Region:Asia

Author(s):Dev

Product Code:KRAA6836

Pages:95

Published On:January 2026

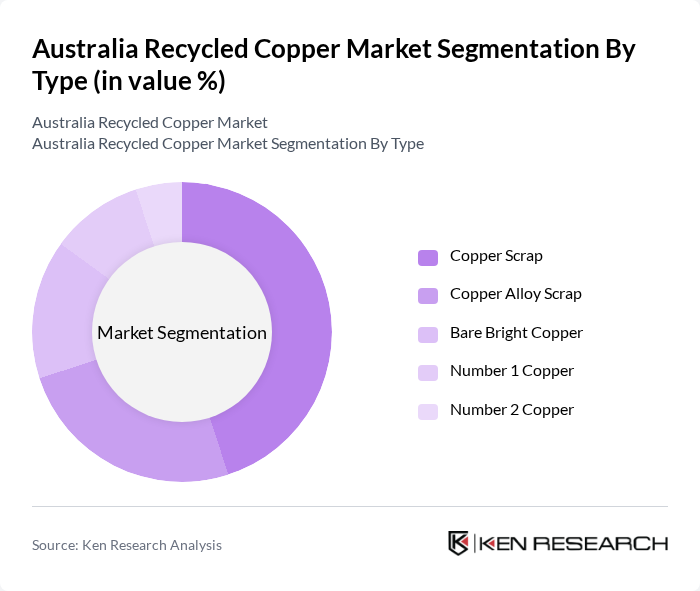

By Type:The market is segmented into various types of recycled copper, including Copper Scrap, Copper Alloy Scrap, Bare Bright Copper, Number 1 Copper, and Number 2 Copper. Among these, Copper Scrap is the most dominant segment due to its widespread availability and versatility in applications. The increasing focus on sustainability and the circular economy has led to a higher demand for recycled copper, particularly in construction and electrical applications. Copper Alloy Scrap follows closely, driven by its use in specialized applications requiring specific material properties.

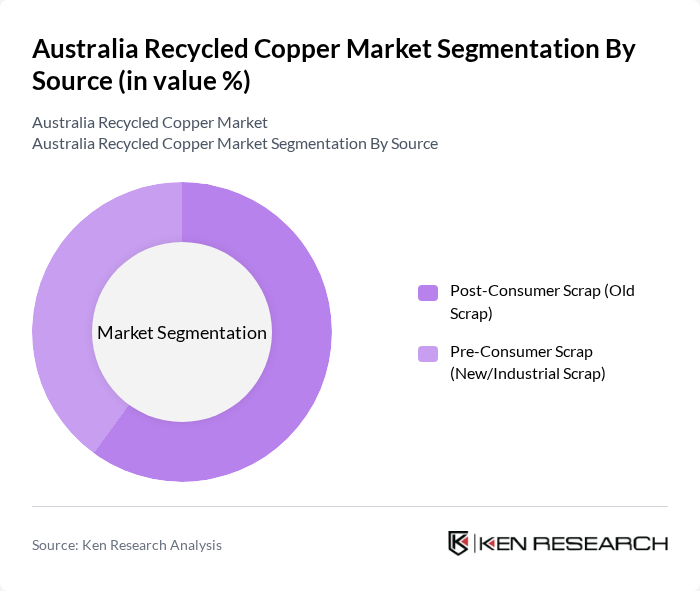

By Source:The market is categorized into Post-Consumer Scrap (Old Scrap) and Pre-Consumer Scrap (New/Industrial Scrap). Post-Consumer Scrap is the leading source, as it encompasses a wide range of discarded products, including electrical appliances and construction materials. The growing trend of recycling old products to recover valuable materials has significantly boosted this segment. Pre-Consumer Scrap, while smaller, is also important as it includes manufacturing waste that can be recycled before reaching the consumer.

The Australia Recycled Copper Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sims Limited, Cleanaway Waste Management Limited, Recycling Technologies Australia, Australian Copper Recycling, Metal Manufacturers, Aurubis AG, Copper Recycling Australia, MRAL, EcoActiv, Envirostream Australia, Toxfree Solutions, Veolia Environmental Services, Suez Recycling and Recovery, J.J. Richards & Sons, A1 Scrap Metal contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia recycled copper market appears promising, driven by increasing regulatory support and technological advancements. As industries shift towards sustainable practices, the demand for recycled copper is expected to rise significantly. Additionally, the expansion of electric vehicle production and renewable energy projects will further enhance the market's growth potential. With ongoing investments in recycling infrastructure, the sector is poised for substantial development, aligning with global sustainability goals and circular economy initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Copper Scrap Copper Alloy Scrap Bare Bright Copper Number 1 Copper Number 2 Copper |

| By Source | Post-Consumer Scrap (Old Scrap) Pre-Consumer Scrap (New/Industrial Scrap) |

| By End-Use | Building & Construction Electrical & Electronics Transportation Industrial Machinery & Equipment Consumer Products |

| By Processing Method | Pyrometallurgical Processing Hydrometallurgical Processing Mechanical Processing Electrometallurgical Processing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Copper Usage | 100 | Project Managers, Procurement Officers |

| Electronics Recycling Practices | 80 | Product Managers, Sustainability Coordinators |

| Automotive Copper Recovery | 70 | Operations Managers, Supply Chain Analysts |

| Industrial Copper Scrap Collection | 90 | Facility Managers, Recycling Coordinators |

| Government Policy Impact on Recycling | 60 | Policy Makers, Environmental Consultants |

The Australia Recycled Copper Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing demand for sustainable materials and environmental awareness across various industries.