Region:Asia

Author(s):Dev

Product Code:KRAA6803

Pages:98

Published On:January 2026

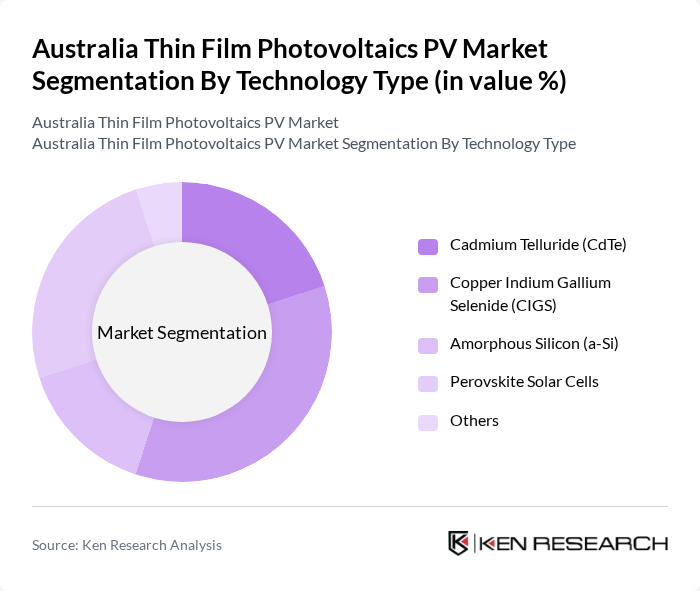

By Technology Type:The technology type segmentation includes various subsegments such as Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon (a-Si), Perovskite Solar Cells, and Others. Among these, CIGS technology is gaining traction due to its high efficiency and flexibility, making it suitable for a variety of applications, including building-integrated photovoltaics. The demand for lightweight and flexible solar panels is driving the growth of this segment, particularly in urban areas where space is limited.

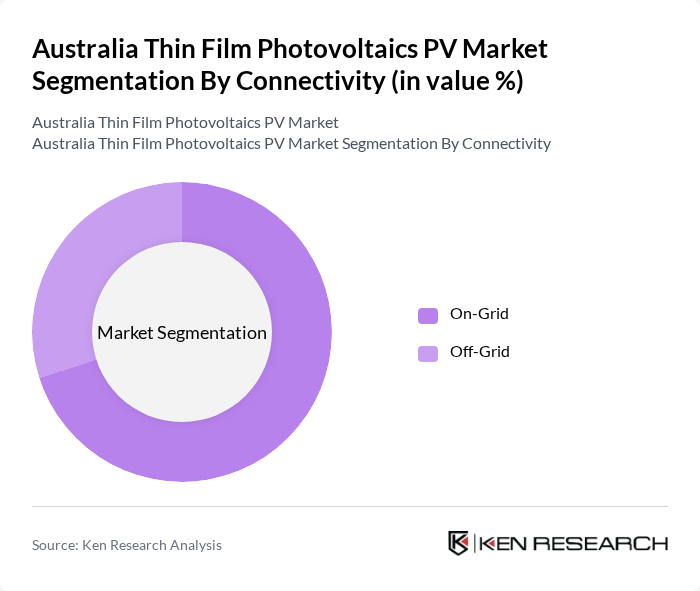

By Connectivity:The connectivity segmentation includes On-Grid and Off-Grid systems. On-Grid systems dominate the market due to their cost-effectiveness and the ability to sell excess energy back to the grid. This segment is particularly popular among residential users who seek to reduce their electricity bills while contributing to the grid's renewable energy supply. Off-Grid systems, while smaller in market share, are essential for remote areas where grid access is limited.

The Australia Thin Film Photovoltaics PV Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, Hanwha Q CELLS, Trina Solar, JinkoSolar, Sharp Corporation, Panasonic Corporation, Hevel Energy Group, Indosolar Limited, Suniva Inc., Tata Power Solar Systems Ltd., GreenBrilliance Renewable Energy LLP, Alps Technology Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thin film photovoltaics market in Australia appears promising, driven by increasing investments in renewable energy infrastructure and technological advancements. As the government continues to implement supportive policies, the market is likely to see enhanced adoption rates. Additionally, the integration of smart grid technologies will facilitate better energy management, further promoting the use of thin film solutions. The focus on sustainability will also encourage innovation, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Cadmium Telluride (CdTe) Copper Indium Gallium Selenide (CIGS) Amorphous Silicon (a-Si) Perovskite Solar Cells Others |

| By Connectivity | On-Grid Off-Grid |

| By Application | Rooftop Installations Utility-Scale Projects Building Integrated Photovoltaics (BIPV) Portable and Flexible Applications |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | New South Wales Victoria Queensland Western Australia South Australia |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Thin Film PV Installations | 100 | Homeowners, Solar Installers |

| Commercial Solar Solutions | 80 | Facility Managers, Energy Procurement Officers |

| Utility-Scale PV Projects | 60 | Project Managers, Renewable Energy Developers |

| Research and Development in PV Technologies | 50 | R&D Managers, University Researchers |

| Policy and Regulatory Insights | 40 | Government Officials, Policy Analysts |

The Australia Thin Film Photovoltaics PV Market is valued at approximately USD 2 billion, reflecting significant growth driven by increasing demand for renewable energy, government incentives, and advancements in thin film technology.