Region:Middle East

Author(s):Dev

Product Code:KRAC3347

Pages:92

Published On:October 2025

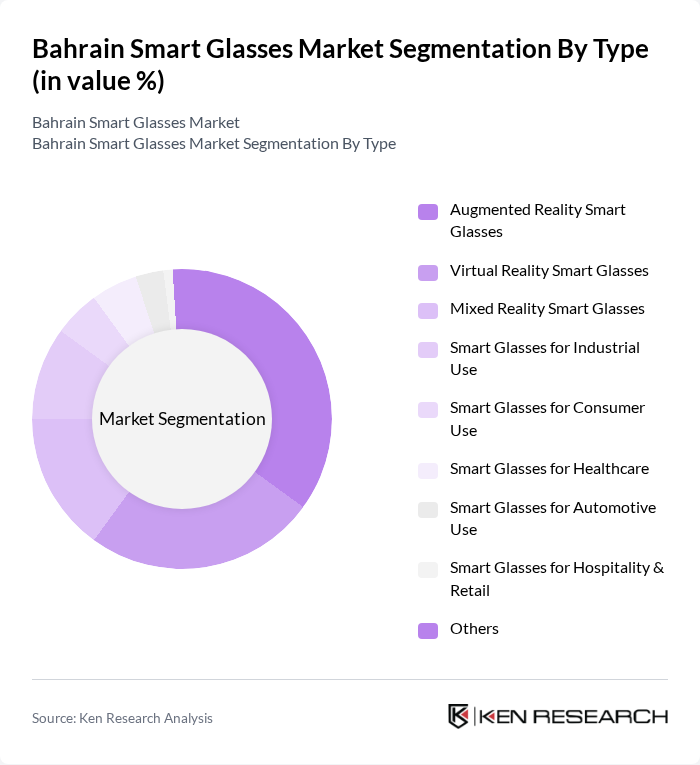

By Type:The market is segmented into Augmented Reality Smart Glasses, Virtual Reality Smart Glasses, Mixed Reality Smart Glasses, Smart Glasses for Industrial Use, Smart Glasses for Consumer Use, Smart Glasses for Healthcare, Smart Glasses for Automotive Use, Smart Glasses for Hospitality & Retail, and Others. Augmented Reality Smart Glasses lead the market, driven by their extensive use in training, education, and retail environments. The segment benefits from the growing demand for immersive experiences, interactive applications, and the integration of AR in enterprise and consumer settings.

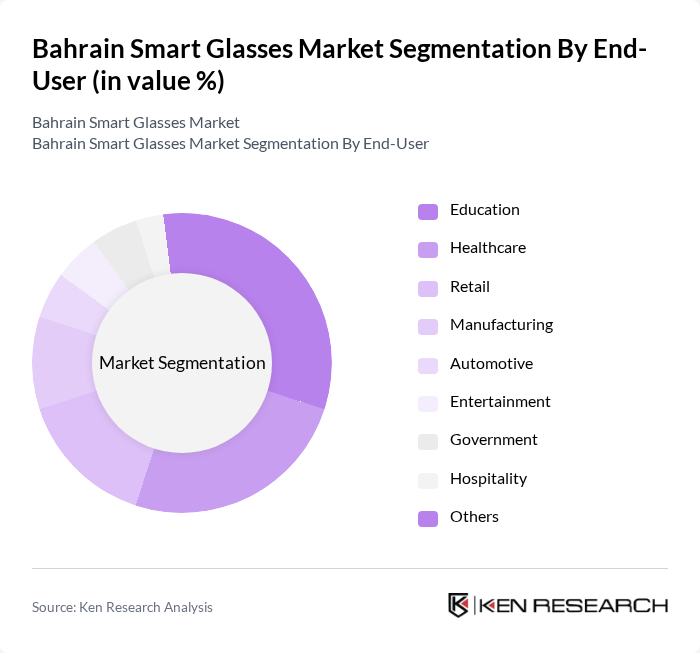

By End-User:The end-user segmentation includes Education, Healthcare, Retail, Manufacturing, Automotive, Entertainment, Government, Hospitality, and Others. The Education sector is the dominant segment, supported by government mandates and the increasing integration of smart glasses into classrooms for interactive and innovative teaching. Healthcare follows closely, leveraging smart glasses for remote consultations, surgical assistance, and patient monitoring. Retail and manufacturing sectors are also adopting smart glasses for enhanced customer engagement and operational efficiency.

