Region:Central and South America

Author(s):Geetanshi

Product Code:KRAD0054

Pages:88

Published On:August 2025

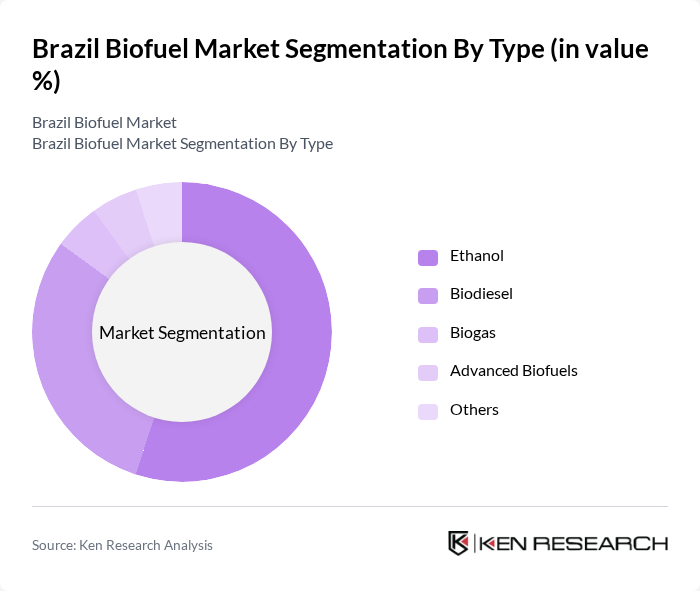

By Type:The biofuel market can be segmented into Ethanol, Biodiesel, Biogas, Advanced Biofuels, and Others. Ethanol is the most dominant segment due to Brazil's extensive sugarcane production, which is used for ethanol production. Biodiesel follows, driven by the increasing use of vegetable oils (especially soybean oil) and animal fats. Biogas and advanced biofuels are emerging segments, gaining traction due to technological advancements and environmental concerns .

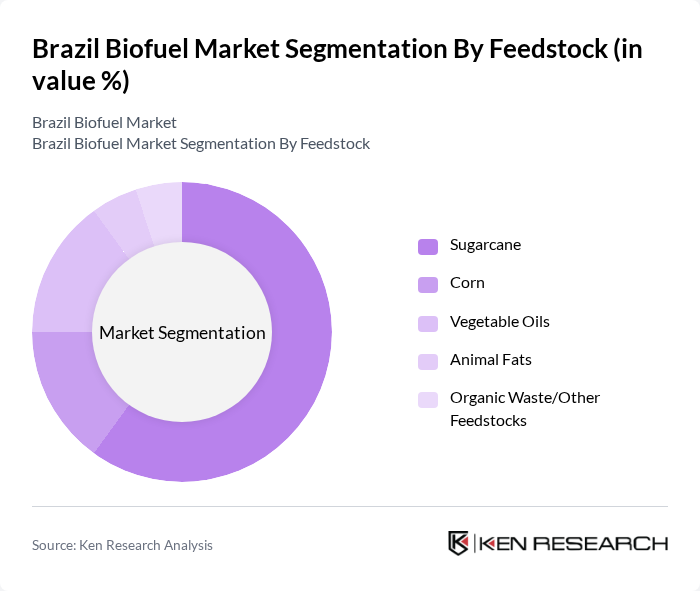

By Feedstock:The feedstock segment includes Sugarcane, Corn, Vegetable Oils, Animal Fats, and Organic Waste/Other Feedstocks. Sugarcane is the leading feedstock due to its high yield and efficiency in ethanol production. Corn is also significant, particularly for ethanol, while vegetable oils—especially soybean oil—dominate biodiesel production. Animal fats are increasingly utilized, and organic waste is gaining attention for its potential in biogas production .

The Brazil Biofuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raízen S.A., Petrobras Biocombustível S.A., GranBio Investimentos S.A., Biosev S.A., Cargill Agrícola S.A., Louis Dreyfus Company Brasil S.A., Copersucar S.A., Usina São Martinho S.A., Usina Coruripe S.A., Usina Alto Alegre S.A., Tereos Açúcar e Etanol S.A., Adecoagro S.A., BP Bunge Bioenergia S.A., Usina da Pedra S.A., and Abengoa Bioenergia Brasil S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The Brazil biofuel market is poised for significant growth, driven by increasing environmental awareness and government initiatives aimed at promoting renewable energy. With a projected rise in biofuel blending mandates and technological advancements, the sector is expected to attract substantial investments. Additionally, the focus on sustainable practices and waste-to-energy solutions will likely enhance production efficiency. As Brazil continues to strengthen its position in the global biofuel landscape, collaboration with the agricultural sector will be essential for maximizing resource utilization and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethanol Biodiesel Biogas Advanced Biofuels Others |

| By Feedstock | Sugarcane Corn Vegetable Oils Animal Fats Organic Waste/Other Feedstocks |

| By Application | Transportation Fuels Power Generation Heating Feedstock for Chemical Production |

| By End-User | Transportation Industrial Residential Commercial |

| By Technology | Fermentation Transesterification Anaerobic Digestion Other Technologies |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Wholesale Distributors |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biofuel Production Facilities | 60 | Plant Managers, Production Supervisors |

| Agricultural Feedstock Suppliers | 50 | Farm Owners, Supply Chain Managers |

| Biofuel Distribution Networks | 40 | Logistics Coordinators, Distribution Managers |

| Regulatory Bodies and Policy Makers | 40 | Government Officials, Policy Analysts |

| End-Users in Transportation Sector | 50 | Fleet Managers, Sustainability Officers |

The Brazil biofuel market is valued at approximately USD 12.7 billion, driven by the country's agricultural resources, particularly sugarcane, and a strong commitment to renewable energy. This market is expected to grow further due to increasing demand for cleaner fuels.