Brazil Cloud Kitchens and Food Delivery Market Overview

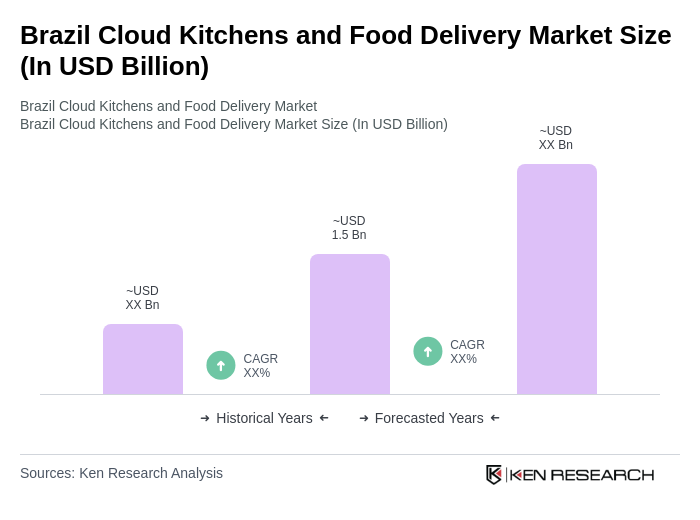

- The Brazil Cloud Kitchens and Food Delivery Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for convenience, the rise of digital platforms, and changing consumer preferences towards online food ordering. The market has seen a significant uptick in the number of cloud kitchens, which cater to the growing appetite for diverse culinary options delivered directly to consumers' doorsteps.

- Key cities such as São Paulo, Rio de Janeiro, and Brasília dominate the market due to their large urban populations and high disposable incomes. These metropolitan areas have a vibrant food culture and a tech-savvy consumer base that readily adopts food delivery services, making them prime locations for cloud kitchen operations. The concentration of restaurants and food startups in these cities further fuels market growth.

- In 2023, the Brazilian government implemented regulations aimed at enhancing food safety standards for cloud kitchens. This includes mandatory health inspections and compliance with hygiene protocols to ensure food quality and safety. Such regulations are designed to protect consumers and promote trust in the food delivery ecosystem, ultimately benefiting the market by ensuring higher standards of service.

Brazil Cloud Kitchens and Food Delivery Market Segmentation

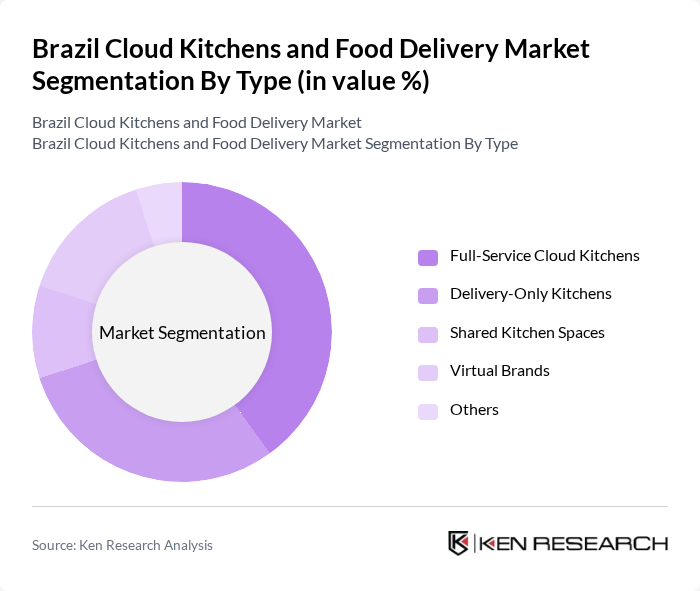

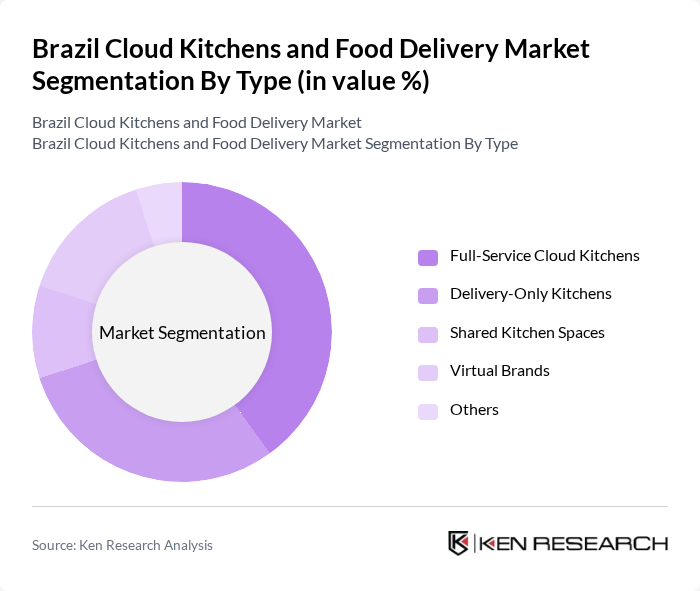

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Kitchens, Shared Kitchen Spaces, Virtual Brands, and Others. Among these, Full-Service Cloud Kitchens are gaining traction due to their ability to offer a wide range of menu options and cater to diverse consumer preferences. Delivery-Only Kitchens are also popular, as they minimize overhead costs and focus solely on delivery efficiency. The trend towards virtual brands is rising, driven by the demand for unique culinary experiences without the need for physical restaurant spaces.

