Region:Central and South America

Author(s):Rebecca

Product Code:KRAB3491

Pages:94

Published On:October 2025

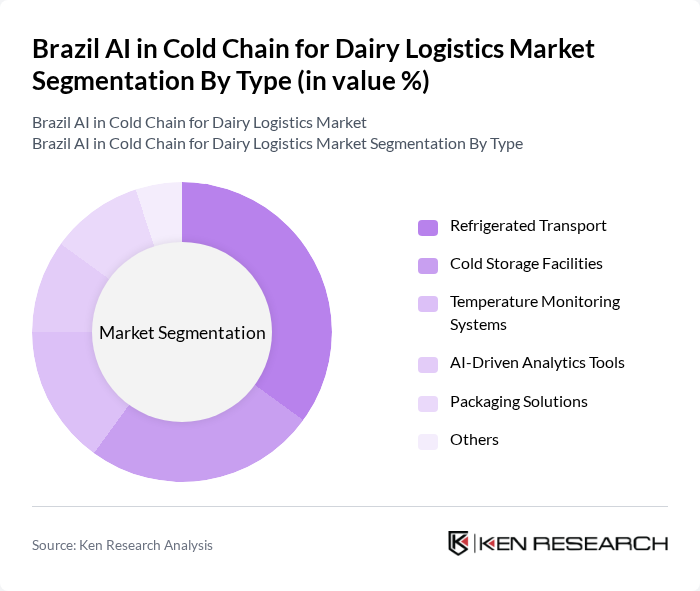

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature Monitoring Systems, AI-Driven Analytics Tools, Packaging Solutions, and Others. Each of these segments plays a crucial role in ensuring the integrity of dairy products throughout the supply chain. The Refrigerated Transport segment is particularly significant due to the necessity of maintaining optimal temperatures during transit. The adoption of advanced temperature monitoring and AI-driven analytics is rising, enabling predictive maintenance and real-time quality control .

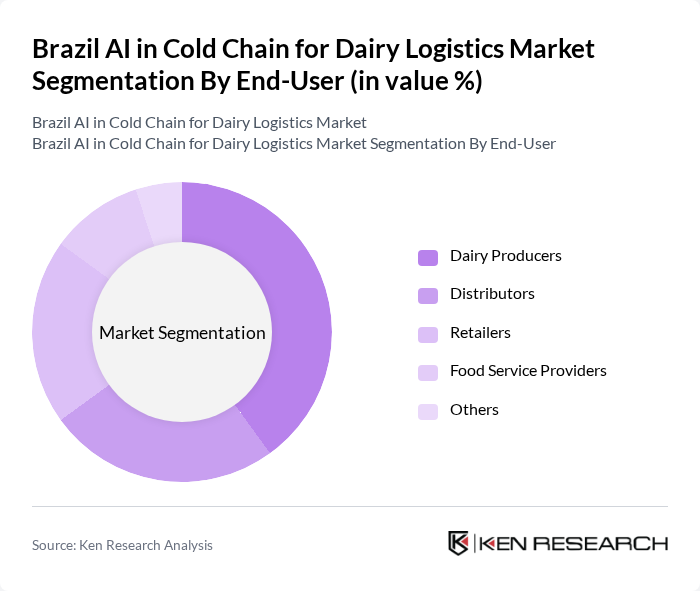

By End-User:The end-user segmentation includes Dairy Producers, Distributors, Retailers, Food Service Providers, and Others. Dairy Producers are the primary users of cold chain logistics, as they require efficient transportation and storage solutions to maintain product quality from farm to consumer. Distributors and retailers are increasingly investing in digital and AI-powered solutions to optimize inventory and reduce losses .

The Brazil AI in Cold Chain for Dairy Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as JBS S.A., BRF S.A., Lactalis Brasil S.A., Danone S.A., Nestlé Brasil Ltda., Grupo Lala S.A.B. de C.V., Vigor Alimentos S.A., Itambé Alimentos S.A., Piracanjuba Alimentos S.A., Coop Ltda. de Laticínios, Queijo Minas Frescal S.A., Fazenda da Toca, Laticínios Bela Vista S.A., Laticínios Pioneiro S.A., Laticínios São Vicente S.A., Localfrio SA, Brado Logística SA, Comfrio Logística, Emergent Cold LatAm, Friozem Armazéns Frigoríficos Ltda., DHL Supply Chain Brasil, Maersk Brasil, Nippon Express do Brasil, SuperFrio, Movecta contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's AI in cold chain logistics for dairy products appears promising, driven by technological advancements and increasing consumer expectations for quality and safety. As the market evolves, companies are likely to invest in automated solutions and predictive analytics to enhance operational efficiency. Additionally, the integration of IoT technologies will facilitate real-time monitoring, ensuring compliance with safety standards. These trends will position the sector for sustainable growth, addressing both consumer needs and environmental concerns in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature Monitoring Systems AI-Driven Analytics Tools Packaging Solutions Others |

| By End-User | Dairy Producers Distributors Retailers Food Service Providers Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Milk Transportation Cheese Distribution Yogurt Logistics Ice Cream Delivery Others |

| By Sales Channel | Online Sales Offline Sales B2B Sales Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Technology Integration | AI and Machine Learning IoT Integration Blockchain for Traceability Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Production Logistics | 60 | Logistics Managers, Supply Chain Analysts |

| Cold Storage Facilities | 50 | Facility Managers, Operations Supervisors |

| AI Technology Providers | 40 | Product Development Managers, Sales Directors |

| Dairy Distribution Networks | 55 | Distribution Managers, Fleet Coordinators |

| Regulatory Bodies and Associations | 45 | Policy Makers, Industry Experts |

The Brazil AI in Cold Chain for Dairy Logistics Market is valued at approximately USD 5.4 billion, driven by increasing dairy product demand and the need for efficient logistics solutions to maintain product quality and safety.