Region:Middle East

Author(s):Rebecca

Product Code:KRAB7349

Pages:98

Published On:October 2025

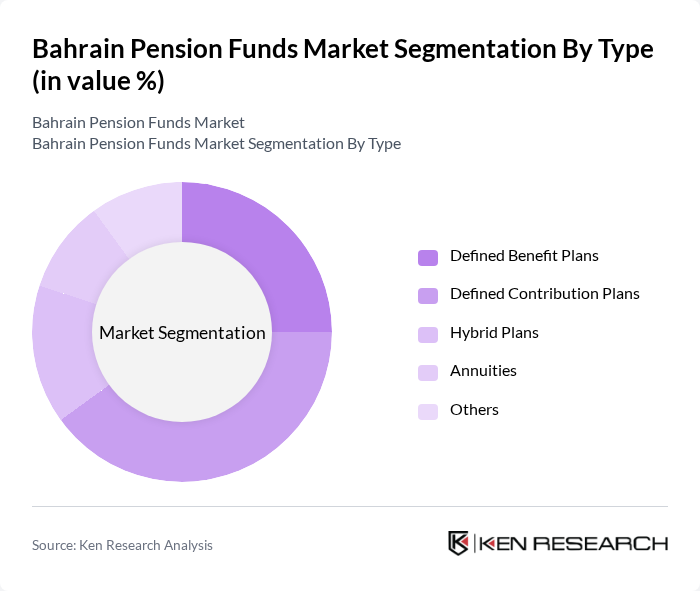

By Type:The pension funds market is segmented into various types, including Defined Benefit Plans, Defined Contribution Plans, Hybrid Plans, Annuities, and Others. Among these, Defined Contribution Plans are gaining traction due to their flexibility and the growing trend of self-directed retirement savings. This shift is driven by the increasing number of self-employed individuals and the need for personalized retirement solutions.

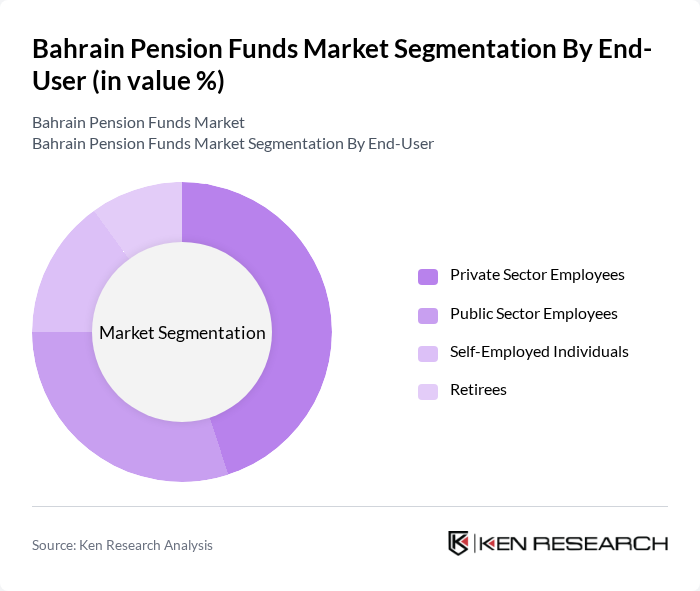

By End-User:The end-user segmentation includes Private Sector Employees, Public Sector Employees, Self-Employed Individuals, and Retirees. The Private Sector Employees segment is currently leading the market, driven by the increasing number of private enterprises and the growing awareness of retirement planning among employees. This trend is further supported by employer-sponsored pension schemes that encourage participation.

The Bahrain Pension Funds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain National Holding Company B.S.C., Gulf International Bank B.S.C., Bahrain Islamic Bank B.S.C., Ahli United Bank B.S.C., National Bank of Bahrain B.S.C., Bank of Bahrain and Kuwait B.S.C., Bahrain Investment Bank B.S.C., Al Baraka Banking Group B.S.C., KFH Bahrain, Abu Dhabi Investment Authority, Qatar Investment Authority, Emirates NBD Asset Management, HSBC Bank Middle East Limited, Standard Chartered Bank, BlackRock, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain pension funds market is poised for transformation as it adapts to demographic changes and technological advancements. With an increasing focus on sustainable investments and personalized retirement solutions, the market is likely to see a shift towards innovative pension products. Additionally, collaboration with fintech companies will enhance service delivery and accessibility, making pension funds more attractive to a broader audience. These trends indicate a promising future for the pension landscape in Bahrain, fostering growth and stability.

| Segment | Sub-Segments |

|---|---|

| By Type | Defined Benefit Plans Defined Contribution Plans Hybrid Plans Annuities Others |

| By End-User | Private Sector Employees Public Sector Employees Self-Employed Individuals Retirees |

| By Investment Strategy | Active Management Passive Management Target Date Funds Others |

| By Fund Size | Small Funds Medium Funds Large Funds |

| By Risk Profile | Conservative Moderate Aggressive |

| By Distribution Channel | Direct Sales Financial Advisors Online Platforms |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Sector Pension Funds | 100 | Pension Fund Managers, Government Officials |

| Private Sector Pension Plans | 80 | HR Managers, Financial Advisors |

| Investment Strategies in Pension Funds | 70 | Investment Analysts, Portfolio Managers |

| Retirement Planning Services | 60 | Financial Planners, Retirement Consultants |

| Regulatory Impact on Pension Funds | 50 | Compliance Officers, Legal Advisors |

The Bahrain Pension Funds Market is valued at approximately USD 10 billion, reflecting a steady growth driven by increasing life expectancy, a growing workforce, and heightened awareness of the importance of retirement savings among the population.