The Bahrain Smart Glasses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Microsoft Corporation, Vuzix Corporation, Epson Corporation, Magic Leap, Inc., Sony Corporation, Lenovo Group Limited, Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., RealWear, Inc., North Inc. (acquired by Google), ODG (Osterhout Design Group), Atheer, Inc., Daqri LLC, ThirdEye Gen, Inc., AGC Inc., Gentex Corporation, Corning Incorporated, Saint-Gobain S.A., Smartglass International, View Inc., Polytronix Inc., Smart Glass Technologies LLC, Halio Inc., Gauzy Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart glasses market in Bahrain appears promising, driven by technological advancements and increasing applications across various sectors. As businesses and educational institutions continue to invest in AR and VR technologies, the demand for smart glasses is expected to rise. Additionally, collaborations between tech companies and local enterprises will likely foster innovation, leading to the development of more affordable and user-friendly devices. This evolving landscape presents significant opportunities for growth and market expansion in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Augmented Reality Smart Glasses Virtual Reality Smart Glasses Mixed Reality Smart Glasses Smart Glasses for Industrial Use Smart Glasses for Consumer Use Smart Glasses for Healthcare Smart Glasses for Automotive Use Smart Glasses for Hospitality & Retail Others |

| By End-User | Education Healthcare Retail Manufacturing Automotive Entertainment Government Hospitality Others |

| By Application | Training and Simulation Remote Assistance Navigation Gaming Healthcare Monitoring Industrial Operations Retail Experience Enhancement Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Sales System Integrators Others |

| By Price Range | Budget Smart Glasses Mid-Range Smart Glasses Premium Smart Glasses Luxury Smart Glasses |

| By Brand | Established Brands Emerging Brands Private Labels |

| By User Demographics | Age Group Gender Income Level Geographic Location |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Adoption | 100 | Healthcare Administrators, Medical Device Managers |

| Retail Technology Integration | 60 | Store Managers, IT Directors |

| Tourism and Hospitality Usage | 50 | Hotel Managers, Tour Operators |

| Education Sector Implementation | 40 | School Administrators, IT Coordinators |

| Consumer Electronics Market | 70 | Retail Buyers, Product Managers |

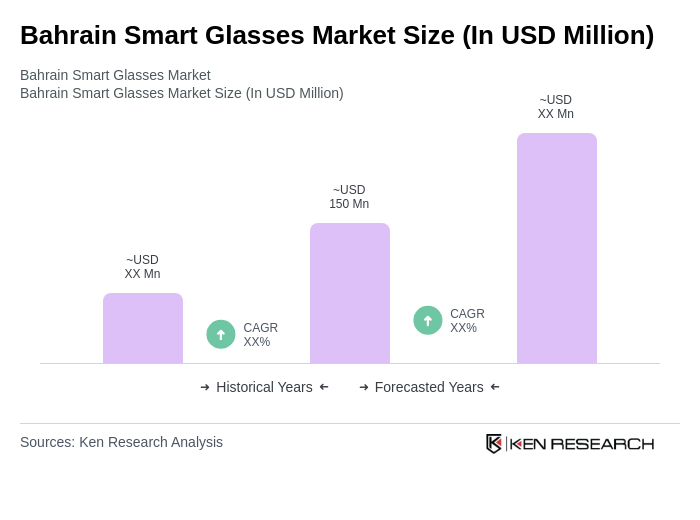

The Bahrain Smart Glasses Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is influenced by advancements in augmented reality (AR) and virtual reality (VR) technologies, as well as the growing demand for smart wearable devices.