Region:Middle East

Author(s):Dev

Product Code:KRAB8779

Pages:93

Published On:October 2025

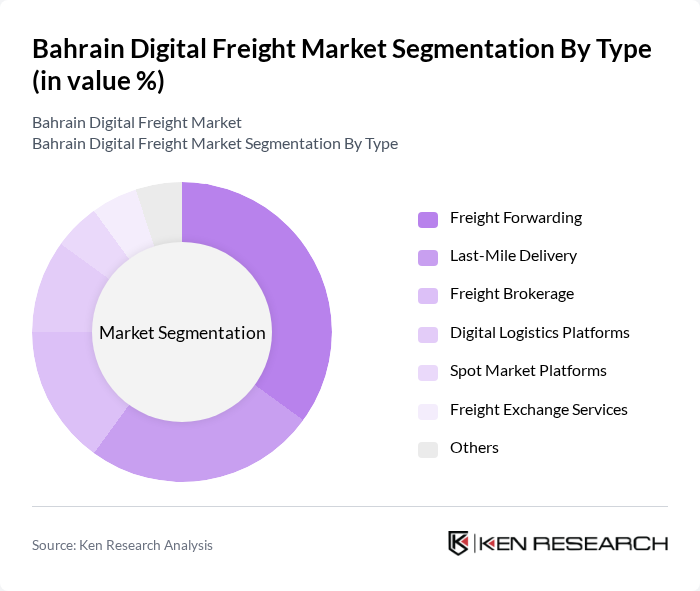

By Type:The digital freight market is segmented into various types, including Freight Forwarding, Last-Mile Delivery, Freight Brokerage, Digital Logistics Platforms, Spot Market Platforms, Freight Exchange Services, and Others. Among these, Freight Forwarding is currently the leading sub-segment due to its essential role in managing international shipping logistics and customs clearance. The increasing complexity of global supply chains has driven demand for reliable freight forwarding services, making it a critical component of the digital freight ecosystem.

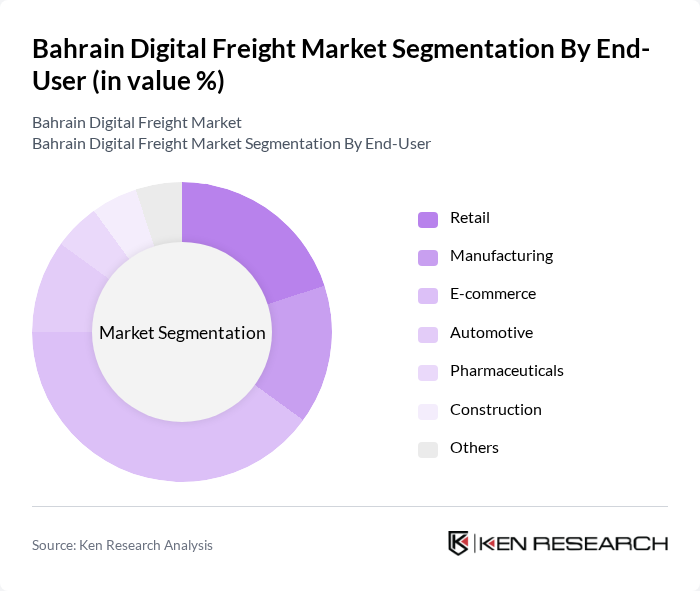

By End-User:The end-user segmentation of the digital freight market includes Retail, Manufacturing, E-commerce, Automotive, Pharmaceuticals, Construction, and Others. The E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the demand for efficient delivery solutions. The increasing consumer preference for fast and reliable shipping options has led to a surge in logistics services tailored for e-commerce businesses.

The Bahrain Digital Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, Agility Logistics, Kuehne + Nagel, DB Schenker, FedEx, UPS, Maersk, XPO Logistics, CEVA Logistics, Panalpina, ZIM Integrated Shipping Services, DSV Panalpina, Sinotrans, Yusen Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain digital freight market appears promising, driven by ongoing technological advancements and increasing consumer expectations. As businesses continue to embrace digital solutions, the integration of AI and automation is expected to enhance operational efficiency. Additionally, the expansion of cross-border trade agreements will likely open new avenues for digital freight services, fostering a more competitive landscape. The focus on sustainability will also shape logistics strategies, encouraging companies to adopt greener practices in their operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Last-Mile Delivery Freight Brokerage Digital Logistics Platforms Spot Market Platforms Freight Exchange Services Others |

| By End-User | Retail Manufacturing E-commerce Automotive Pharmaceuticals Construction Others |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Services Expedited Freight Services Temperature-Controlled Transport Others |

| By Distribution Mode | Road Transport Air Freight Sea Freight Rail Freight Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing Pay-Per-Use Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations Others |

| By Technology Integration | IoT-Enabled Solutions AI and Machine Learning Applications Blockchain Technology Cloud-Based Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Adoption in Retail | 100 | Logistics Managers, E-commerce Directors |

| Technology Integration in Freight Forwarding | 80 | IT Managers, Operations Directors |

| Impact of Digital Solutions on Supply Chain Efficiency | 70 | Supply Chain Analysts, Procurement Managers |

| Customer Experience in Digital Freight Services | 60 | Customer Service Managers, Business Development Heads |

| Regulatory Challenges in Digital Freight | 50 | Compliance Officers, Legal Advisors |

The Bahrain Digital Freight Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies in logistics, the rise of e-commerce, and the demand for efficient supply chain solutions.