Region:Middle East

Author(s):Rebecca

Product Code:KRAD5017

Pages:87

Published On:December 2025

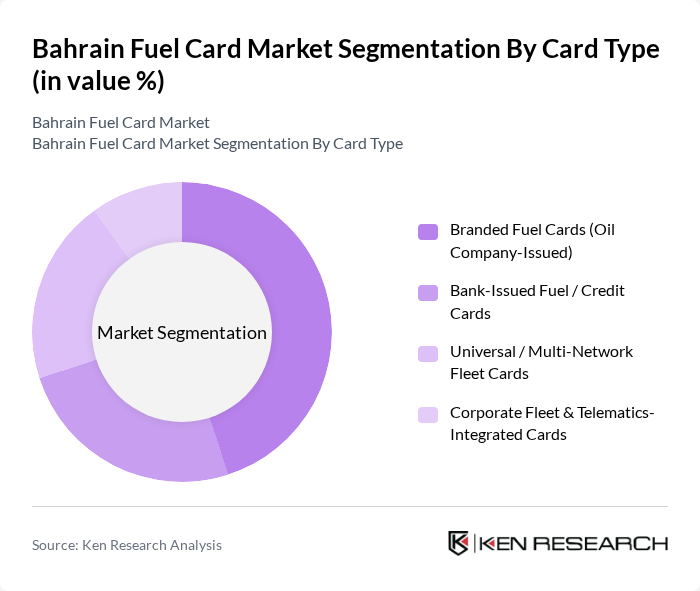

By Card Type:The segmentation of the market by card type includes various categories such as branded fuel cards, bank-issued fuel cards, universal fleet cards, and corporate fleet cards. Branded fuel cards (oil company-issued) are widely used in Bahrain due to established fuel station networks and corporate fleet relationships, in line with the broader Middle East pattern where branded and universal cards are the primary types. Bank-issued fuel cards are also gaining traction as they are linked to credit or prepaid accounts and offer additional financial services, rewards, and consolidated billing. Universal fleet cards are preferred by companies with cross-border or multi-network fuel needs, reflecting global trends where universal cards capture a substantial share of fuel card usage. Corporate fleet cards, increasingly integrated with telematics and fleet management platforms, are growing in importance for their ability to provide detailed analytics, driver-level controls, and real-time reporting on fuel consumption and vehicle utilization.

