Region:Middle East

Author(s):Rebecca

Product Code:KRAD8495

Pages:96

Published On:December 2025

By Type:The market is segmented into various types of hot melt adhesives, including Ethylene Vinyl Acetate (EVA), Polyamide, Polyolefin, Styrenic Block Copolymers (SBC), and others. Among these, Ethylene Vinyl Acetate (EVA) is the leading subsegment due to its versatility and strong bonding properties, making it suitable for a wide range of applications in packaging and construction. The demand for EVA is driven by its excellent adhesion to various substrates and its ability to perform well under different environmental conditions.

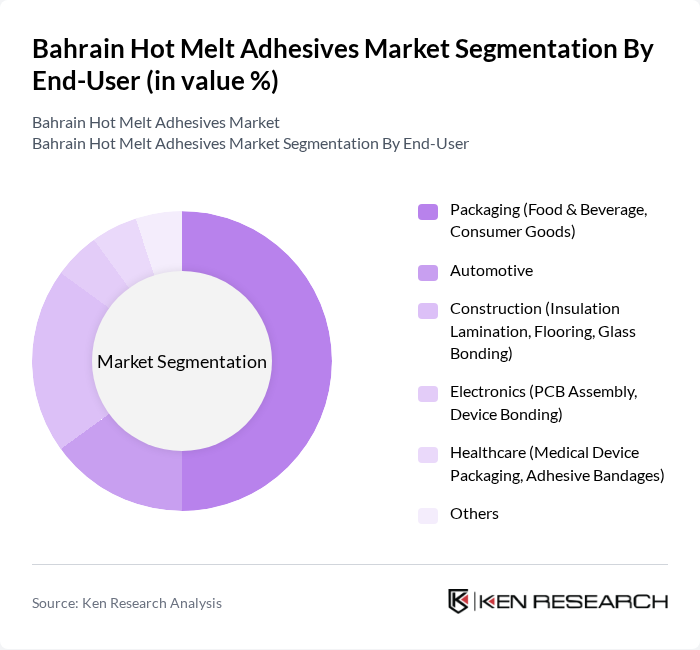

By End-User:The hot melt adhesives market is segmented by end-user industries, including Packaging (Food & Beverage, Consumer Goods), Automotive, Construction (Insulation Lamination, Flooring, Glass Bonding), Electronics (PCB Assembly, Device Bonding), Healthcare (Medical Device Packaging, Adhesive Bandages), and others. The packaging sector is the dominant end-user, driven by the rapid growth of e-commerce and the need for efficient packaging solutions. The increasing demand for sustainable packaging materials is also propelling the growth of hot melt adhesives in this sector.

The Bahrain Hot Melt Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Sika AG, Avery Dennison Corporation, Dow Inc., Ashland Global Holdings Inc., Jowat SE, Arkema Group, and Exxon Mobil Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hot melt adhesives market in Bahrain appears promising, driven by increasing demand for sustainable solutions and technological innovations. As industries prioritize eco-friendly materials, the market is likely to witness a shift towards bio-based adhesives. Additionally, the growth of e-commerce will further enhance the need for efficient packaging solutions, creating new avenues for hot melt adhesive applications. Companies that invest in R&D and adapt to regulatory changes will be well-positioned to capitalize on these trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethylene Vinyl Acetate (EVA) Polyamide Polyolefin Styrenic Block Copolymers (SBC) Others |

| By End-User | Packaging (Food & Beverage, Consumer Goods) Automotive Construction (Insulation Lamination, Flooring, Glass Bonding) Electronics (PCB Assembly, Device Bonding) Healthcare (Medical Device Packaging, Adhesive Bandages) Others |

| By Application | Carton Sealing Labeling Furniture Assembly Medical Applications Bookbinding Others |

| By Formulation | Hot Melt Pressure Sensitive Adhesives (HMPSA) Hot Melt Structural Adhesives Hot Melt Reactive Adhesives Bio-based Hot Melt Adhesives Others |

| By Packaging Type | Bulk Packaging Cartridge Packaging Stick Packaging Glue Gun Cartridges Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Partners Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Adhesives | 100 | Project Managers, Procurement Officers |

| Automotive Adhesives | 80 | Manufacturing Engineers, Quality Control Managers |

| Packaging Adhesives | 70 | Product Managers, Supply Chain Coordinators |

| Consumer Adhesives | 60 | Retail Buyers, Marketing Managers |

| Industrial Adhesives | 90 | Operations Managers, Technical Sales Representatives |

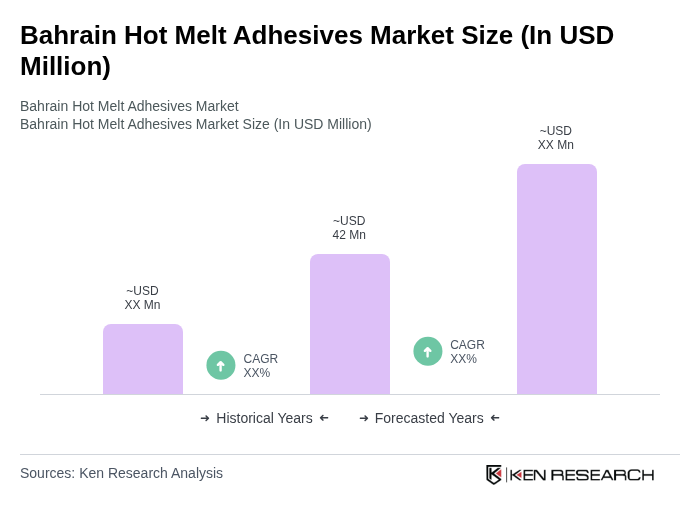

The Bahrain Hot Melt Adhesives Market is valued at approximately USD 42 million, reflecting a five-year historical analysis. This growth is driven by increasing demand from sectors like packaging, automotive, and construction, which require efficient bonding solutions.