Region:Middle East

Author(s):Dev

Product Code:KRAA6835

Pages:91

Published On:January 2026

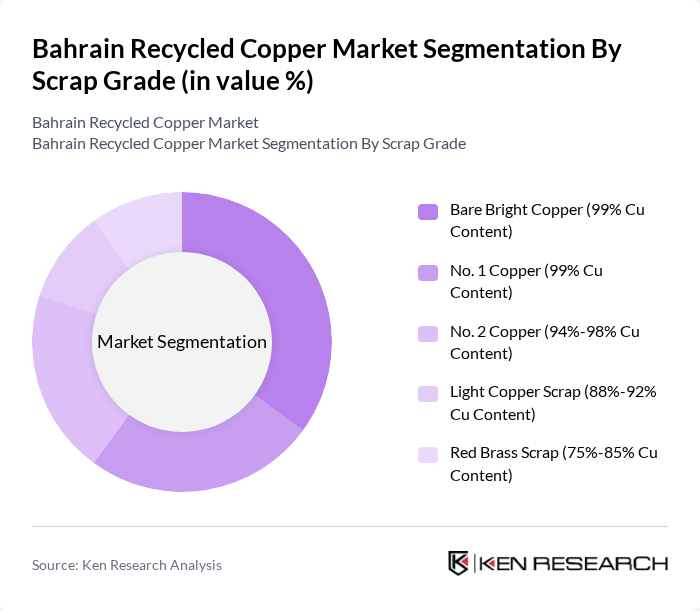

By Scrap Grade:The market is segmented based on the grade of copper scrap, which includes Bare Bright Copper, No. 1 Copper, No. 2 Copper, Light Copper Scrap, and Red Brass Scrap. Each grade has distinct characteristics and applications, influencing its demand in various industries. Bare Bright Copper, with its high purity, is particularly sought after for electrical applications, while No. 1 and No. 2 Copper are favored in construction and manufacturing. The demand for Light Copper Scrap and Red Brass Scrap is also growing due to their use in plumbing and automotive applications.

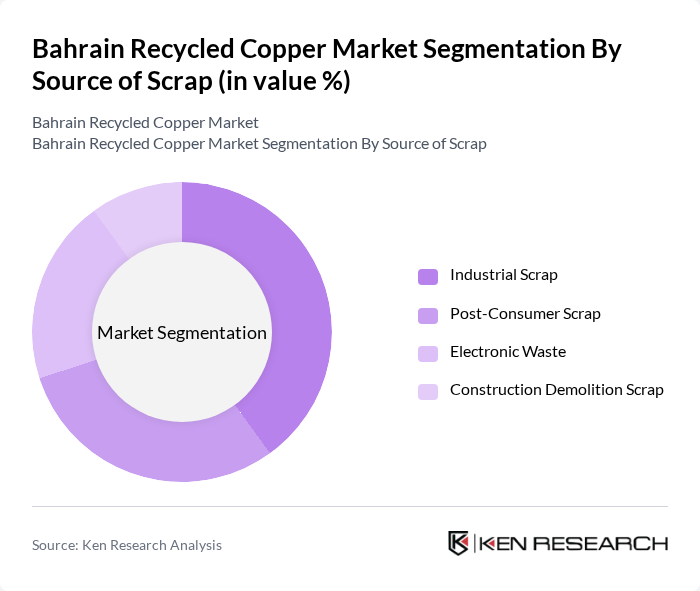

By Source of Scrap:The market is also segmented by the source of scrap, which includes Industrial Scrap, Post-Consumer Scrap, Electronic Waste, and Construction Demolition Scrap. Industrial Scrap is the largest contributor due to the high volume of copper used in manufacturing processes. Post-Consumer Scrap is gaining traction as consumers become more environmentally conscious, while Electronic Waste is a growing source due to the increasing use of electronic devices. Construction Demolition Scrap is also significant, driven by ongoing infrastructure projects and urban redevelopment.

The Bahrain Recycled Copper Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Copper and Aluminum, Bahrain Recycling Company, Al Jazeera Steel Products Co. SAOG, Al-Moayyed International Group, Bahrain National Metal Products Company, Al-Ahlia Integrated Industrial Company, Al-Futtaim Group, Al-Mohsin Group, Al-Bahar Group, Al-Hassan Group, Al-Mansoori Specialized Engineering, Al-Salam International Hospital, Al-Muharraq Group, Al-Muhriz Group, Al-Mahroos Group contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain recycled copper market is poised for significant growth, driven by increasing consumer awareness of sustainability and government support for recycling initiatives. As electric vehicle production rises, the demand for copper will likely surge, creating new opportunities for recyclers. Additionally, the shift towards circular economy practices will encourage businesses to adopt sustainable sourcing strategies, further enhancing the market's potential. The focus on technological advancements in recycling processes will also play a crucial role in shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Scrap Grade | Bare Bright Copper (99% Cu Content) No. 1 Copper (99% Cu Content) No. 2 Copper (94%-98% Cu Content) Light Copper Scrap (88%-92% Cu Content) Red Brass Scrap (75%-85% Cu Content) |

| By Source of Scrap | Industrial Scrap Post-Consumer Scrap Electronic Waste Construction Demolition Scrap |

| By End-User Application | Building & Construction Electrical & Electronics Transportation Industrial Machinery & Equipment Energy & Power |

| By Processing Method | Hydrometallurgical Pyrometallurgical Mechanical Recycling |

| By Distribution Channel | Direct Sales to Manufacturers Distributors & Traders Smelters & Refiners Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Recycling Facility Operations | 120 | Plant Managers, Operations Supervisors |

| Manufacturers of Copper Products | 90 | Production Managers, Supply Chain Coordinators |

| Environmental Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| End-User Industries (Construction, Electronics) | 70 | Procurement Managers, Sustainability Officers |

| Trade Associations and Industry Groups | 60 | Association Leaders, Industry Analysts |

The Bahrain Recycled Copper Market is valued at approximately USD 115 thousand, reflecting a five-year historical analysis. This valuation is influenced by the growing demand for sustainable materials and the expansion of recycling initiatives in the region.