Region:Middle East

Author(s):Dev

Product Code:KRAD5082

Pages:100

Published On:December 2025

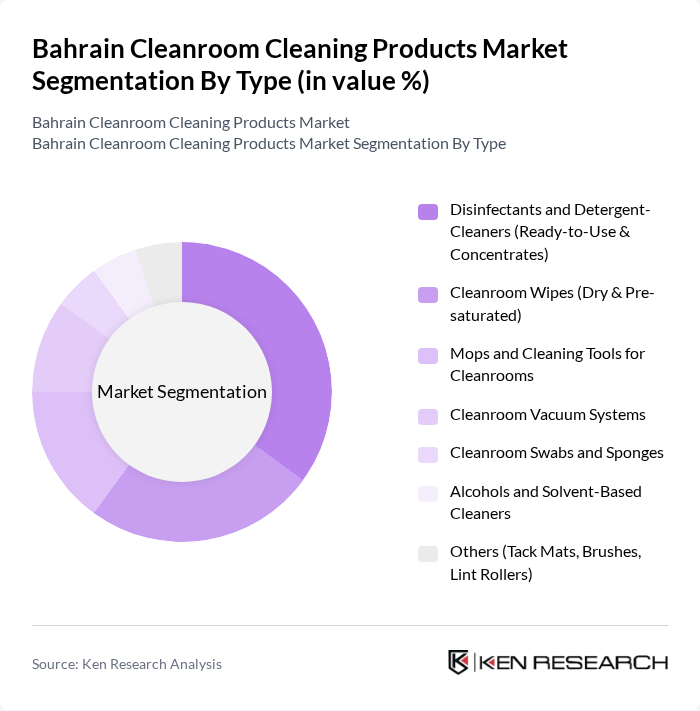

By Type:The market is segmented into various types of cleaning products, each serving specific needs within cleanroom environments. The subsegments include disinfectants and detergent-cleaners, cleanroom wipes, mops and cleaning tools, vacuum systems, swabs and sponges, alcohols and solvent-based cleaners, and other miscellaneous products such as tack mats and lint rollers. Among these, disinfectants and detergent-cleaners are the most widely used due to their central role in bioburden reduction, surface decontamination, and routine sanitization, particularly in pharmaceutical, biotechnology, and healthcare cleanrooms where validated sporicidal and broad-spectrum products are required.

