Region:Middle East

Author(s):Dev

Product Code:KRAB7231

Pages:87

Published On:October 2025

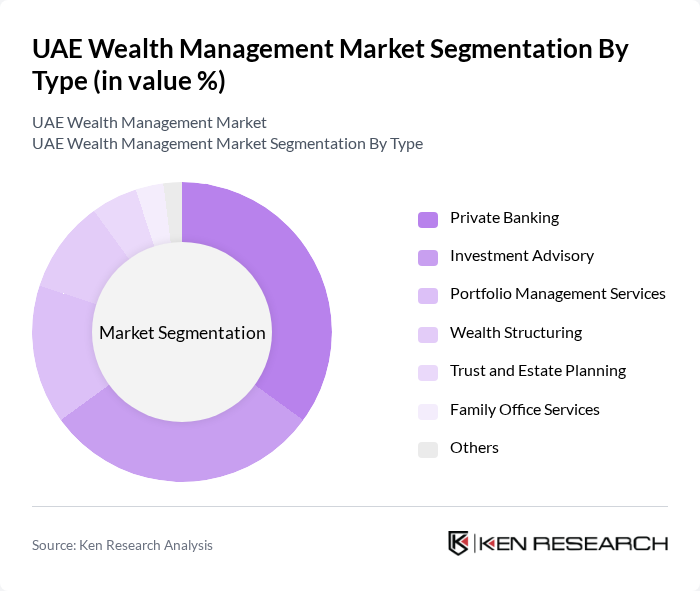

By Type:The wealth management market can be segmented into various types, including Private Banking, Investment Advisory, Portfolio Management Services, Wealth Structuring, Trust and Estate Planning, Family Office Services, and Others. Each of these segments caters to different client needs and preferences, with Private Banking and Investment Advisory being particularly prominent due to their personalized service offerings.

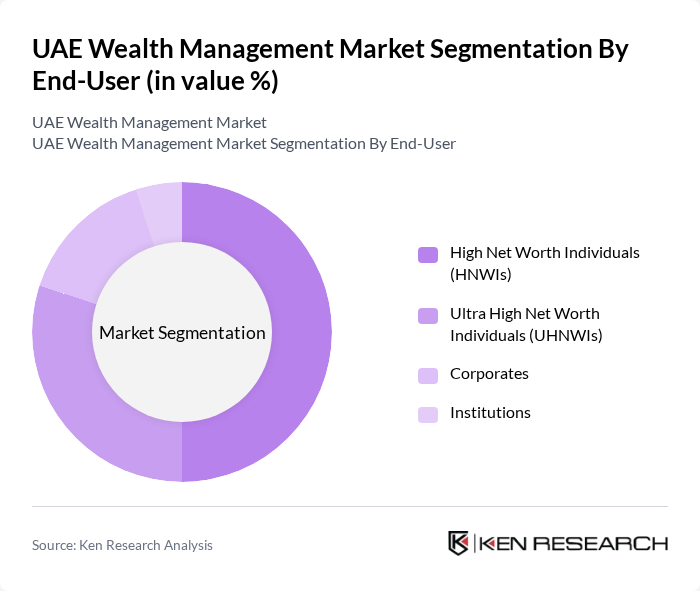

By End-User:The end-user segmentation includes High Net Worth Individuals (HNWIs), Ultra High Net Worth Individuals (UHNWIs), Corporates, and Institutions. HNWIs and UHNWIs dominate the market due to their significant wealth and the demand for tailored financial solutions that cater to their unique investment goals.

The UAE Wealth Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, First Abu Dhabi Bank, HSBC Middle East, Standard Chartered Bank, Citibank UAE, BNP Paribas Wealth Management, Julius Baer, Credit Suisse, UBS Group AG, Morgan Stanley, Deutsche Bank, Qatar National Bank, Al Hilal Bank contribute to innovation, geographic expansion, and service delivery in this space.

The UAE wealth management market is poised for continued evolution, driven by technological advancements and changing client preferences. The integration of artificial intelligence and machine learning is expected to enhance service delivery, enabling firms to offer more personalized investment strategies. Additionally, the growing emphasis on sustainable investments will likely reshape portfolio management approaches, aligning with global trends towards responsible investing. As the market adapts, firms that leverage technology and sustainability will be well-positioned for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Private Banking Investment Advisory Portfolio Management Services Wealth Structuring Trust and Estate Planning Family Office Services Others |

| By End-User | High Net Worth Individuals (HNWIs) Ultra High Net Worth Individuals (UHNWIs) Corporates Institutions |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation |

| By Service Channel | Direct Sales Online Platforms Financial Advisors Wealth Management Firms |

| By Geographic Focus | Domestic Investments International Investments Regional Investments |

| By Asset Class | Equities Fixed Income Real Estate Commodities Alternatives |

| By Client Relationship Model | Transactional Relationship Advisory Relationship Discretionary Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individual Insights | 150 | HNWIs, Family Office Executives |

| Wealth Management Firm Perspectives | 100 | Wealth Managers, Financial Advisors |

| Investment Product Preferences | 80 | Portfolio Managers, Investment Analysts |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

| Market Trend Analysis | 70 | Market Researchers, Economic Analysts |

The UAE Wealth Management Market is valued at approximately USD 1.2 trillion, reflecting significant growth driven by an increasing number of high-net-worth individuals (HNWIs) and a favorable economic environment that promotes diverse investment opportunities.