Region:Central and South America

Author(s):Dev

Product Code:KRAA0381

Pages:83

Published On:August 2025

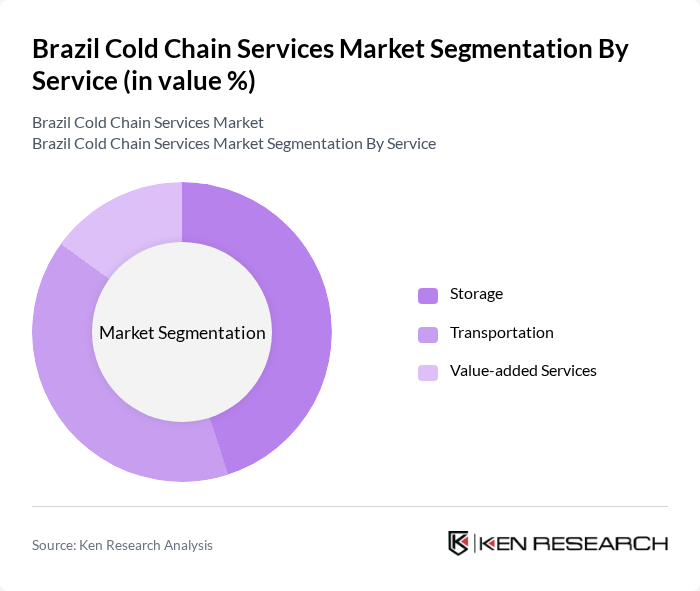

By Service:The service segment includes Storage, Transportation, and Value-added Services. Storage refers to temperature-controlled warehouses and distribution centers that preserve perishable goods. Transportation covers logistics solutions for moving temperature-sensitive products, including refrigerated trucks, containers, and rail. Value-added Services encompass packaging, labeling, inventory management, and real-time tracking, all of which enhance cold chain efficiency and compliance.

By Temperature Type:The temperature type segment is categorized into Chilled and Frozen. Chilled services maintain temperatures typically between 0°C to 5°C, suitable for products such as dairy, fresh produce, and certain pharmaceuticals. Frozen services operate at temperatures below -18°C, essential for preserving meat, seafood, and frozen foods, ensuring product safety and shelf life during storage and transportation.

The Brazil Cold Chain Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Localfrio S.A., Superfrio Armazéns Gerais Ltda, Brado Logística S.A., Friozem Armazéns Frigoríficos Ltda, Logfrio S.A., Maersk (Brazil), Nippon Express do Brasil, DHL Supply Chain (Brazil), Kuehne + Nagel (Brazil), DB Schenker (Brazil), Lineage Logistics (Brazil), Americold Logistics (Brazil), JBS S.A. (Cold Chain Division), BRF S.A. (Cold Chain Division), and Cargill (Brazil Cold Chain Operations) contribute to innovation, geographic expansion, and service delivery in this space .

The future of Brazil's cold chain services market appears promising, driven by technological advancements and increasing consumer demand for quality food products. The integration of IoT and AI technologies is expected to enhance operational efficiency and improve demand forecasting. Additionally, as e-commerce continues to expand, the need for robust cold chain solutions will grow, presenting opportunities for innovation and investment in infrastructure to meet evolving market needs.

| Segment | Sub-Segments |

|---|---|

| By Service | Storage Transportation Value-added Services |

| By Temperature Type | Chilled Frozen |

| By Application | Horticulture (Fruits & Vegetables) Meat Fish Poultry |

| By End-User | Food and Beverage Pharmaceuticals Biotechnology Retail E-commerce Agriculture |

| By Mode of Transportation | Road Transport Rail Transport Air Transport Sea Transport |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 60 | Supply Chain Managers, Quality Assurance Officers |

| Food and Beverage Distribution | 100 | Logistics Coordinators, Operations Managers |

| Retail Cold Storage Solutions | 50 | Warehouse Managers, Retail Operations Directors |

| Temperature-Controlled Transportation | 40 | Fleet Managers, Transportation Directors |

| Cold Chain Technology Adoption | 45 | IT Managers, Technology Officers |

The Brazil Cold Chain Services Market is valued at approximately USD 10 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, as well as the expansion of e-commerce and online grocery delivery.