Region:Middle East

Author(s):Dev

Product Code:KRAA9596

Pages:92

Published On:November 2025

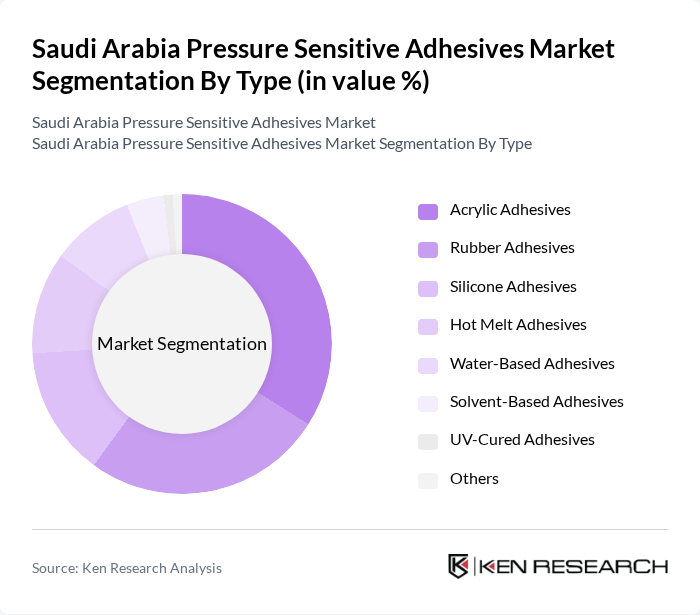

By Type:The market is segmented into various types of pressure-sensitive adhesives, including acrylic, rubber, silicone, hot melt, water-based, solvent-based, UV-cured, and others. Among these, acrylic adhesives lead due to their excellent adhesion properties and versatility across multiple applications. Rubber adhesives are also prominent, favored for their strong bonding capabilities in demanding environments. The market is witnessing a notable shift toward eco-friendly and water-based formulations, reflecting both regulatory pressures and consumer preferences for sustainable products .

By End-User:The end-user segmentation includes packaging, automotive & transportation, construction & building, electronics & electrical, medical & healthcare, food & beverage, and others. The packaging sector is the largest consumer of pressure-sensitive adhesives, driven by the expansion of e-commerce, retail, and food packaging. Automotive and transportation applications are significant, utilizing adhesives for lightweighting, assembly, and interior components. Construction and building are increasingly adopting these adhesives for efficiency, durability, and compliance with green building standards .

The Saudi Arabia Pressure Sensitive Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, Avery Dennison Corporation, Bostik SA (Arkema Group), Dow Inc., H.B. Fuller Company, RPM International Inc., Ashland Global Holdings Inc., Tesa SE, Scapa Group plc, Illinois Tool Works Inc. (ITW), Momentive Performance Materials Inc., KRAHN Chemie GmbH, Mapei S.p.A., National Adhesives Saudi Arabia, Al Muqarram Group, Gulf Adhesives Manufacturing Co., Jowat Middle East FZE, Intercol Adhesives contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia pressure-sensitive adhesives market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly adhesives, manufacturers are likely to invest in research and development to create innovative products. Additionally, the growth of e-commerce and the automotive sector will continue to drive demand for PSAs, while regulatory compliance will push companies towards more sustainable production methods, ensuring a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylic Adhesives Rubber Adhesives Silicone Adhesives Hot Melt Adhesives Water-Based Adhesives Solvent-Based Adhesives UV-Cured Adhesives Others |

| By End-User | Packaging Automotive & Transportation Construction & Building Electronics & Electrical Medical & Healthcare Food & Beverage Others |

| By Application | Labels Tapes Graphics & Films Medical Applications Laminates Others |

| By Formulation | Water-Based Adhesives Solvent-Based Adhesives Hot Melt Adhesives UV-Cured Adhesives Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Customer Type | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Adhesives Usage | 100 | Product Managers, Procurement Specialists |

| Packaging Industry Insights | 110 | Packaging Engineers, Supply Chain Managers |

| Construction Adhesives Applications | 80 | Project Managers, Site Supervisors |

| Consumer Goods Adhesive Preferences | 90 | Marketing Managers, Product Development Teams |

| Electronics Manufacturing Adhesives | 70 | Manufacturing Engineers, Quality Assurance Managers |

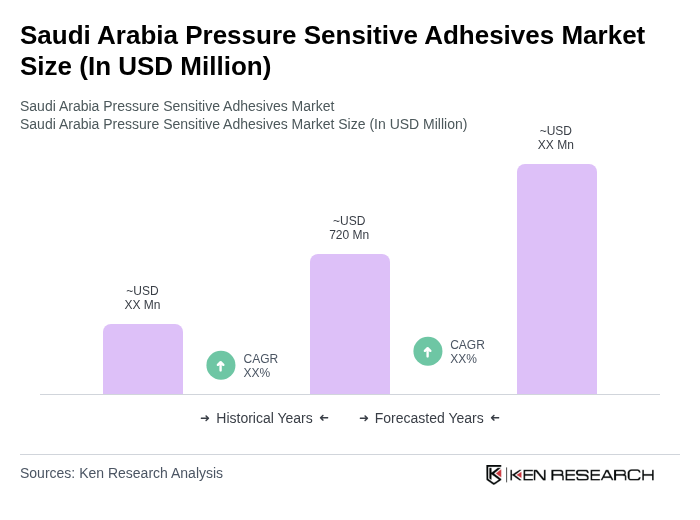

The Saudi Arabia Pressure Sensitive Adhesives Market is valued at approximately USD 720 million, reflecting a robust growth trajectory driven by demand from sectors such as packaging, automotive, and construction, alongside advancements in adhesive formulations.