Region:Middle East

Author(s):Shubham

Product Code:KRAB7294

Pages:89

Published On:October 2025

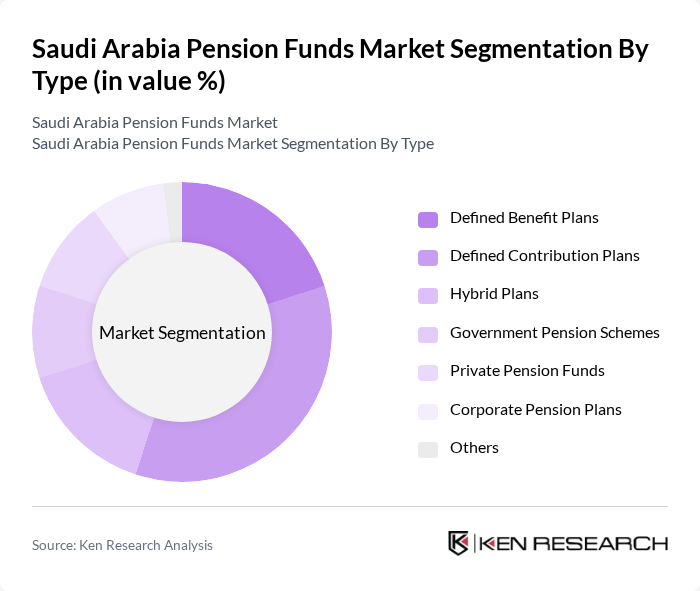

By Type:The pension funds market can be segmented into various types, including Defined Benefit Plans, Defined Contribution Plans, Hybrid Plans, Government Pension Schemes, Private Pension Funds, Corporate Pension Plans, and Others. Each of these subsegments serves different demographic and corporate needs, with Defined Contribution Plans currently leading the market due to their flexibility and growing popularity among younger employees.

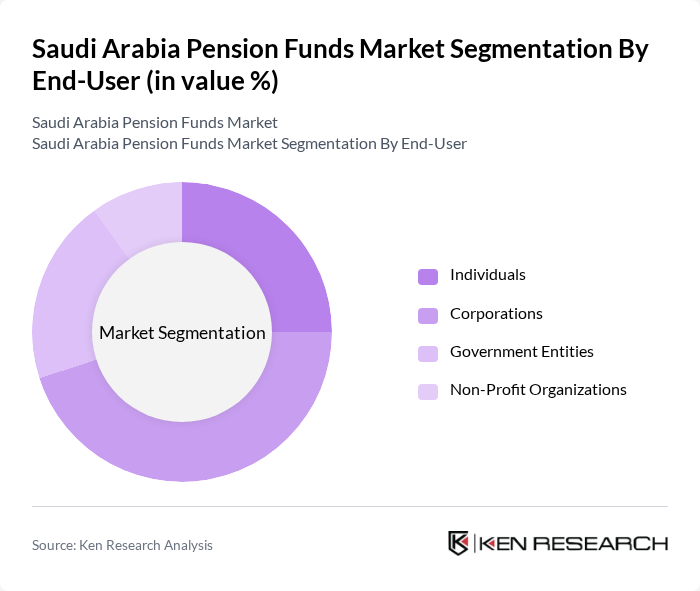

By End-User:The end-users of pension funds include Individuals, Corporations, Government Entities, and Non-Profit Organizations. Among these, Corporations are the dominant end-user segment, as they are increasingly offering pension plans to attract and retain talent, especially in a competitive job market.

The Saudi Arabia Pension Funds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Public Pension Agency, Saudi Arabian Monetary Authority, Alinma Investment, NCB Capital, Samba Capital, Riyad Capital, Al Rajhi Capital, Jadwa Investment, Arab National Bank Investment, Banque Saudi Fransi, Gulf International Bank, HSBC Saudi Arabia, Morgan Stanley Saudi Arabia, Deutsche Bank Saudi Arabia, Citigroup Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia pension funds market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As digital platforms become more prevalent, fund management is expected to become more efficient, attracting younger investors. Additionally, the focus on sustainable investments will likely reshape asset allocation strategies, aligning with global trends. With government support for financial literacy and retirement savings, the market is anticipated to experience a gradual increase in participation and investment, fostering long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Defined Benefit Plans Defined Contribution Plans Hybrid Plans Government Pension Schemes Private Pension Funds Corporate Pension Plans Others |

| By End-User | Individuals Corporations Government Entities Non-Profit Organizations |

| By Investment Strategy | Active Management Passive Management Target Date Funds Tactical Asset Allocation |

| By Fund Size | Small Funds Medium Funds Large Funds |

| By Risk Profile | Conservative Moderate Aggressive |

| By Distribution Channel | Direct Sales Financial Advisors Online Platforms |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Public Awareness Campaigns |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Sector Pension Funds | 100 | Pension Fund Managers, Government Officials |

| Private Sector Pension Schemes | 80 | HR Directors, Financial Advisors |

| Corporate Pension Plans | 70 | Benefits Managers, CFOs |

| Investment Strategies and Performance | 90 | Investment Analysts, Portfolio Managers |

| Retirement Planning and Expectations | 60 | Employees, Retirees, Financial Planners |

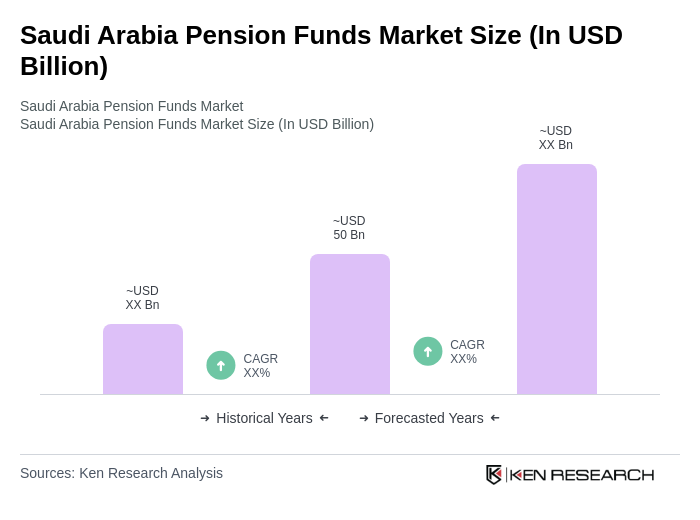

The Saudi Arabia Pension Funds Market is valued at approximately USD 50 billion, reflecting growth driven by an increasing number of retirees, rising life expectancy, and government initiatives aimed at enhancing social security systems.