Region:Middle East

Author(s):Dev

Product Code:KRAB7246

Pages:92

Published On:October 2025

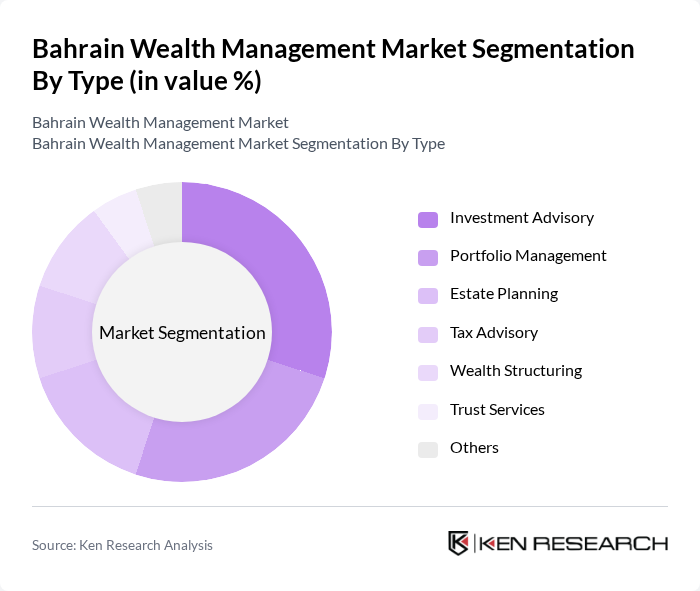

By Type:The wealth management market can be segmented into various types of services that cater to the diverse needs of clients. The primary services include Investment Advisory, Portfolio Management, Estate Planning, Tax Advisory, Wealth Structuring, Trust Services, and Others. Each of these services plays a crucial role in helping clients manage their wealth effectively, with Investment Advisory and Portfolio Management being the most sought-after services due to their direct impact on investment returns.

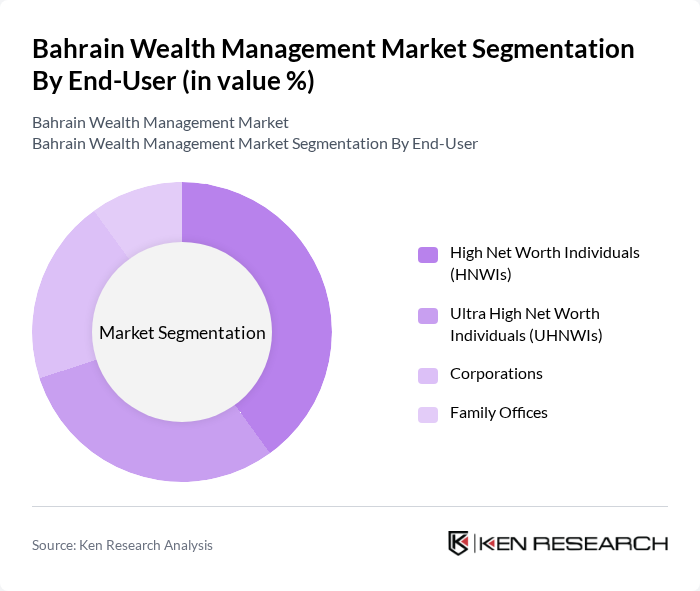

By End-User:The wealth management market serves a variety of end-users, including High Net Worth Individuals (HNWIs), Ultra High Net Worth Individuals (UHNWIs), Corporations, and Family Offices. HNWIs and UHNWIs dominate the market due to their substantial financial resources and the need for tailored wealth management solutions that address their unique financial goals and complexities.

The Bahrain Wealth Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Islamic Bank, Gulf International Bank, Ahli United Bank, National Bank of Bahrain, Bank of Bahrain and Kuwait, SICO BSC, Bahrain Investment Bank, Abu Dhabi Investment Authority, Qatar National Bank, Emirates NBD, HSBC Bank Middle East, Standard Chartered Bank, Citibank N.A., Deutsche Bank AG, UBS Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain wealth management market appears promising, driven by technological advancements and a growing emphasis on sustainable investments. As firms increasingly adopt digital platforms and robo-advisory services, client engagement is expected to improve significantly. Additionally, the rising interest in ESG investments will likely reshape portfolio strategies, aligning financial goals with social responsibility. This evolving landscape presents opportunities for firms to innovate and cater to the changing preferences of HNWIs in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Type | Investment Advisory Portfolio Management Estate Planning Tax Advisory Wealth Structuring Trust Services Others |

| By End-User | High Net Worth Individuals (HNWIs) Ultra High Net Worth Individuals (UHNWIs) Corporations Family Offices |

| By Service Channel | Direct Sales Online Platforms Financial Advisors Wealth Management Firms |

| By Investment Strategy | Active Management Passive Management Alternative Investments |

| By Asset Class | Equities Fixed Income Real Estate Commodities |

| By Client Demographics | Age Group Income Level Geographic Location |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 150 | Individuals with investable assets over $1 million |

| Wealth Management Advisors | 100 | Financial advisors and wealth managers in Bahrain |

| Institutional Investors | 80 | Representatives from family offices and institutional funds |

| Regulatory Bodies | 50 | Officials from the Central Bank of Bahrain and financial regulatory authorities |

| Investment Product Providers | 70 | Executives from firms offering investment products and services |

The Bahrain Wealth Management Market is valued at approximately USD 20 billion, driven by an increasing number of high-net-worth individuals (HNWIs) and a growing demand for personalized financial services and investment solutions.