Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8172

Pages:83

Published On:November 2025

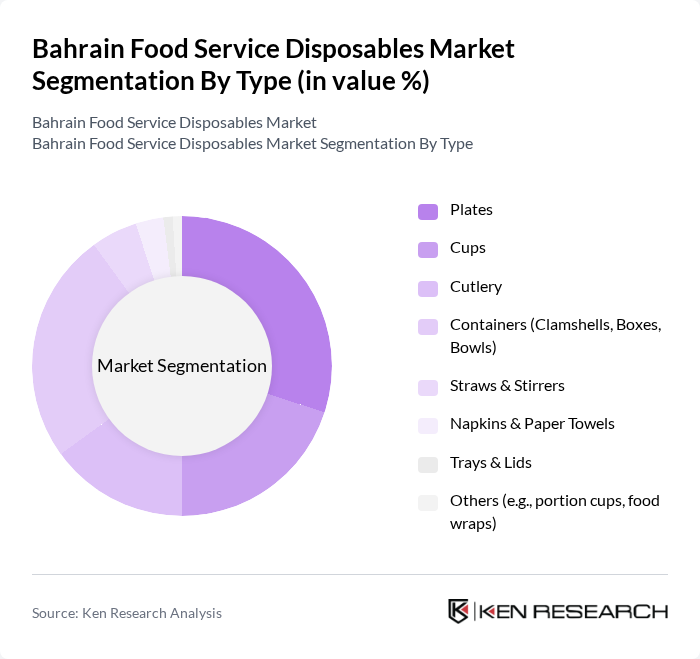

By Type:The market can be segmented into various types of food service disposables, including plates, cups, cutlery, containers, straws, napkins, trays, and others. Among these, plates and containers are the most widely used due to their essential role in food presentation and packaging. The increasing trend of takeaway and delivery services has further boosted the demand for these products, as consumers seek convenient and hygienic options for their meals. The shift toward biodegradable and compostable materials is also influencing product choices, with businesses increasingly adopting eco-friendly alternatives to comply with new regulations and meet consumer preferences for sustainability .

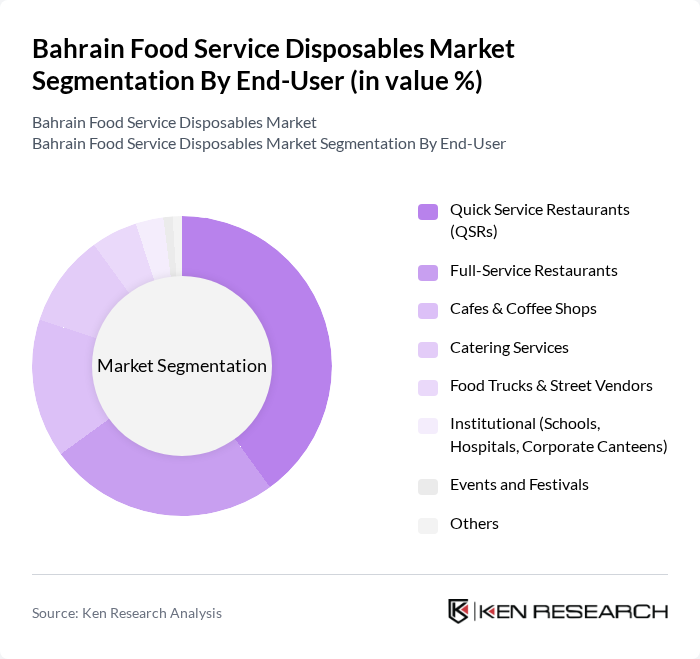

By End-User:The end-user segmentation includes quick service restaurants (QSRs), full-service restaurants, cafes, catering services, food trucks, institutional users, and events. Quick service restaurants dominate the market due to their high volume of sales and reliance on disposable products for efficiency. The growing trend of food delivery services has also led to increased demand from food trucks and catering services, as they require disposables for serving food on-the-go. Institutional users and event organizers are increasingly opting for eco-friendly disposables in response to regulatory requirements and consumer expectations for sustainability .

The Bahrain Food Service Disposables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Hilal Group, Gulf Plastic Industries W.L.L., Bahrain Packaging Industry (BPI), Al Ahlia Plastic Products Co., Al Ameen Plastics, Al Salam Specialist Plastic Factory, Bahrain National Plastic Company (BANAPCO), Al Mohsin Trading & Packaging, Al Fateh Plastic Factory, Al Mansoori Plastic Industries, Al Mahroos Trading & Contracting Co., Al Muhriz Plastic Factory, Al Qudsi Plastic Factory, Al Shaikh Plastic Industries, Al Zayani Commercial Services contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain food service disposables market is poised for significant transformation, driven by evolving consumer preferences and regulatory changes. As sustainability becomes a priority, businesses are likely to invest in innovative, eco-friendly packaging solutions. Additionally, the continued growth of online food delivery services will further enhance the demand for disposable products. Companies that adapt to these trends and focus on hygiene and convenience will likely thrive in this dynamic market landscape, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Plates Cups Cutlery Containers (Clamshells, Boxes, Bowls) Straws & Stirrers Napkins & Paper Towels Trays & Lids Others (e.g., portion cups, food wraps) |

| By End-User | Quick Service Restaurants (QSRs) Full-Service Restaurants Cafes & Coffee Shops Catering Services Food Trucks & Street Vendors Institutional (Schools, Hospitals, Corporate Canteens) Events and Festivals Others |

| By Material | Plastic (Conventional & Compostable) Paper & Cardboard Biodegradable/Bio-based (Bagasse, PLA, Cornstarch, etc.) Aluminum Foam Others (e.g., wood, bamboo, palm leaf) |

| By Distribution Channel | Online Retail (e-commerce platforms, B2B portals) Offline Retail (supermarkets, hypermarkets, specialty stores) Direct Sales (manufacturer to end-user) Wholesale/Distributors Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others |

| By Application | Takeaway Services Dine-in Services Delivery Services Events and Catering Institutional Use Others |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Restaurant Sector Insights | 120 | Restaurant Owners, Operations Managers |

| Catering Services Feedback | 100 | Catering Managers, Event Coordinators |

| Consumer Preferences Survey | 150 | Regular Diners, Food Enthusiasts |

| Supplier and Distributor Insights | 80 | Sales Managers, Product Development Heads |

| Market Trend Analysis | 120 | Industry Analysts, Market Researchers |

The Bahrain Food Service Disposables Market is valued at approximately USD 130 million, reflecting a significant growth trend driven by increasing demand for convenience in food service, particularly due to the rise of food delivery and takeaway culture.