Region:Middle East

Author(s):Rebecca

Product Code:KRAA6947

Pages:84

Published On:September 2025

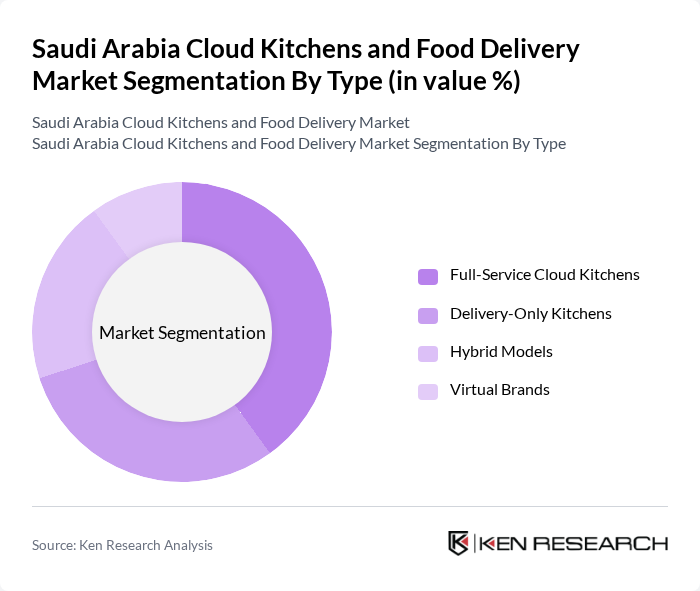

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Kitchens, Hybrid Models, and Virtual Brands. Full-Service Cloud Kitchens are gaining traction due to their ability to offer a wide range of menu options and cater to diverse consumer preferences. Delivery-Only Kitchens are also popular as they minimize overhead costs and focus solely on delivery efficiency. Hybrid Models combine both dine-in and delivery services, appealing to a broader customer base. Virtual Brands leverage existing kitchen infrastructure to create new food concepts, capitalizing on the growing trend of online food ordering.

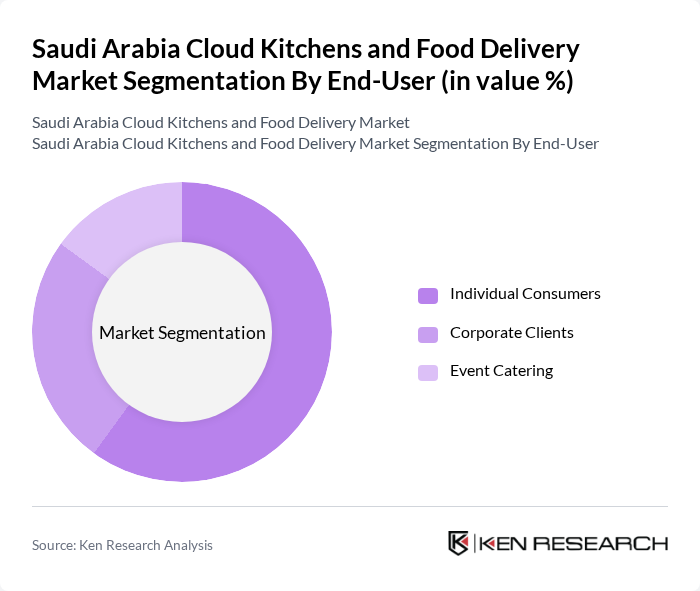

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, and Event Catering. Individual Consumers represent the largest segment, driven by the increasing trend of online food ordering for personal consumption. Corporate Clients are also significant, as businesses often utilize food delivery services for meetings and events. Event Catering is a growing segment, particularly for large gatherings and celebrations, where convenience and variety are essential.

The Saudi Arabia Cloud Kitchens and Food Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Talabat, HungerStation, Jahez, Deliveroo, Zomato, Uber Eats, Foodics, Kitopi, CloudKitchens, EatEasy, Noon Food, Fatafeat, Munchery, Kitch, FoodPanda contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud kitchen and food delivery market in Saudi Arabia appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for convenient food solutions will likely increase, encouraging further investment in cloud kitchen infrastructure. Additionally, the integration of AI and data analytics will enhance operational efficiency, allowing businesses to tailor offerings to consumer preferences, thereby fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Delivery-Only Kitchens Hybrid Models Virtual Brands |

| By End-User | Individual Consumers Corporate Clients Event Catering |

| By Cuisine Type | Middle Eastern Asian Western Fast Food |

| By Delivery Method | Direct Delivery Third-Party Delivery Services |

| By Pricing Model | Subscription-Based Pay-Per-Order |

| By Location | Urban Areas Suburban Areas |

| By Customer Segment | Students Working Professionals Families Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 100 | Owners, Managers, Operations Directors |

| Food Delivery Platform Executives | 80 | Product Managers, Marketing Directors, Business Development Leads |

| Consumers of Food Delivery Services | 150 | Frequent Users, Occasional Users, Non-Users |

| Restaurant Owners Transitioning to Cloud Kitchens | 70 | Founders, Chefs, Business Managers |

| Industry Experts and Analysts | 50 | Market Researchers, Consultants, Academics |

The Saudi Arabia Cloud Kitchens and Food Delivery Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing consumer demand for convenience, urbanization, and the rise of digital payment systems.