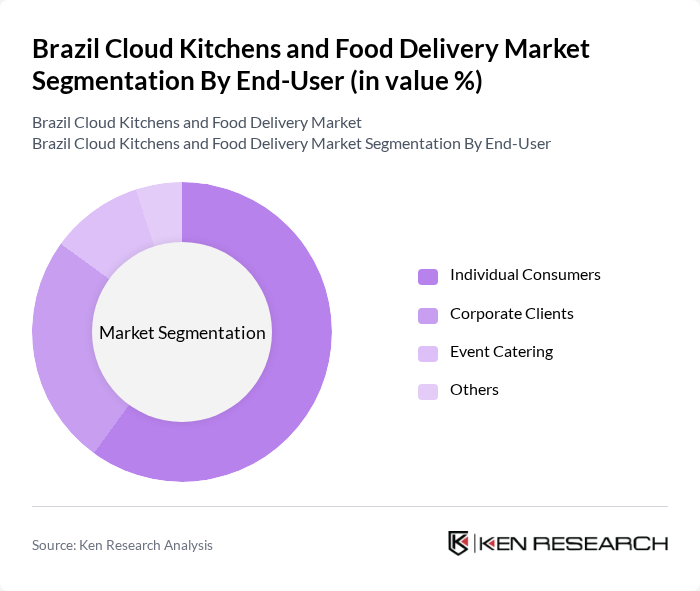

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Event Catering, and Others. Individual Consumers dominate the market, driven by the increasing trend of online food ordering for convenience and variety. Corporate Clients are also significant, as businesses often utilize food delivery services for meetings and events. Event Catering is a growing segment, particularly for large gatherings and celebrations, where the demand for diverse food options is high.

Brazil Cloud Kitchens and Food Delivery Market Competitive Landscape

The Brazil Cloud Kitchens and Food Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as iFood, Rappi, Uber Eats, Zaitt, Kitchen Central, CloudChef, ChefsClub, Domicilios.com, ProntoPro, Tasty, Delivery Much, Aloha Kitchen, Fooda, Bistrô do Chef, Munchery contribute to innovation, geographic expansion, and service delivery in this space.

Brazil Cloud Kitchens and Food Delivery Market Industry Analysis

Growth Drivers

- Increasing Demand for Food Delivery Services:The Brazilian food delivery market is projected to reach approximately 30 million active users in future, driven by a growing preference for convenience. The World Bank reports that urban areas in Brazil are experiencing a 2.5% annual population growth, leading to increased demand for food delivery services. Additionally, the average consumer is expected to spend around BRL 160 per month on food delivery, reflecting a significant shift in dining habits towards online platforms.

- Rise of Online Ordering Platforms:Brazil's online food ordering platforms have seen a surge, with over 55% of consumers using apps like iFood and Uber Eats in future. The Brazilian e-commerce market is expected to grow by 22% annually, with food delivery services capturing a substantial share. This trend is supported by the increasing smartphone penetration rate, which is projected to reach 92% in urban areas, facilitating easier access to food delivery services and enhancing user engagement.

- Cost Efficiency of Cloud Kitchens:Cloud kitchens in Brazil are gaining traction due to their lower operational costs, with estimates suggesting a 32% reduction in overhead compared to traditional restaurants. The average investment for setting up a cloud kitchen is around BRL 210,000, significantly lower than the BRL 1.1 million required for a full-service restaurant. This cost efficiency allows for quicker market entry and scalability, appealing to both new entrepreneurs and established brands looking to expand their reach.

Market Challenges

- Intense Competition Among Players:The Brazilian cloud kitchen market is characterized by fierce competition, with over 1,200 players vying for market share in future. Major players like iFood and Rappi dominate, making it challenging for new entrants to establish a foothold. This competitive landscape drives down profit margins, with average delivery fees hovering around BRL 12, compelling operators to innovate continuously to attract and retain customers.

- Quality Control and Food Safety Concerns:Ensuring food safety and quality remains a significant challenge for cloud kitchens in Brazil. The National Health Surveillance Agency (ANVISA) reported that 27% of food establishments faced compliance issues in future. With increasing scrutiny from regulatory bodies, cloud kitchens must invest in robust quality control measures, which can increase operational costs and complicate logistics, impacting overall profitability.

Brazil Cloud Kitchens and Food Delivery Market Future Outlook

The future of Brazil's cloud kitchens and food delivery market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, the demand for convenient food options will likely rise, encouraging further investment in cloud kitchen infrastructure. Additionally, the integration of AI and data analytics will enhance operational efficiency and customer experience, while sustainability practices will become increasingly important, aligning with consumer values and regulatory expectations.

Market Opportunities

- Expansion into Tier 2 and Tier 3 Cities:With over 65% of Brazil's population residing in smaller cities, there is a significant opportunity for cloud kitchens to expand their services. These markets are currently underserved, presenting a chance for operators to capture new customer bases and increase revenue streams by offering localized food options tailored to regional tastes.

- Growth of Health-Conscious Food Options:The demand for healthy food alternatives is on the rise, with a 17% increase in consumers seeking nutritious meal options in future. Cloud kitchens can capitalize on this trend by offering diverse, health-focused menus that cater to the growing segment of health-conscious consumers, thereby enhancing their market appeal and driving sales.