Region:Middle East

Author(s):Dev

Product Code:KRAA6832

Pages:100

Published On:January 2026

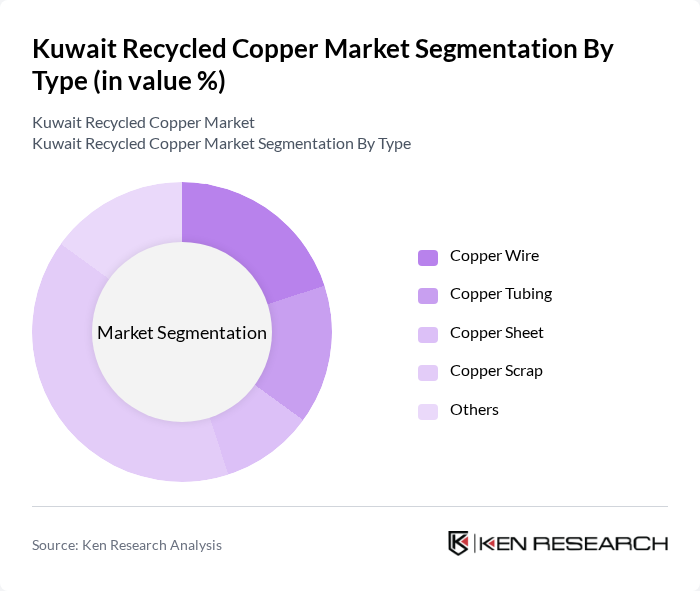

By Type:The market is segmented into various types, including Copper Wire, Copper Tubing, Copper Sheet, Copper Scrap, and Others. Among these, Copper Scrap is the leading sub-segment due to its widespread availability and high demand in various industries. Bare Bright Copper Scrap and #1 Copper Scrap dominate the scrap segment due to their high purity, value, and versatility for remelting and refining. The increasing focus on recycling and sustainability has led to a surge in the collection and processing of copper scrap, making it a preferred choice for manufacturers looking to reduce costs and environmental impact.

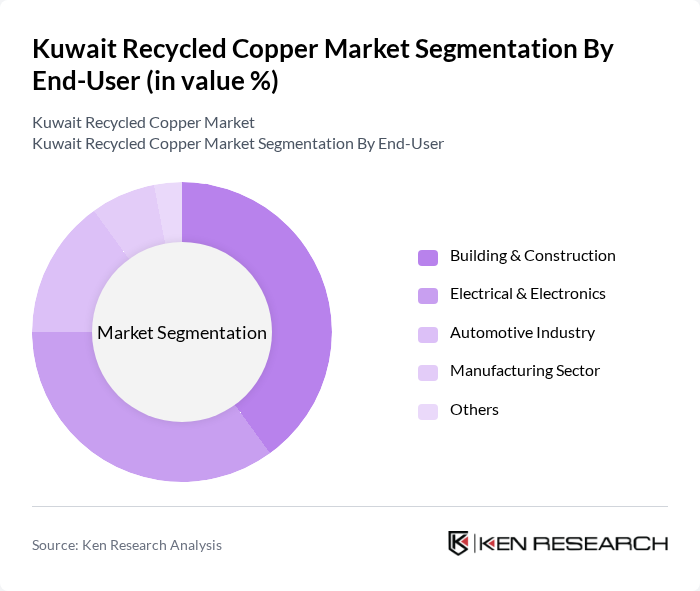

By End-User:The end-user segmentation includes the Electrical Industry, Construction Industry, Automotive Industry, Manufacturing Sector, and Others. The Building & Construction sector is the dominant segment, driven by extensive use of copper in plumbing, fire protection systems, HVAC components, and electrical wiring in residential, commercial, and infrastructure projects. The Electrical & Electronics industry follows closely, driven by demand for high-quality copper in manufacturing cables, transformers, switchgear, and electronic components used in utilities, telecom, and consumer devices. The growth in renewable energy projects, smart city initiatives, and infrastructure development has further propelled the need for recycled copper in these applications.

The Kuwait Recycled Copper Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Metal Recycling Company, Kuwait Industries Co. Holding K.S.C., Al Khalid Metal Scrap Co., Al Mulla Group, Alghanim Industries, Kharafi National, Kuwait Foundry Company, Metal & Recycling Company K.S.C., United Waste Management Company, Kuwait Recyclable Materials Co., Al Sayer Group Holding, Al Qatami Steel & Metal Works, Gulf Recycling Company, and Arabian Metal Industries Co. contribute to innovation, geographic expansion, and service delivery in this space, aligning with the broader Middle East copper scrap ecosystem where traders, recyclers, and integrated industrial groups play complementary roles.

The future of the Kuwait recycled copper market appears promising, driven by increasing consumer awareness of sustainability and government support for recycling initiatives. As industries transition towards circular economy practices, the demand for recycled materials is expected to rise. Innovations in recycling technologies will further enhance efficiency and reduce costs, making recycled copper more competitive against virgin alternatives. This evolving landscape presents significant growth potential for local businesses and investors in the recycling sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Copper Wire Copper Tubing Copper Sheet Copper Scrap Others |

| By End-User | Electrical Industry Construction Industry Automotive Industry Manufacturing Sector Others |

| By Application | Electrical Wiring Plumbing Electronics Renewable Energy Systems Others |

| By Source of Collection | Industrial Scrap Post-Consumer Scrap Construction and Demolition Waste Others |

| By Processing Method | Hydrometallurgical Processing Pyrometallurgical Processing Mechanical Processing Others |

| By Quality Grade | Grade A Grade B Grade C Others |

| By Market Channel | Direct Sales Distributors Online Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Recycling Facility Operations | 45 | Plant Managers, Operations Directors |

| Manufacturers of Copper Products | 50 | Procurement Managers, Production Supervisors |

| Government Regulatory Bodies | 25 | Policy Makers, Environmental Officers |

| Industry Associations | 30 | Executive Directors, Research Analysts |

| End-users of Recycled Copper | 40 | Product Development Managers, Sustainability Coordinators |

The Kuwait Recycled Copper Market is valued at approximately USD 0.1 billion, reflecting a growing trend towards sustainable materials and efficient waste management solutions, driven by increasing industrial activities and government initiatives promoting recycling.