Region:Middle East

Author(s):Dev

Product Code:KRAD3430

Pages:94

Published On:November 2025

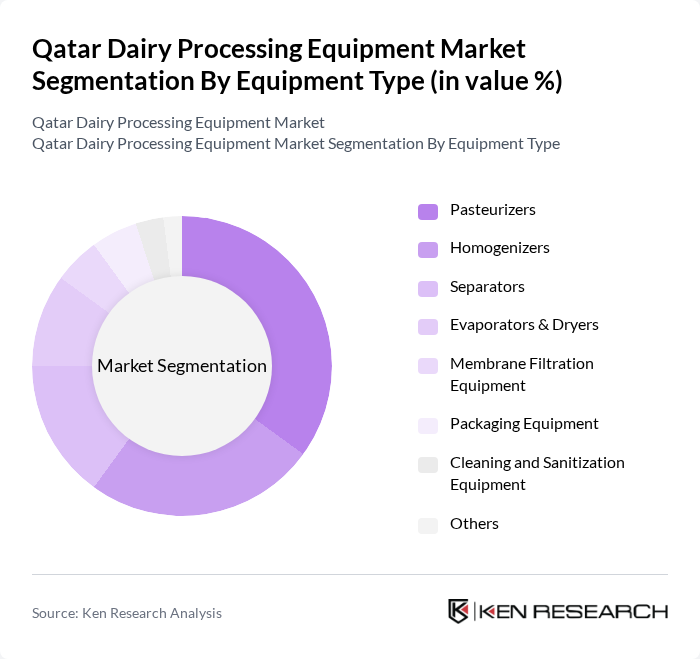

By Equipment Type:The equipment type segment includes various categories essential for dairy processing. The dominant sub-segment is pasteurizers, which are crucial for ensuring the safety and quality of dairy products. The increasing focus on food safety and quality assurance drives the demand for pasteurizers, making them a key player in the market. Other significant equipment types include homogenizers and separators, which also play vital roles in the processing chain.

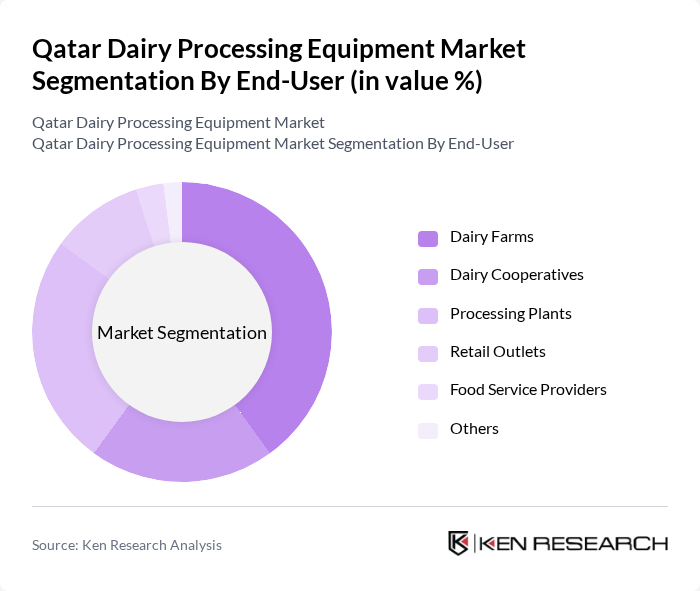

By End-User:The end-user segment encompasses various categories that utilize dairy processing equipment. Dairy farms are the leading sub-segment, driven by the need for efficient processing of raw milk into various dairy products. The increasing number of dairy farms in Qatar, coupled with the rising demand for processed dairy products, significantly contributes to this segment's growth. Other notable end-users include processing plants and retail outlets, which also play essential roles in the dairy supply chain.

The Qatar Dairy Processing Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baladna, Qatar Dairy Company, Almarai, Al Ain Dairy, Nadec, Al Safi Danone, Al Rawabi Dairy Company, Al Watania Dairy, Qatari Dairy Products Company, Al Jazeera Dairy, Al Khor Dairy, Gulf Dairy Company, Tetra Pak Qatar, SPX FLOW Middle East, GEA Group Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar dairy processing equipment market appears promising, driven by increasing investments in technology and government initiatives aimed at enhancing local production. As consumer preferences shift towards organic and health-oriented dairy products, manufacturers are likely to adopt innovative processing solutions. Additionally, the integration of IoT technologies will streamline operations, improve efficiency, and ensure compliance with stringent food safety standards, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Pasteurizers Homogenizers Separators Evaporators & Dryers Membrane Filtration Equipment Packaging Equipment Cleaning and Sanitization Equipment Others |

| By End-User | Dairy Farms Dairy Cooperatives Processing Plants Retail Outlets Food Service Providers Others |

| By Application | Milk Processing Cheese Production Yogurt Manufacturing Ice Cream Production Milk Powder Production Whey & Protein Concentrates Others |

| By Material Type | Stainless Steel Plastic Glass Others |

| By Technology | Traditional Processing Automated Processing Smart Processing (IoT, AI-enabled) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Doha Al Rayyan Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Farm Operations | 45 | Dairy Farm Owners, Farm Managers |

| Dairy Processing Equipment Suppliers | 38 | Sales Managers, Product Development Heads |

| Regulatory Bodies and Associations | 22 | Policy Makers, Industry Analysts |

| Logistics and Distribution Channels | 32 | Logistics Managers, Supply Chain Coordinators |

| End-User Dairy Product Manufacturers | 41 | Production Managers, Quality Assurance Officers |

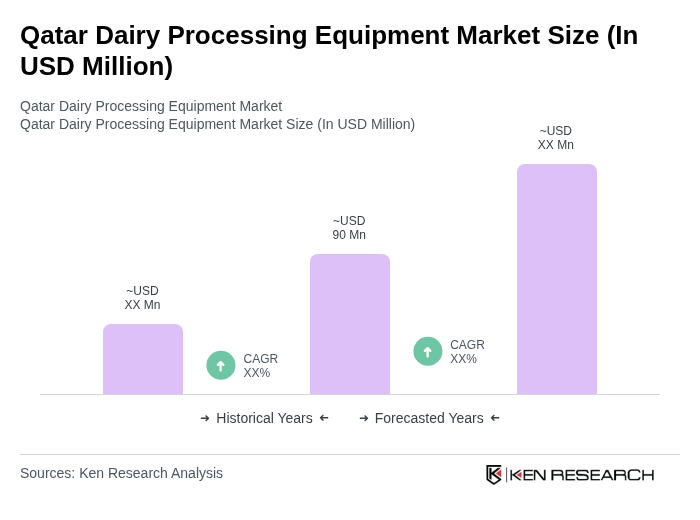

The Qatar Dairy Processing Equipment Market is valued at approximately USD 90 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for dairy products and advancements in processing technologies that enhance efficiency and product quality.