Region:Middle East

Author(s):Dev

Product Code:KRAD7764

Pages:85

Published On:December 2025

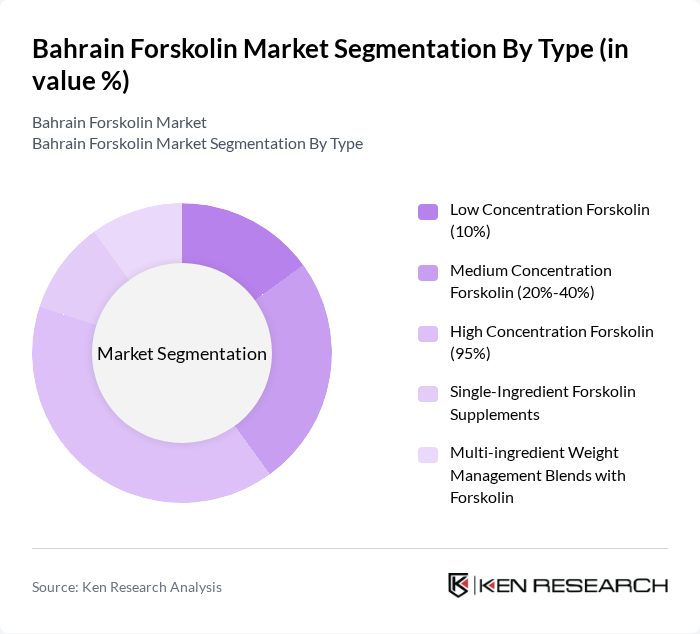

By Type:The market is segmented into various types based on concentration and product form. The subsegments include Low Concentration Forskolin (10%), Medium Concentration Forskolin (20%-40%), High Concentration Forskolin (95%), Single-Ingredient Forskolin Supplements, and Multi-ingredient Weight Management Blends with Forskolin. Medium concentration Forskolin in the 20%–40% range is widely reported as the leading product type at the global level because it balances efficacy with safety and is preferred by many supplement manufacturers. In Bahrain, demand for medium and high concentration formulations is supported by consumers seeking visible results in weight management, while lower concentrations and blended formulations are used more for general wellness and entry-level supplementation. The trend towards higher-potency and standardized extracts is reinforced by growing consumer awareness of active-ingredient percentages and clinical doses communicated in global and regional marketing of Forskolin products.

By Application:The applications of Forskolin are diverse, including Weight Management & Obesity Control, Sports Nutrition & Fitness Support, Cardiovascular Health, Respiratory Health (Asthma & Bronchial Support), and Others (General Wellness, Thyroid Support, etc.). Weight management and obesity-related use is the most prominent application globally, as Forskolin is widely positioned in dietary supplements targeting fat metabolism, body composition, and metabolic health. In Bahrain, this application benefits from rising regional obesity and overweight prevalence, an expanding gym and fitness culture, and growing consumer focus on lifestyle-related disease prevention through nutraceuticals. Cardiovascular and respiratory support, along with broader wellness positioning, remain smaller but relevant application areas aligned with global usage patterns of Forskolin in nutraceutical and complementary health products.

The Bahrain Forskolin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., GNC Holdings, LLC (GNC Bahrain), Holland & Barrett Retail Limited (Holland & Barrett Bahrain), Nature's Way Products, LLC, NOW Health Group, Inc. (NOW Foods), Swanson Health Products, Inc., Solgar Inc., The Nature's Bounty Co. (Nature's Bounty), Life Extension Foundation Buyers Club, Inc. (Life Extension), Garden of Life LLC, Pure Encapsulations, LLC, Jarrow Formulas, Inc., Doctor's Best, Inc., iHerb, LLC, Vitabiotics Ltd. contribute to innovation, geographic expansion, and service delivery in this space by offering Forskolin either directly or through broader herbal and weight management portfolios in the Middle East and online channels.

The future of the Forskolin market in Bahrain appears promising, driven by increasing health consciousness and a shift towards natural products. As e-commerce continues to expand, more consumers will have access to Forskolin supplements, enhancing market penetration. Additionally, collaborations with health professionals are likely to boost consumer trust and awareness. The focus on sustainable sourcing and innovative product development will further align with consumer preferences, positioning Forskolin favorably in the evolving health landscape.

| Segment | Sub-Segments |

|---|---|

| By Type (Concentration & Product Form) | Low Concentration Forskolin (10%) Medium Concentration Forskolin (20%-40%) High Concentration Forskolin (95%) Single-Ingredient Forskolin Supplements Multi-ingredient Weight Management Blends with Forskolin |

| By Application | Weight Management & Obesity Control Sports Nutrition & Fitness Support Cardiovascular Health Respiratory Health (Asthma & Bronchial Support) Others (General Wellness, Thyroid Support, etc.) |

| By End-User | Nutraceutical & Dietary Supplement Brands Pharmacies & Drug Stores (Retail Consumers) Fitness Centers, Gyms & Wellness Clubs Online-Only Nutrition Brands Others (Clinics, Dieticians, Wellness Practitioners) |

| By Distribution Channel | E-commerce & Online Marketplaces Supermarkets/Hypermarkets Specialty Nutrition & Health Food Stores Community & Hospital Pharmacies Direct Selling & Multi-level Marketing (MLM) |

| By Product Formulation | Capsules & Softgels Tablets Liquid Extracts & Tinctures Powders & Sachets Others (Gummies, Effervescent Forms) |

| By Consumer Demographics | Adults (18-34 years) Middle-aged (35-54 years) Seniors (55+ years) Others (Teenagers under medical supervision) |

| By Buyer Type & Purchasing Behavior | Health-conscious Lifestyle Consumers Weight Management-focused Consumers Performance-driven Fitness Enthusiasts & Athletes Price-sensitive & Occasional Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Supplement Retailers | 100 | Store Managers, Purchasing Agents |

| Fitness Centers and Gyms | 50 | Owners, Personal Trainers |

| Online Health Product Platforms | 60 | eCommerce Managers, Marketing Directors |

| Consumers of Herbal Supplements | 120 | Health-Conscious Individuals, Regular Supplement Users |

| Healthcare Professionals | 40 | Nutritionists, General Practitioners |

The Bahrain Forskolin market is valued at approximately USD 1 million, reflecting a growing consumer interest in natural weight management solutions and the rising prevalence of obesity-related health issues in the region.