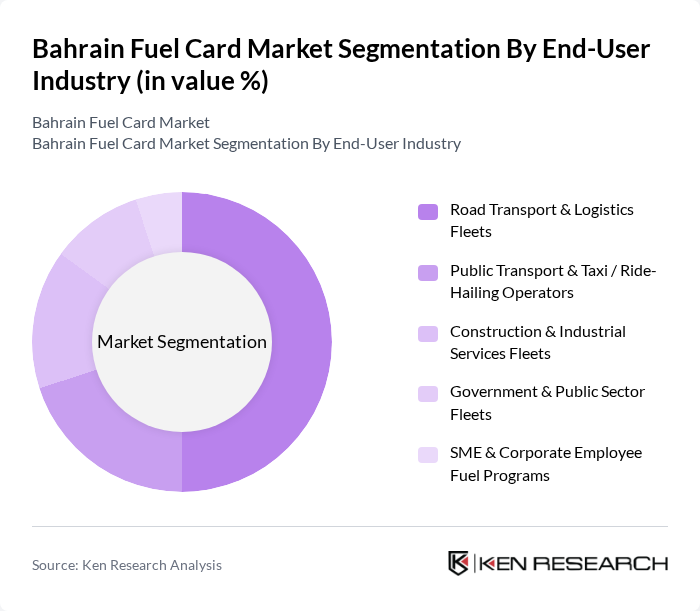

By End-User Industry:The market segmentation by end-user industry includes road transport and logistics fleets, public transport and taxi operators, construction and industrial services fleets, government and public sector fleets, and SME and corporate employee fuel programs. The road transport and logistics fleets segment dominates the market, consistent with global and regional trends where logistics and heavy and light commercial fleets are the primary users of fuel cards due to high fuel consumption and the need for rigorous fuel expense control. Public transport and taxi / ride-hailing operators are also significant users, driven by the need for cost control, route optimization, and driver-level monitoring in a highly utilized vehicle base. The construction and industrial services fleets segment is growing as these operations require reliable fuel supply for heavy machinery and site vehicles, benefiting from centralized fuel billing and reduced cash handling. Government and public sector fleets, along with SME and corporate employee fuel programs, increasingly use fuel cards to enhance transparency, apply policy controls, and support digital transformation initiatives in public services and corporate mobility management.

The Bahrain Fuel Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Petroleum Company (BAPCO Energies), Bahrain National Gas Company (BANAGAS), National Oil & Gas Authority (NOGA) / Ministry of Oil & Environment, Gulf Petrochemical Industries Company (GPIC), Bahrain Kuwait Insurance Company (BKIC) – Motor & Fleet Solutions, Ahli United Bank B.S.C., National Bank of Bahrain (NBB), Bank of Bahrain and Kuwait (BBK), Al Salam Bank – Bahrain, Kuwait Finance House – Bahrain (KFH-Bahrain), Bahrain Islamic Bank (BisB), Alba (Aluminium Bahrain) – Large Fleet End-User, Bahrain Public Transport Company – Public Bus Fleet Operator, Bahrain Taxi / Ride-Hailing & Limousine Operators (Aggregate), Key International Fleet & Fuel Card Solution Providers Present in GCC (e.g., UTA / WEX / Shell Fleet Solutions – Regional Overview) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain fuel card market is poised for significant transformation as digital payment adoption accelerates and consumer preferences shift towards contactless solutions. With the government's push for cashless transactions and the increasing integration of technology in fleet management, fuel cards are becoming essential tools for businesses. Additionally, the focus on sustainability and green initiatives is likely to drive innovation in the sector, fostering new partnerships and enhancing service offerings to meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Card Type | Branded Fuel Cards (Oil Company-Issued) Bank-Issued Fuel / Credit Cards Universal / Multi-Network Fleet Cards Corporate Fleet & Telematics-Integrated Cards |

| By End-User Industry | Road Transport & Logistics Fleets Public Transport & Taxi / Ride-Hailing Operators Construction & Industrial Services Fleets Government & Public Sector Fleets SME & Corporate Employee Fuel Programs |

| By Billing & Settlement Model | Prepaid Fuel Cards Postpaid / Credit Fuel Cards Charge Cards Linked to Corporate Accounts Pay-at-Pump via Mobile Wallet / App-Linked Cards |

| By Distribution Channel | Direct Sales to Large Fleets & Corporates Bank Branches & Relationship Managers Fuel Station Networks & On-site Enrollment Digital Channels (Online Portals & Mobile Apps) |

| By Vehicle Category | Light Commercial Vehicles (Vans & Pickups) Heavy Commercial Vehicles (Trucks & Buses) Passenger Cars (Corporate & Retail) Specialized & Off-Highway Vehicles |

| By Customer Type | Individual Retail Customers Small and Medium Enterprises (SMEs) Large Corporates & Conglomerates Government & State-Owned Entities |

| By Value-Added Services | Fuel-only Cards Fuel + Toll / Parking / Car Wash Bundled Services Cards with Loyalty & Rewards Programs Cards with Fleet Management & Telematics Analytics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Fleet Management | 120 | Fleet Managers, Operations Directors |

| Logistics and Transportation Sector | 90 | Logistics Coordinators, Supply Chain Managers |

| Retail Fuel Card Users | 80 | Retail Managers, Procurement Officers |

| Gas Station Operators | 70 | Station Managers, Business Development Executives |

| Government and Regulatory Bodies | 60 | Policy Makers, Regulatory Analysts |

The Bahrain Fuel Card Market is valued at approximately USD 140 million, reflecting a significant growth driven by the increasing demand for efficient fuel management solutions and the rising number of vehicles in the region.