Region:Middle East

Author(s):Rebecca

Product Code:KRAC8402

Pages:97

Published On:November 2025

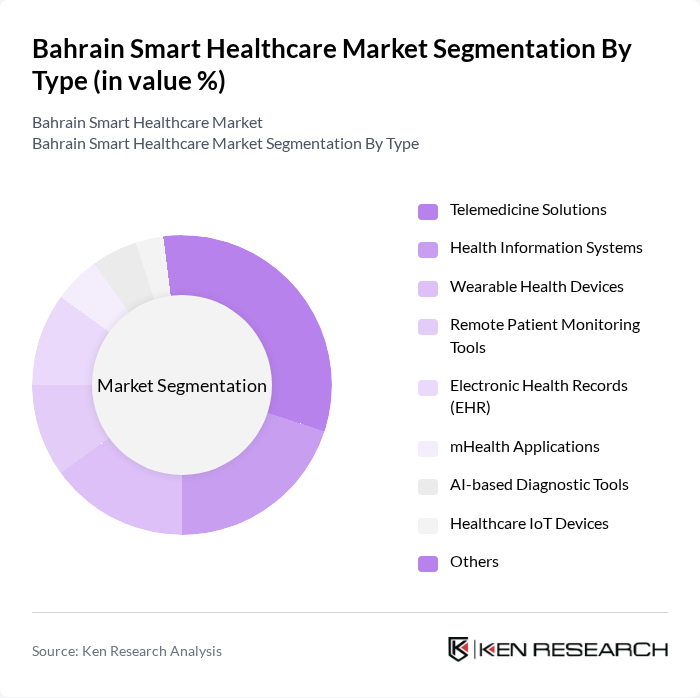

By Type:This segmentation includes various technological solutions that enhance healthcare delivery and patient management. The subsegments are Telemedicine Solutions, Health Information Systems, Wearable Health Devices, Remote Patient Monitoring Tools, Electronic Health Records (EHR), mHealth Applications, AI-based Diagnostic Tools, Healthcare IoT Devices, and Others. The market is witnessing a significant shift towards telemedicine solutions, driven by the increasing demand for remote healthcare services, the convenience they offer to patients, and the growing prevalence of chronic diseases that require ongoing monitoring and management. Additionally, the adoption of IoT-connected medical devices and AI-driven analytics is enabling continuous monitoring and personalized care .

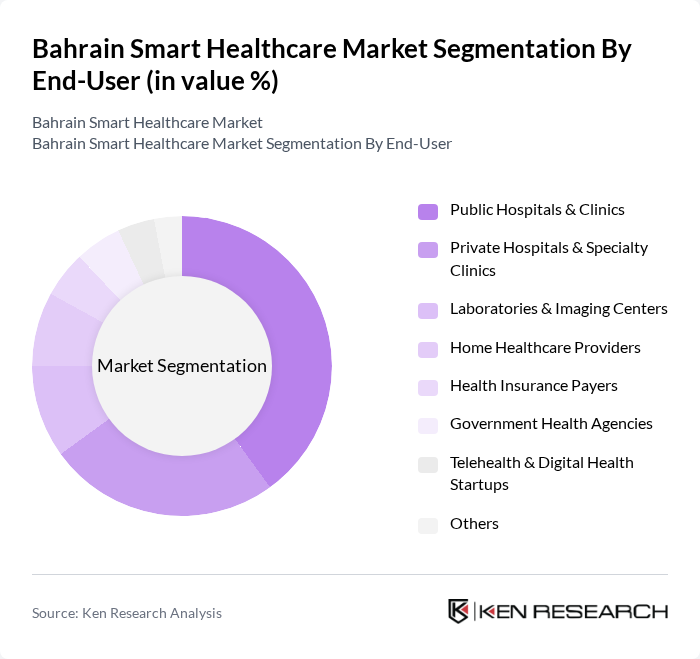

By End-User:This segmentation focuses on the various entities utilizing smart healthcare solutions. The subsegments include Public Hospitals & Clinics, Private Hospitals & Specialty Clinics, Laboratories & Imaging Centers, Home Healthcare Providers, Health Insurance Payers, Government Health Agencies, Telehealth & Digital Health Startups, and Others. Public hospitals and clinics are leading this segment due to their large patient base, the increasing need for efficient healthcare delivery systems, and the government’s focus on digitizing public health infrastructure. Private hospitals and specialty clinics are also rapidly adopting smart healthcare solutions to enhance patient engagement and operational efficiency .

The Bahrain Smart Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salmaniya Medical Complex, King Hamad University Hospital, Bahrain Defense Force Hospital, American Mission Hospital, Royal Bahrain Hospital, KIMSHEALTH Bahrain, Ibn Al-Nafees Hospital, Bahrain Specialist Hospital, Al Hilal Hospital, Health 360, Seha, AWS Middle East (Bahrain) Region, Almoayed Group, Tamkeen, and Medgulf contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain smart healthcare market appears promising, driven by technological advancements and increasing consumer acceptance of digital health solutions. As the government continues to invest in healthcare infrastructure, the integration of artificial intelligence and IoT devices is expected to enhance patient care and operational efficiency. Furthermore, the growing emphasis on preventive healthcare will likely lead to increased demand for innovative health monitoring solutions, positioning Bahrain as a regional leader in smart healthcare initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Solutions Health Information Systems Wearable Health Devices Remote Patient Monitoring Tools Electronic Health Records (EHR) mHealth Applications AI-based Diagnostic Tools Healthcare IoT Devices Others |

| By End-User | Public Hospitals & Clinics Private Hospitals & Specialty Clinics Laboratories & Imaging Centers Home Healthcare Providers Health Insurance Payers Government Health Agencies Telehealth & Digital Health Startups Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Chronic Disease Patients Others |

| By Service Type | Consultation Services Diagnostic Services Treatment Services Follow-up Services Preventive Care Services Others |

| By Technology | Cloud Computing Artificial Intelligence Internet of Things (IoT) Big Data Analytics Blockchain Others |

| By Geographic Coverage | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Digital Health Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Adoption | 100 | Healthcare Providers, IT Managers |

| Wearable Health Technology | 60 | Patients, Fitness Trainers |

| Health Information Systems | 50 | Hospital Administrators, IT Directors |

| Remote Patient Monitoring | 40 | Healthcare Professionals, Care Coordinators |

| Smart Health Apps Usage | 70 | Patients, App Developers |

The Bahrain Smart Healthcare Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital health technologies and government initiatives aimed at enhancing healthcare infrastructure.