Region:Middle East

Author(s):Dev

Product Code:KRAA7001

Pages:90

Published On:January 2026

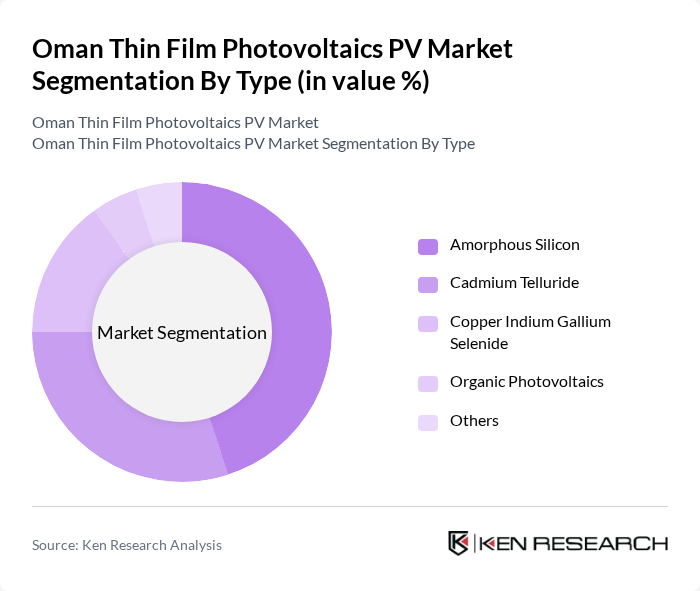

By Type:The thin film photovoltaics market is segmented into various types, including Amorphous Silicon, Cadmium Telluride, Copper Indium Gallium Selenide, Organic Photovoltaics, and Others. Among these, Cadmium Telluride is currently the leading sub-segment due to its high efficiency in large-scale applications and cost-effectiveness. Amorphous Silicon follows closely, favored for its flexibility, lightweight nature, and lower production costs, making it suitable for a variety of applications. The demand for these technologies is driven by their adaptability and the increasing focus on sustainable energy solutions.

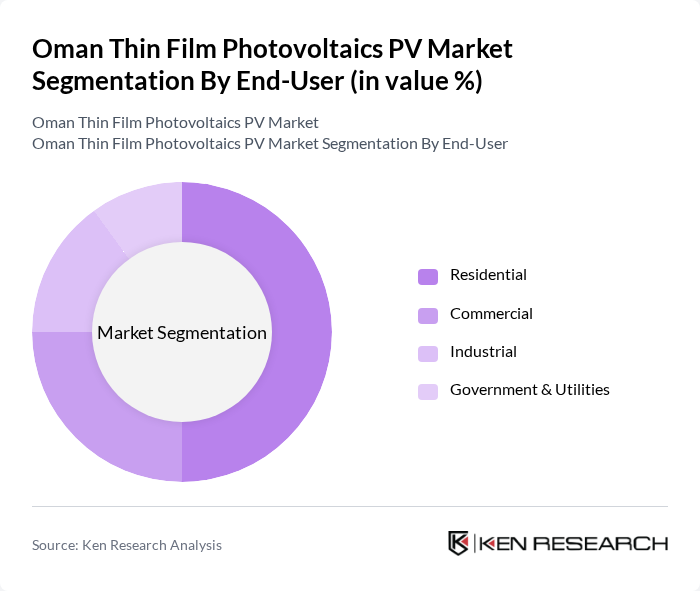

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Government & Utilities segment is currently the dominant sub-segment, driven by large-scale solar projects and national energy goals. The Residential segment is growing due to increasing consumer awareness of renewable energy benefits and government incentives for solar installations. The Commercial sector is also expanding, as businesses seek to reduce energy costs and enhance sustainability. Industrial applications are advancing due to the need for energy-efficient solutions.

The Oman Thin Film Photovoltaics PV Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, SunPower Corporation, Canadian Solar, JinkoSolar, Trina Solar, Hanwha Q CELLS, LONGi Green Energy, REC Group, Yingli Green Energy, Solaria, GCL-Poly Energy, JA Solar Technology, Q CELLS, Silevo, BHEL contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman thin film photovoltaics market appears promising, driven by increasing investments in renewable energy and technological advancements. In future, the integration of smart grid technologies and energy storage solutions is expected to enhance the efficiency of solar energy systems. Additionally, the growing focus on sustainability and carbon neutrality will likely encourage further adoption of thin film technology, positioning Oman as a regional leader in renewable energy initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Amorphous Silicon Cadmium Telluride Copper Indium Gallium Selenide Organic Photovoltaics Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah |

| By Technology | Thin Film Photovoltaics Concentrated Solar Power (CSP) |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 100 | Homeowners, Solar Installation Companies |

| Commercial Solar Projects | 80 | Facility Managers, Energy Procurement Officers |

| Government Renewable Energy Initiatives | 50 | Policy Makers, Energy Regulators |

| Research and Development in PV Technology | 40 | Academic Researchers, Industry Experts |

| Solar Energy Financing and Investment | 60 | Investors, Financial Analysts |

The Oman Thin Film Photovoltaics PV Market is valued at approximately USD 10 million, reflecting a growing interest in renewable energy sources and government initiatives aimed at promoting solar energy solutions.