Region:Middle East

Author(s):Shubham

Product Code:KRAD6819

Pages:94

Published On:December 2025

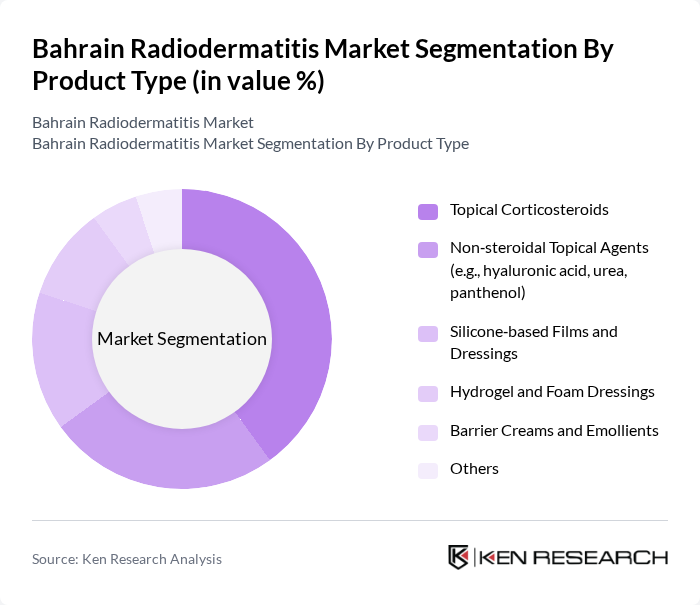

By Product Type:The product type segmentation includes various treatment options for radiodermatitis, each catering to different patient needs. The subsegments include Topical Corticosteroids, Non-steroidal Topical Agents, Silicone-based Films and Dressings, Hydrogel and Foam Dressings, Barrier Creams and Emollients, and Others. Among these, Topical Corticosteroids are the most widely used due to their effectiveness in reducing inflammation and providing symptomatic relief. The increasing adoption of these products in clinical settings is driven by their proven efficacy and the growing awareness among healthcare professionals regarding their benefits.

By Line of Therapy:The line of therapy segmentation encompasses Prophylactic (Preventive) Treatment, Symptomatic / Reactive Treatment, and Others. Prophylactic treatments are gaining traction as healthcare providers increasingly recognize the importance of preventing radiodermatitis in patients undergoing radiation therapy. This proactive approach not only enhances patient comfort but also reduces the overall treatment burden, making it a preferred choice among clinicians.

The Bahrain Radiodermatitis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mölnlycke Health Care AB, Smith & Nephew plc, 3M Company, ConvaTec Group plc, B. Braun Melsungen AG, Coloplast A/S, Derma Sciences Inc. (Integra LifeSciences), Medline Industries, LP, Meda AB (a Mylan Company), Ferring Pharmaceuticals A/S, Alliance Pharmaceuticals plc, Galderma S.A., Bayer AG, Sanofi S.A., Pfizer Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain radiodermatitis market appears promising, driven by increasing healthcare investments and a growing emphasis on patient-centered care. As the government allocates more resources to healthcare infrastructure, the availability of specialized dermatological services is expected to improve. Additionally, the integration of telemedicine is likely to enhance access to dermatological consultations, allowing patients to receive timely care and education about radiodermatitis management, ultimately fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Topical Corticosteroids Non?steroidal Topical Agents (e.g., hyaluronic acid, urea, panthenol) Silicone?based Films and Dressings Hydrogel and Foam Dressings Barrier Creams and Emollients Others |

| By Line of Therapy | Prophylactic (Preventive) Treatment Symptomatic / Reactive Treatment Others |

| By Radiation Therapy Setting | Public Cancer Centers (e.g., Salmaniya Medical Complex) Private Oncology Hospitals and Clinics Regional Referral and Teaching Hospitals Others |

| By Severity of Condition | Grade 1 (Mild Radiodermatitis) Grade 2 (Moderate Radiodermatitis) Grade 3–4 (Severe / Ulcerative Radiodermatitis) Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By Patient Profile | Breast Cancer Patients Head & Neck Cancer Patients Pelvic and Abdominal Cancer Patients Hematologic and Other Indications Others |

| By Payer Type | Government / Public Insurance (NHRA?regulated) Private Insurance Out?of?Pocket / Self?pay Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 80 | Dermatologists, Clinic Managers |

| Patient Treatment Feedback | 120 | Patients undergoing radiodermatitis treatment |

| Healthcare Providers | 70 | Nurses, Physician Assistants |

| Pharmaceutical Distributors | 60 | Sales Representatives, Distribution Managers |

| Health Insurance Companies | 40 | Claims Analysts, Policy Underwriters |

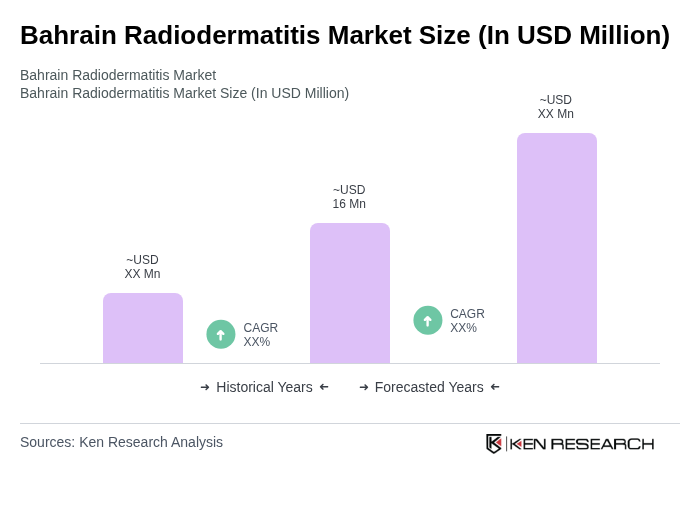

The Bahrain Radiodermatitis Market is valued at approximately USD 16 million, reflecting a significant growth driven by the increasing prevalence of cancer treatments, particularly radiation therapy, which leads to a higher incidence of radiodermatitis among patients.