Nestlé S.A. (Nestlé Nutrition – Infant Formula), Mead Johnson Nutrition (Reckitt Benckiser Group plc), Arla Foods amba, Fonterra Co-operative Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Arachidonic Acid market in Bahrain appears promising, driven by increasing consumer awareness and the expansion of the nutritional supplement sector. As health trends continue to evolve, manufacturers are likely to innovate product formulations to meet the growing demand for ARA. Additionally, the rise of e-commerce platforms is expected to facilitate greater access to ARA products, enhancing market penetration and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Source | Microbial / Fermentation-Derived ARA Animal-Sourced ARA (Egg / Organ-Tissue Derived) Algal-Sourced ARA Others |

| By End-Use Industry | Infant Formula & Follow-On Formula Manufacturers Nutraceutical & Dietary Supplement Manufacturers Pharmaceuticals & Clinical Nutrition Manufacturers Food & Beverage Fortification Others |

| By Application | Infant Nutrition (ARA-Fortified Formula & Baby Foods) Adult Dietary Supplements & Sports Nutrition Clinical & Enteral Nutrition Functional Foods & Beverages Animal Feed & Aquaculture Others |

| By Distribution / Procurement Channel | Direct Sales to Formula & Nutrition Manufacturers Distributors / Importers of Nutritional Ingredients Online B2B Platforms Pharmacies & Retail Supplement Channels Others |

| By Geography within Bahrain | Capital Governorate (Manama & Surrounding Areas) Muharraq Governorate Northern Governorate Southern Governorate Others (Industrial Zones & Free Zones) |

| By Form | Liquid Oil ARA Powder / Encapsulated ARA Others |

| By Consumer Group | Infants & Toddlers Pregnant & Lactating Women General Adult Population Sports & Performance-Oriented Consumers Seniors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infant Nutrition Products | 100 | Pediatricians, Nutritionists, Product Managers |

| Clinical Nutrition Applications | 80 | Healthcare Providers, Dietitians, Hospital Administrators |

| Dietary Supplements Market | 90 | Retail Buyers, Brand Managers, Health Coaches |

| Food Industry Usage | 70 | Food Technologists, Quality Assurance Managers, R&D Specialists |

| Pharmaceutical Applications | 60 | Pharmaceutical Researchers, Regulatory Affairs Specialists, Product Developers |

The Bahrain Arachidonic Acid ARA Market is valued at approximately USD 18 million, reflecting a growing demand for ARA in infant nutrition, dietary supplements, and clinical nutrition, driven by increased health consciousness among consumers.