Region:Middle East

Author(s):Shubham

Product Code:KRAC2871

Pages:99

Published On:October 2025

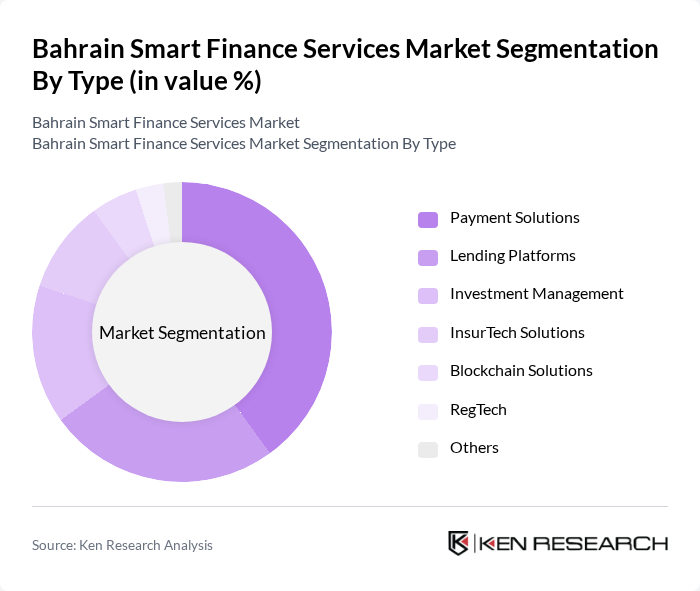

By Type:The market is segmented into various types, including Payment Solutions, Lending Platforms, Investment Management, InsurTech Solutions, Blockchain Solutions, RegTech, and Others. Payment Solutions dominate the market due to the increasing preference for cashless transactions, the expansion of e-commerce, and the convenience offered by mobile payment applications. Lending Platforms are also gaining traction as consumers and SMEs seek quick and accessible financing options, supported by digital onboarding and alternative credit scoring

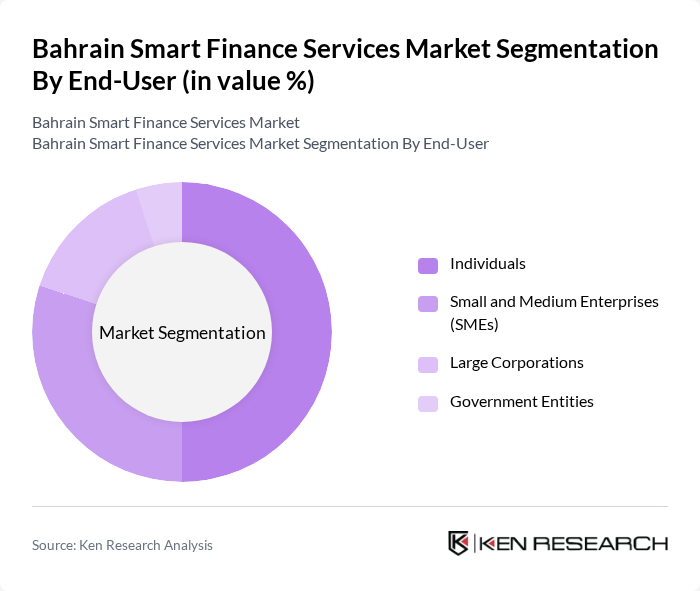

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individuals represent the largest segment as they increasingly adopt smart finance services for personal finance management, digital wallets, and mobile banking. SMEs are also significant contributors, leveraging these services to enhance operational efficiency, access funding, and streamline payments .

The Bahrain Smart Finance Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Islamic Bank, Ahli United Bank, National Bank of Bahrain, Gulf International Bank, Bank of Bahrain and Kuwait, Bahrain Development Bank, Fintech Bay, BENEFIT Company, Tamkeen, Zain Bahrain, stc Bahrain, PayTabs, Tarabut Gateway, Rain Financial, Aion Digital contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's smart finance services market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance service personalization, while the growing trend of contactless payments will further streamline transactions. Additionally, as the government continues to support fintech initiatives, the market is likely to witness increased competition and innovation, fostering a more dynamic financial ecosystem that meets the diverse needs of consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Solutions Lending Platforms Investment Management InsurTech Solutions Blockchain Solutions RegTech Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Personal Finance Management Business Financing Wealth Management Insurance Services |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Retail Customers Institutional Clients Corporate Clients |

| By Payment Method | Credit/Debit Cards Bank Transfers Cryptocurrency |

| By Policy Support | Tax Incentives Regulatory Sandboxes Subsidies for Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Payment Solutions | 100 | Product Managers, Digital Strategy Leads |

| Online Lending Platforms | 80 | Risk Analysts, Business Development Managers |

| Investment Advisory Services | 60 | Financial Advisors, Wealth Management Executives |

| Consumer Banking Services | 90 | Branch Managers, Customer Experience Officers |

| Fintech Startups | 40 | Founders, CTOs, and Innovation Managers |

The Bahrain Smart Finance Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital payment solutions, fintech startups, and efficient financial management tools among consumers and businesses.