Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6025

Pages:94

Published On:December 2025

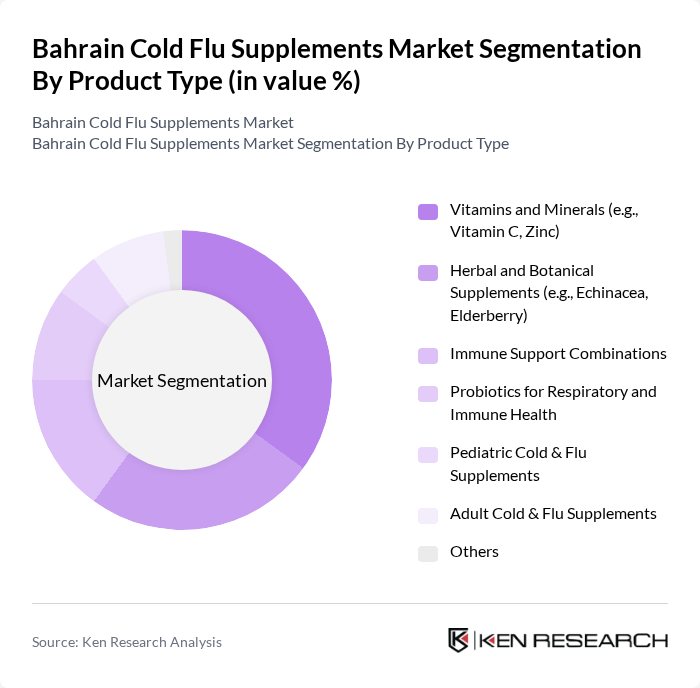

By Product Type:The product type segmentation includes various categories such as Vitamins and Minerals, Herbal and Botanical Supplements, Immune Support Combinations, Probiotics for Respiratory and Immune Health, Pediatric Cold & Flu Supplements, Adult Cold & Flu Supplements, and Others. This structure is consistent with global cold and flu supplement product segmentation, where vitamins and minerals, herbal extracts, and natural molecules are the core product classes. Among these, Vitamins and Minerals, particularly Vitamin C and Zinc, dominate the market due to their established use in immune-support formulations, strong consumer recognition, and their leading share within both global cold and flu supplements and Bahrain’s vitamins and minerals segment.

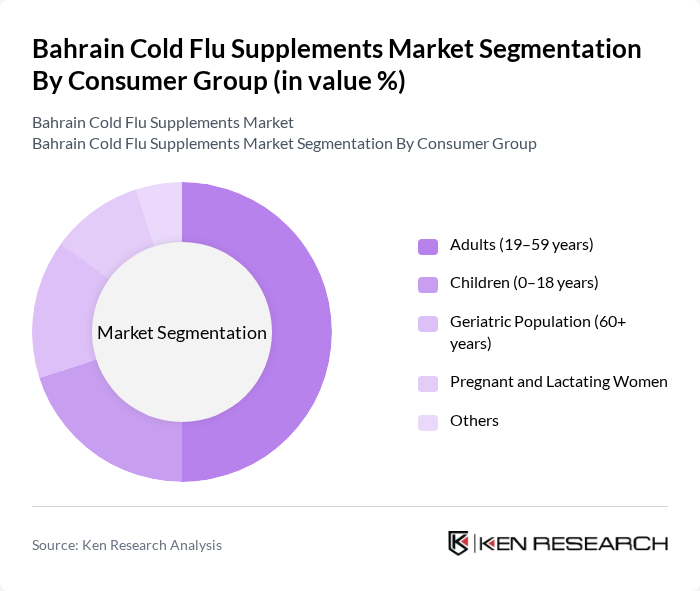

By Consumer Group:The consumer group segmentation includes Adults (19–59 years), Children (0–18 years), Geriatric Population (60+ years), Pregnant and Lactating Women, and Others. This segmentation aligns with typical age?group targeting in the dietary supplements and nutraceuticals industry in the MENA region. The adult segment is the largest consumer group, driven by the increasing awareness of health and wellness, the widespread adoption of over?the?counter supplements for self?care, and the growing trend of self?medication among adults seeking preventive measures against cold and flu in line with global cold and flu supplement usage patterns.

The Bahrain Cold Flu Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as GlaxoSmithKline Consumer Healthcare (Haleon) – Panadol Cold & Flu Range, Bayer AG – Redoxon and related immune support supplements, Sanofi Consumer Healthcare – Fervex and related cold & flu supplements, Reckitt Benckiser Group plc – Strepsils and related immune products, Pfizer Consumer Healthcare / Viatris – Centrum and immunity lines, Vitabiotics Ltd. – Immunace, Wellman, Wellwoman ranges, Europharma W.L.L. (Bahrain) – local distribution of cold & flu supplements, Bahrain Pharma W.L.L. – OTC vitamins and immune support products, Al Jishi Corporation – distributor of international cold & flu supplement brands, Kooheji Pharma – regional distributor of vitamins and cold & flu supplements, Natures Only – immune health and respiratory support supplements, Jamjoom Pharma – GCC?focused nutritional and immune support portfolio, Almarai – Nuralac and fortified nutrition products with immune benefits, Abela Pharm – Echinacea and herbal cold & flu supplements, and local pharmacy private labels (e.g., Boots, Lulu, and other chains’ house brands) contribute to innovation, geographic expansion, and service delivery in this space, reflecting the broader global competitive landscape of cold and flu supplements dominated by multinational consumer health and nutraceutical companies.

The future of the Bahrain cold flu supplements market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As consumers prioritize wellness, the demand for innovative and effective supplements is expected to rise. Additionally, the growth of e-commerce will facilitate broader access to these products, enhancing market penetration. Companies that adapt to consumer preferences and invest in digital marketing strategies will likely thrive in this evolving landscape, positioning themselves for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Vitamins and Minerals (e.g., Vitamin C, Zinc) Herbal and Botanical Supplements (e.g., Echinacea, Elderberry) Immune Support Combinations Probiotics for Respiratory and Immune Health Pediatric Cold & Flu Supplements Adult Cold & Flu Supplements Others |

| By Consumer Group | Adults (19–59 years) Children (0–18 years) Geriatric Population (60+ years) Pregnant and Lactating Women Others |

| By Distribution Channel | Retail Pharmacies / Drug Stores Hospital Pharmacies Supermarkets / Hypermarkets Health & Nutrition Stores Online Pharmacies and E-commerce Platforms Others |

| By Formulation | Tablets and Caplets Capsules and Softgels Powders and Sachets Syrups and Liquid Drops Gummies and Chewables Effervescent Formulations |

| By Packaging Type | Bottles Blister Packs / Strips Sachets / Pouches Jars and Tubs Others |

| By Price Range | Economy Mid-Range Premium and Imported Brands OTC Private Label / Store Brands |

| By Consumer Preference | Preference for Natural / Herbal Ingredients Preference for Clinically Proven / Doctor-Recommended Products Convenience-Oriented Formats (on-the-go, single-serve) Price-Sensitive Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Purchasing Behavior | 120 | Health-conscious Consumers, Supplement Users |

| Healthcare Professional Insights | 80 | Pharmacists, General Practitioners |

| Retail Market Analysis | 60 | Store Managers, Health Product Buyers |

| Market Trend Evaluation | 50 | Health and Wellness Influencers, Nutritionists |

| Regulatory Impact Assessment | 40 | Policy Makers, Health Regulators |

The Bahrain Cold Flu Supplements Market is valued at approximately USD 18 million, reflecting a significant growth trajectory driven by increasing health awareness, rising incidences of cold and flu, and a trend towards preventive healthcare.