Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3063

Pages:91

Published On:October 2025

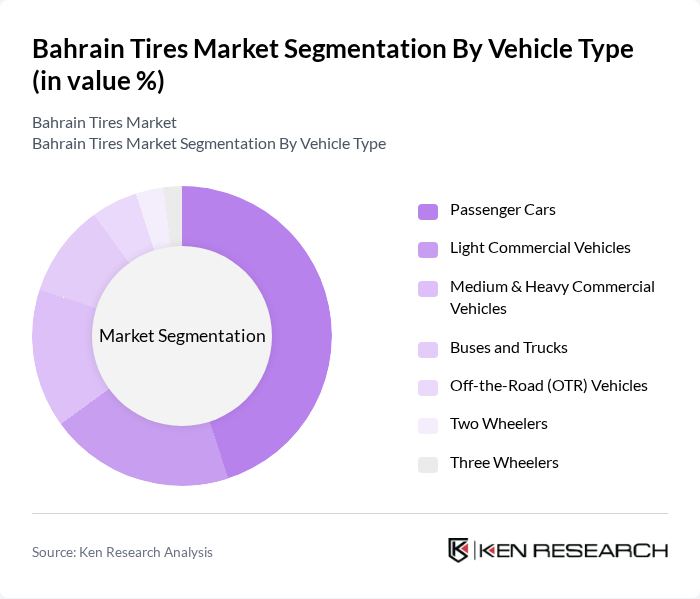

By Vehicle Type:The vehicle type segmentation includes various categories such as Passenger Cars, Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, Buses and Trucks, Off-the-Road (OTR) Vehicles, Two Wheelers, and Three Wheelers. Among these, Passenger Cars dominate the market due to the high number of personal vehicles in Bahrain. The increasing trend of urbanization and the growing middle-class population contribute to the rising demand for passenger vehicles, thus driving the tire market significantly .

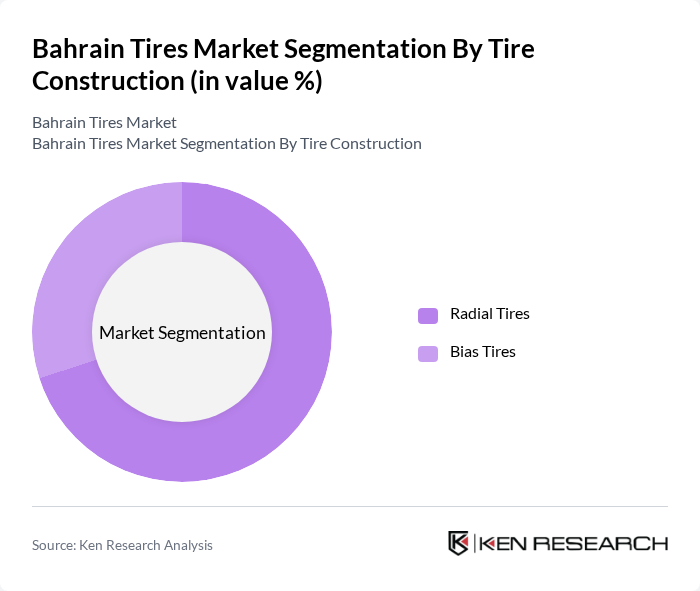

By Tire Construction:The tire construction segmentation includes Radial Tires and Bias Tires. Radial tires are the leading sub-segment due to their superior performance, fuel efficiency, and durability. The growing consumer preference for high-performance tires, especially in passenger vehicles, has led to an increased adoption of radial tires, making them the dominant choice in the market .

The Bahrain Tires Market is characterized by a dynamic mix of regional and international players. Leading participants such as Michelin, Bridgestone, Goodyear, Continental, Pirelli, Dunlop, Yokohama, Hankook, BFGoodrich, Kumho Tire, Toyo Tires, Nexen Tire, Falken Tire, Cooper Tire, Apollo Tyres, Sumitomo Rubber Industries, Giti Tire, Triangle Tire, Al Haddad Motors (local distributor), Ebrahim Khalil Kanoo (local distributor for Bridgestone and Michelin) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain tires market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As electric vehicle adoption increases, the demand for specialized tires is expected to rise, creating new opportunities for manufacturers. Additionally, the expansion of e-commerce platforms will facilitate easier access to tire products, enhancing consumer convenience. These trends indicate a dynamic market landscape, where innovation and consumer preferences will shape the future of tire sales and services in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Medium & Heavy Commercial Vehicles Buses and Trucks Off-the-Road (OTR) Vehicles Two Wheelers Three Wheelers |

| By Tire Construction | Radial Tires Bias Tires |

| By Demand Category | OEM (Original Equipment Manufacturer) Replacement |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Distributors Direct Sales |

| By Price Range | Budget Tires Mid-Range Tires Premium Tires |

| By Application | Urban Driving Off-Road Driving Racing |

| By Region | Central South East West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Tire Sales | 100 | Retail Managers, Sales Executives |

| Commercial Vehicle Tire Distribution | 80 | Logistics Managers, Fleet Operators |

| Specialty Tires for Construction Equipment | 40 | Procurement Managers, Equipment Rental Companies |

| Automotive Service Center Insights | 70 | Service Managers, Technicians |

| Consumer Preferences in Tire Purchasing | 120 | Car Owners, Automotive Enthusiasts |

The Bahrain Tires Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing vehicle ownership, urbanization, and the expansion of the automotive sector in the region.