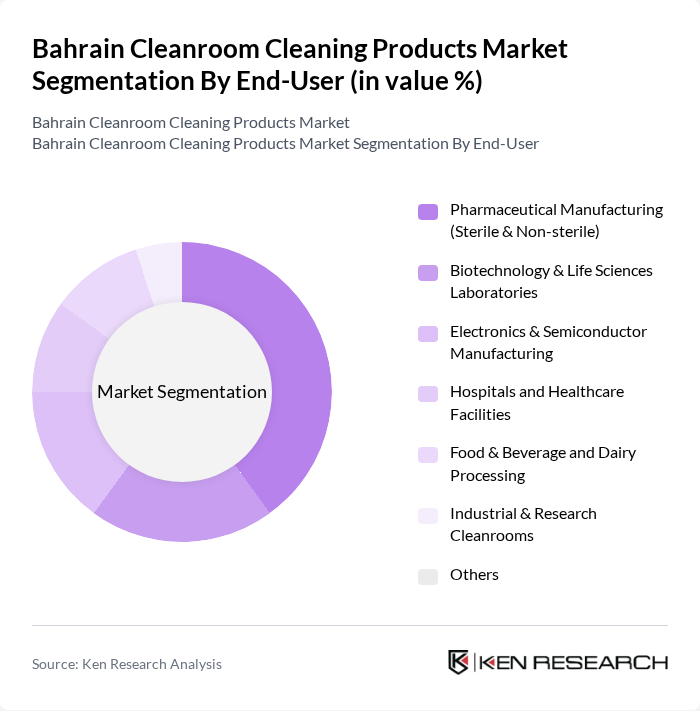

By End-User:The cleanroom cleaning products market is segmented by end-user industries, including pharmaceutical manufacturing, biotechnology and life sciences laboratories, electronics and semiconductor manufacturing, hospitals and healthcare facilities, food and beverage processing, and industrial and research cleanrooms. The pharmaceutical manufacturing sector is the largest consumer of cleanroom cleaning products, supported by Bahrain’s expanding demand for medicines, vaccines, and sterile preparations and by NHRA and GMP requirements for validated environmental cleaning regimes. Hospitals, diagnostic laboratories, and outpatient specialty centers in Bahrain also represent a growing user base as infection prevention programs and audit-driven hygiene standards increasingly specify dedicated cleanroom-compatible wipes, disinfectants, and tools for critical areas such as operating theatres, ICUs, and compounding pharmacies.

The Bahrain Cleanroom Cleaning Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab Inc., Diversey Holdings, Ltd., Kimberly-Clark Professional (Kimberly-Clark Corporation), 3M Company, Contec, Inc., STERIS Corporation, Texwipe (Illinois Tool Works Inc.), VWR International, LLC (Avantor, Inc.), Micronova Manufacturing, Inc., Ahlstrom Oyj (Ahlstrom-Munksjö), Shield Scientific B.V., Ansell Limited, Cleantec Hygiene Products W.L.L. (Bahrain), Gulf Cleaning & Detergents Co. W.L.L. (Bahrain), Intercare Limited (Middle East) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain cleanroom cleaning products market appears promising, driven by technological advancements and increasing investments in cleanroom infrastructure. As industries continue to prioritize contamination control, the demand for innovative cleaning solutions will rise. Furthermore, the integration of automation and IoT technologies in cleanroom management is expected to enhance operational efficiency. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Disinfectants and Detergent-Cleaners (Ready-to-Use & Concentrates) Cleanroom Wipes (Dry & Pre-saturated) Mops and Cleaning Tools for Cleanrooms Cleanroom Vacuum Systems Cleanroom Swabs and Sponges Alcohols and Solvent-Based Cleaners Others (Tack Mats, Brushes, Lint Rollers) |

| By End-User | Pharmaceutical Manufacturing (Sterile & Non-sterile) Biotechnology & Life Sciences Laboratories Electronics & Semiconductor Manufacturing Hospitals and Healthcare Facilities Food & Beverage and Dairy Processing Industrial & Research Cleanrooms Others |

| By Application | Floor and Wall Decontamination Surface and Workstation Cleaning Equipment & Instrument Cleaning Airlock, Gowning Area & High-Touch Point Cleaning Terminal Disinfection & Bio-decontamination Others |

| By Distribution Channel | Direct Sales to Key Accounts (Hospitals, Pharma, Labs) Specialized Industrial/Cleanroom Distributors Online B2B Platforms Local Chemical & Hygiene Product Dealers Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| By Product Formulation | Alcohol-Based (IPA, Ethanol Blends) Quaternary Ammonium Compound (QAC)-Based Peroxide and Peracetic Acid-Based Chlorine-Based and Oxidizing Agents Biodegradable / Low-VOC Formulations Others (Enzymatic, Neutral pH, Specialty) |

| By Packaging Type | Trigger and Pump Bottles Sachets, Pouches & Wipe Canisters Bulk Containers (5–25L Drums, IBCs) Single-Use Sterile Packs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cleanroom Facilities | 60 | Quality Control Managers, Cleanroom Supervisors |

| Biotechnology Laboratories | 50 | Laboratory Managers, Compliance Officers |

| Electronics Manufacturing Cleanrooms | 40 | Production Managers, Facility Engineers |

| Healthcare Sector Cleanrooms | 40 | Infection Control Specialists, Facility Managers |

| Research Institutions with Cleanroom Facilities | 40 | Research Directors, Lab Technicians |

The Bahrain Cleanroom Cleaning Products Market is valued at approximately USD 40 million, reflecting a historical analysis aligned with related markets such as surface disinfectants and industrial cleaning solvents.