Region:Asia

Author(s):Dev

Product Code:KRAA6794

Pages:90

Published On:January 2026

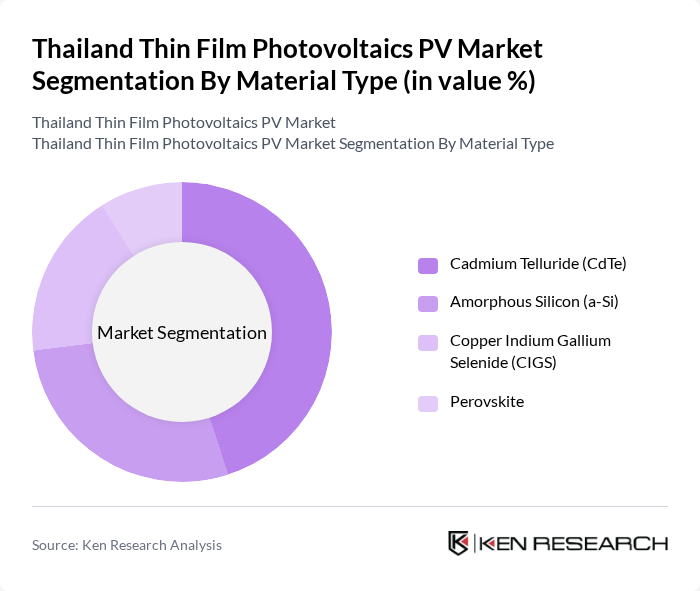

By Material Type:The material types in the thin film photovoltaics market include Cadmium Telluride (CdTe), Amorphous Silicon (a-Si), Copper Indium Gallium Selenide (CIGS), and Perovskite. Cadmium Telluride (CdTe) holds a dominant position due to its cost-effectiveness, high efficiency, and low production costs, making it favored for large-scale solar installations. The demand for CdTe and CIGS continues to grow, driven by their superior efficiency and performance in larger installations, while Amorphous Silicon (a-Si) remains suitable for various applications, especially in urban settings where space is limited.

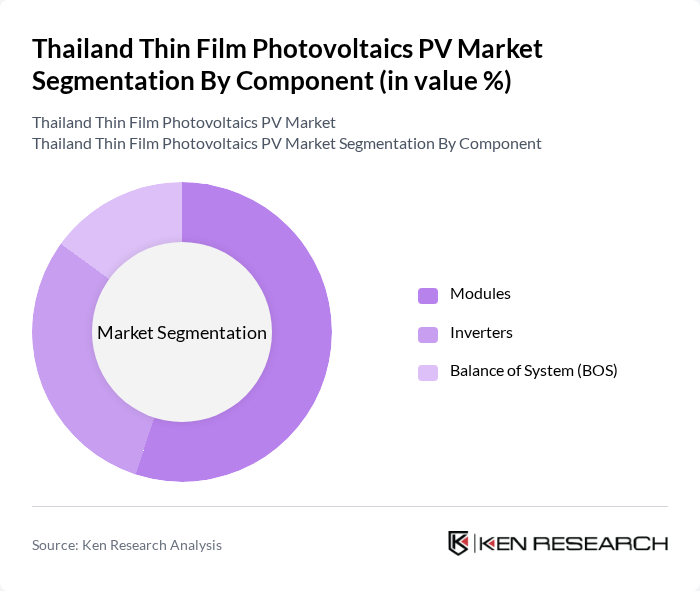

By Component:The components of the thin film photovoltaics market include Modules, Inverters, and Balance of System (BOS). The Modules segment is the most significant contributor to the market, driven by the increasing installation of solar panels in residential and commercial sectors. Inverters are also essential, as they convert the direct current generated by the panels into alternating current for use in homes and businesses. The BOS segment, which includes mounting systems and wiring, is crucial for the overall efficiency and performance of solar installations.

The Thailand Thin Film Photovoltaics PV Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, Trina Solar, Canadian Solar, JinkoSolar, Hanwha Q CELLS, SunPower Corporation, LONGi Green Energy, JA Solar Technology, Yingli Green Energy, REC Group, GCL-Poly Energy, Sharp Corporation, Silevo, Hanwha SolarOne, Solaria Energía y Medio Ambiente contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand thin film photovoltaics market appears promising, driven by increasing government support and technological advancements. As the country aims for a 30% renewable energy share in future, investments in solar technology are expected to rise significantly. Additionally, the growing trend towards decentralized energy systems and smart grid technologies will likely enhance the integration of thin film PV solutions, fostering a more sustainable energy landscape in Thailand.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Cadmium Telluride (CdTe) Amorphous Silicon (a-Si) Copper Indium Gallium Selenide (CIGS) Perovskite |

| By Component | Modules Inverters Balance of System (BOS) |

| By Application | Residential Commercial Utility-Scale |

| By Grid Type | On-Grid Off-Grid |

| By Region | Central Thailand Eastern Thailand Northern Thailand Southern Thailand |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 100 | Homeowners, Solar Installation Contractors |

| Commercial Solar Projects | 80 | Facility Managers, Energy Procurement Officers |

| Government Solar Initiatives | 60 | Policy Makers, Energy Regulators |

| Research and Development in PV Technology | 50 | R&D Managers, University Researchers |

| Solar Energy Financing | 70 | Investment Analysts, Financial Advisors |

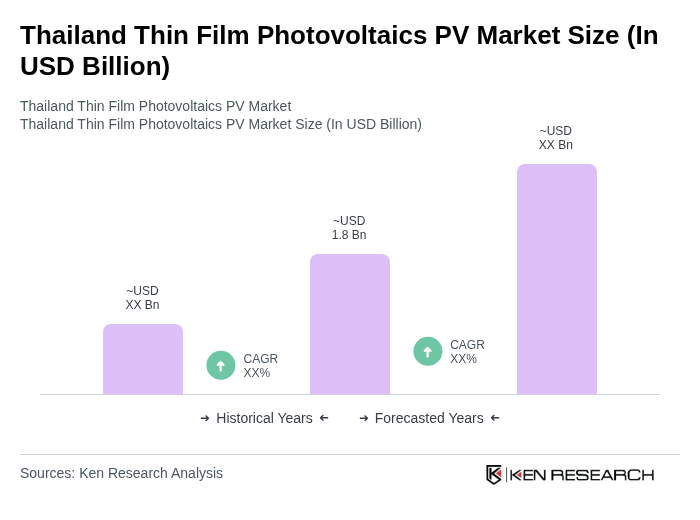

The Thailand Thin Film Photovoltaics PV Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by increasing demand for renewable energy, government incentives, and advancements in thin film technology.