Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7214

Pages:86

Published On:December 2025

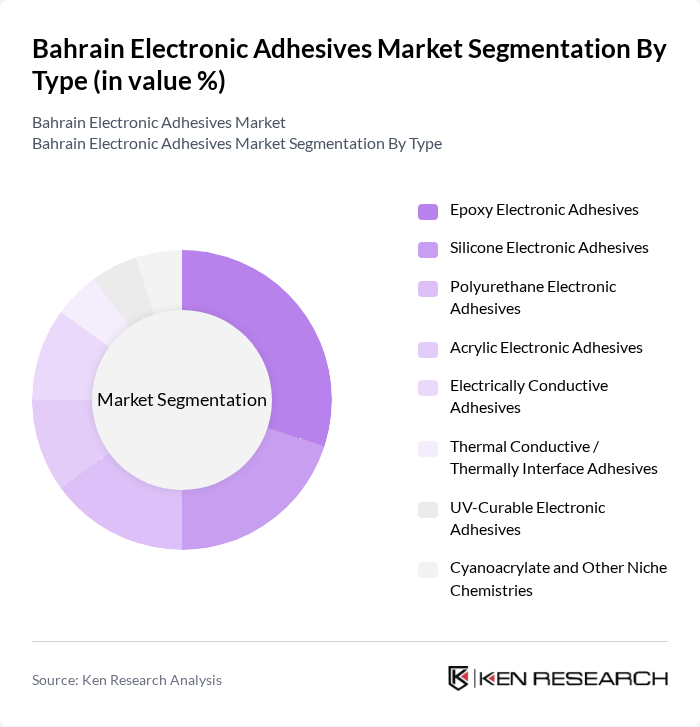

By Type:The electronic adhesives market can be segmented into various types, including Epoxy Electronic Adhesives, Silicone Electronic Adhesives, Polyurethane Electronic Adhesives, Acrylic Electronic Adhesives, Electrically Conductive Adhesives, Thermal Conductive / Thermally Interface Adhesives, UV-Curable Electronic Adhesives, and Cyanoacrylate and Other Niche Chemistries. Among these, Epoxy Electronic Adhesives are leading the market due to their superior bonding strength, chemical resistance, and versatility across PCB assembly, component encapsulation, and structural bonding applications. The demand for these adhesives is driven by their extensive use in consumer electronics, automotive electronics, and industrial power electronics, where durability, thermal stability, and electrical insulation performance are critical for long?term reliability.

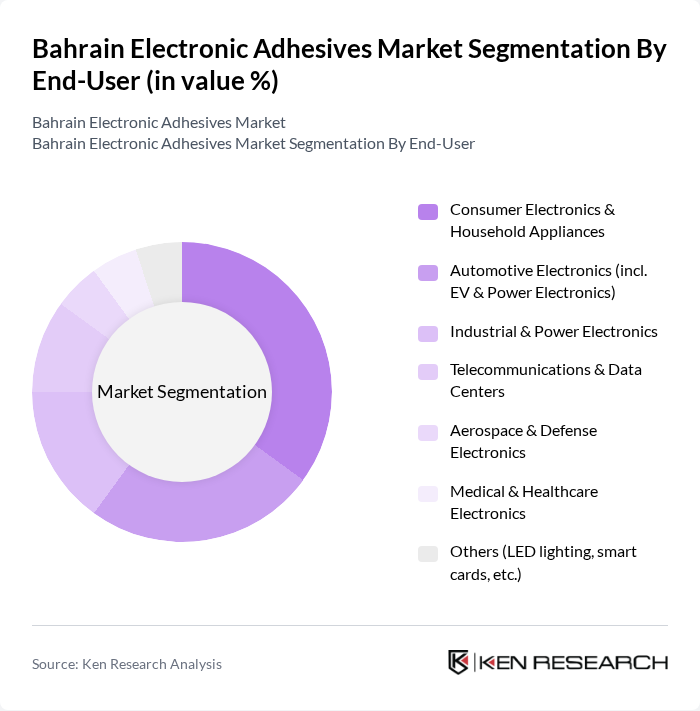

By End-User:The electronic adhesives market is segmented by end-user industries, including Consumer Electronics & Household Appliances, Automotive Electronics (including EV & Power Electronics), Industrial & Power Electronics, Telecommunications & Data Centers, Aerospace & Defense Electronics, Medical & Healthcare Electronics, and Others (LED lighting, smart cards, etc.). The Consumer Electronics & Household Appliances segment is the largest, supported by strong regional demand for smartphones, tablets, wearables, laptops, and white goods, all of which rely on high?reliability adhesive solutions for die attach, underfill, display bonding, and structural assembly. Rapid growth in automotive electronics and power electronics for energy and infrastructure in the wider Middle East further reinforces demand for thermally conductive, electrically conductive, and high?temperature electronic adhesive systems.

