Region:Middle East

Author(s):Dev

Product Code:KRAC2075

Pages:86

Published On:October 2025

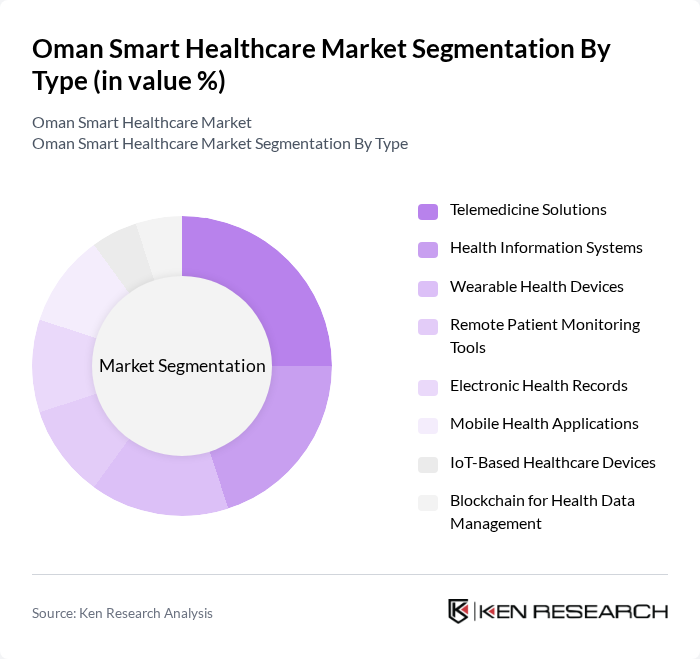

By Type:The market is segmented into various types, including Telemedicine Solutions, Health Information Systems, Wearable Health Devices, Remote Patient Monitoring Tools, Electronic Health Records, Mobile Health Applications, IoT-Based Healthcare Devices, and Blockchain for Health Data Management. Each of these segments plays a crucial role in enhancing healthcare delivery and patient engagement.

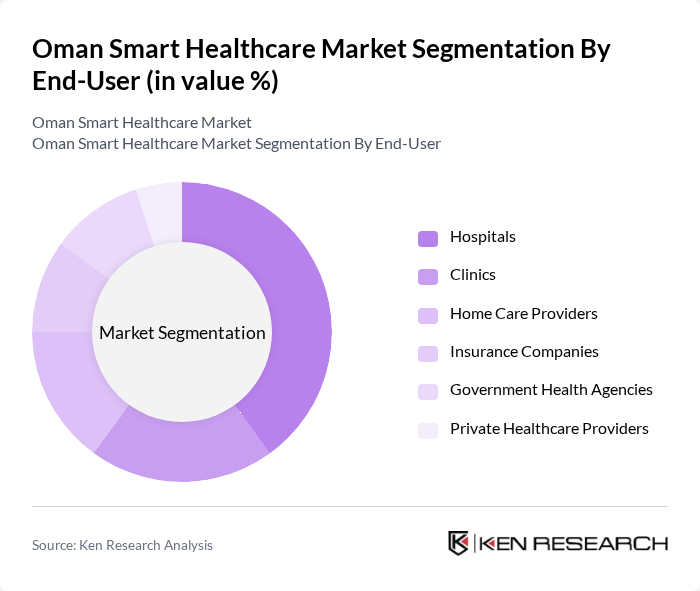

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Providers, Insurance Companies, Government Health Agencies, and Private Healthcare Providers. Each segment has unique requirements and contributes to the overall growth of the smart healthcare market.

The Oman Smart Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Cerner Corporation, Allscripts Healthcare Solutions, Medtronic, IBM Watson Health, Oracle Health Sciences, Epic Systems Corporation, eClinicalWorks, Health Catalyst, Teladoc Health, Zocdoc, Doximity, MedPage Today, MOH Shifa Tele-clinics, Badr Al Samaa Telemedicine, Burjeel Oman eConsult, KIMS Oman Virtual Care, Starcare Oman Telemedicine, Aster Oman Telehealth contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Smart Healthcare Market is poised for significant transformation, driven by technological advancements and a shift towards patient-centric care models. In future, the integration of artificial intelligence and IoT in healthcare devices is expected to enhance operational efficiency and patient engagement. Furthermore, the government's commitment to digital health initiatives will likely foster innovation, paving the way for new solutions that address healthcare challenges and improve service delivery across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Solutions Health Information Systems Wearable Health Devices Remote Patient Monitoring Tools Electronic Health Records Mobile Health Applications IoT-Based Healthcare Devices Blockchain for Health Data Management |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Government Health Agencies Private Healthcare Providers |

| By Application | Chronic Disease Management Emergency Care Services Health Monitoring Patient Engagement Preventive Healthcare |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Pharmacies Telehealth Platforms |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase Value-Based Pricing |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Artificial Intelligence (AI) and Machine Learning (ML) |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Administration | 60 | Healthcare Administrators, IT Managers |

| Telemedicine Services | 45 | Telehealth Coordinators, Medical Practitioners |

| Patient Experience with Smart Technologies | 50 | Patients, Caregivers |

| Healthcare IT Solutions | 40 | Healthcare IT Specialists, Software Developers |

| Public Health Initiatives | 35 | Public Health Officials, Policy Makers |

The Oman Smart Healthcare Market is valued at approximately USD 80 million, reflecting a significant growth trend driven by the adoption of digital health technologies and government initiatives aimed at enhancing healthcare infrastructure.