Region:Middle East

Author(s):Dev

Product Code:KRAA7003

Pages:93

Published On:January 2026

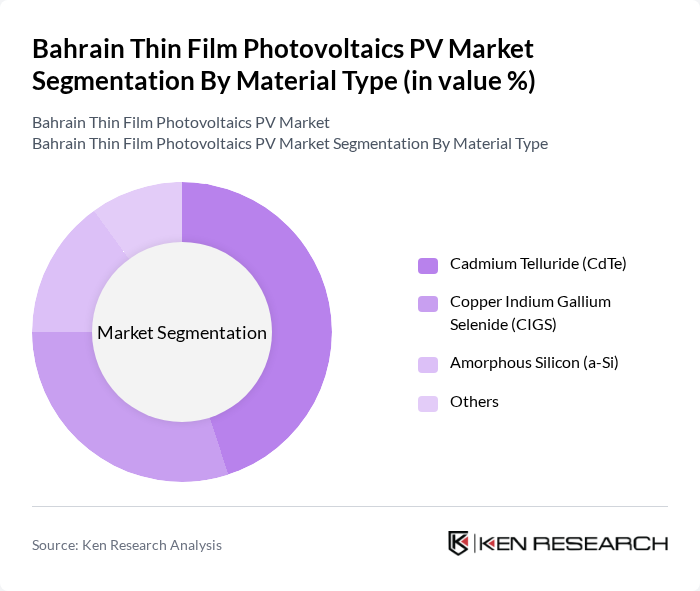

By Material Type:The material type segmentation includes various subsegments such as Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon (a-Si), and Others. Among these, Cadmium Telluride (CdTe) is currently the leading subsegment due to its high efficiency and lower production costs compared to other materials. The growing preference for CdTe in utility-scale applications is driven by its ability to perform well in low-light conditions and hot climates, making it a popular choice for solar installations in Bahrain's climate.

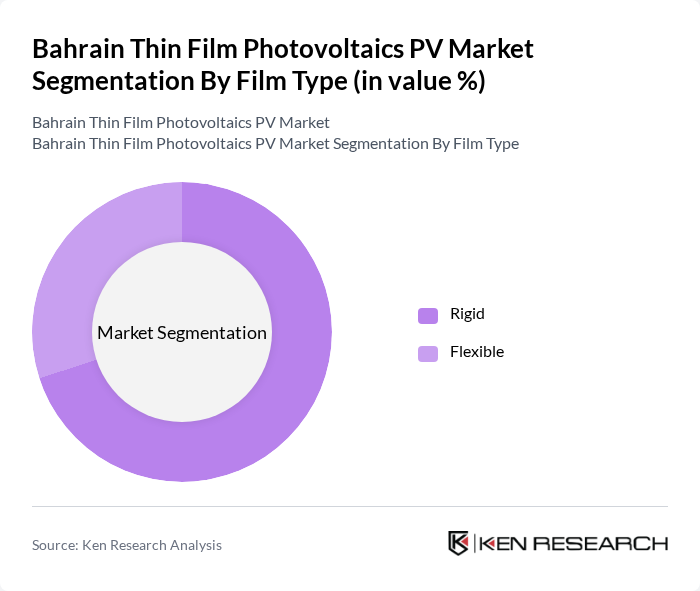

By Film Type:The film type segmentation consists of Rigid and Flexible subsegments. The Rigid film type is currently dominating the market due to its robustness and higher efficiency in energy conversion. Rigid thin film photovoltaics are preferred for large-scale installations, particularly in utility-scale power plants, where durability and performance are critical. The trend towards renewable energy adoption in Bahrain has further solidified the position of rigid films in the market.

The Bahrain Thin Film Photovoltaics PV Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, SunPower Corporation, Canadian Solar, JinkoSolar, Trina Solar, Hanwha Q CELLS, LONGi Green Energy, REC Group, Yingli Green Energy, Solaria, GCL-Poly Energy, JA Solar Technology, Sharp Corporation, Silevo, Q CELLS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thin film photovoltaics market in Bahrain appears promising, driven by increasing government support and technological advancements. As the country aims to meet its renewable energy targets, investments in solar infrastructure are expected to rise. Additionally, the integration of smart grid technologies will enhance energy management and efficiency. With a growing focus on sustainability, the market is likely to witness a surge in community solar projects and residential installations, fostering a more energy-conscious society.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Cadmium Telluride (CdTe) Copper Indium Gallium Selenide (CIGS) Amorphous Silicon (a-Si) Others |

| By Film Type | Rigid Flexible |

| By End-User | Residential Commercial Utility |

| By Application | Utility-Scale Power Plants Building-Integrated Photovoltaics (BIPV) Off-Grid & Remote Power Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 100 | Homeowners, Solar System Installers |

| Commercial Solar Projects | 80 | Facility Managers, Energy Procurement Officers |

| Utility-Scale PV Developments | 60 | Project Developers, Energy Analysts |

| Government Policy Impact | 50 | Regulatory Officials, Energy Policy Advisors |

| Research and Development in PV Technology | 40 | Research Scientists, University Professors |

The Bahrain Thin Film Photovoltaics PV Market is valued at approximately USD 145 million, reflecting a growing demand for renewable energy sources and government initiatives promoting solar energy, particularly large-scale rooftop installations.