The Bahrain Electronic Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Dow Inc., Sika AG, Bostik SA (Arkema Group), Parker Lord Corporation (Parker Hannifin Corporation), Permabond LLC, Avery Dennison Corporation, Momentive Performance Materials Inc., ITW Performance Polymers (Illinois Tool Works Inc.), Master Bond Inc., Huntsman Corporation, Dymax Corporation, Jowat SE contribute to innovation, geographic expansion, and service delivery in this space, supplying epoxy, silicone, acrylic, polyurethane, and specialty electronic adhesive solutions through regional distributors and channel partners.

The Bahrain electronic adhesives market is poised for significant growth, driven by technological advancements and increasing applications across various sectors. The integration of smart technologies and IoT in adhesive applications is expected to enhance product functionality and performance. Additionally, the focus on sustainability will likely lead to the development of eco-friendly adhesive solutions, aligning with global trends towards greener manufacturing practices. As the market evolves, manufacturers will need to adapt to changing consumer preferences and regulatory landscapes to remain competitive.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Electronic Adhesives Silicone Electronic Adhesives Polyurethane Electronic Adhesives Acrylic Electronic Adhesives Electrically Conductive Adhesives Thermal Conductive / Thermally Interface Adhesives UV-Curable Electronic Adhesives Cyanoacrylate and Other Niche Chemistries |

| By End-User | Consumer Electronics & Household Appliances Automotive Electronics (incl. EV & Power Electronics) Industrial & Power Electronics Telecommunications & Data Centers Aerospace & Defense Electronics Medical & Healthcare Electronics Others (LED lighting, smart cards, etc.) |

| By Application | Surface Mount Technology (SMT) & Chip Attachment Die Attach and Wire Tacking Underfill, Potting & Encapsulation Conformal Coating & Protection Thermal Management & Gap Filling Bonding & Sealing of Housings and Connectors Others |

| By Formulation | One-Part (Pre-mixed) Systems Two-Part (2K) Systems Hot Melt Electronic Adhesives Solvent-Borne Electronic Adhesives Water-Borne / Low-VOC Electronic Adhesives Others |

| By Curing Mechanism | Heat-Cured Electronic Adhesives UV / LED-Cured Electronic Adhesives Moisture-Cured Electronic Adhesives Dual-Cure and Snap-Cure Systems Others |

| By Packaging Type | Syringe & Cartridge Packaging Pail & Drum Packaging Dual-Cartridge / Meter-Mix Packaging Bulk & Customized Packaging Others |

| By Distribution Channel | Direct Sales to OEMs & EMS Providers Industrial Distributors & Channel Partners Online Technical & E?Commerce Platforms Retail & Trade Counters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Adhesives | 100 | Product Managers, R&D Engineers |

| Automotive Adhesive Applications | 90 | Procurement Managers, Quality Control Specialists |

| Construction Adhesives Market | 80 | Project Managers, Site Supervisors |

| Industrial Adhesive Solutions | 70 | Operations Managers, Supply Chain Coordinators |

| Research & Development in Adhesives | 60 | Technical Directors, Innovation Managers |

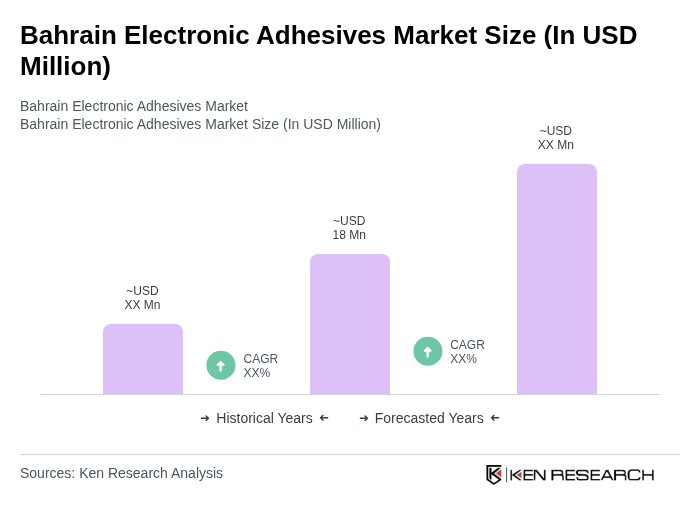

The Bahrain Electronic Adhesives Market is valued at approximately USD 18 million, reflecting growth driven by increasing demand for electronic devices, PCB assembly, and smart consumer devices requiring high-performance adhesives.