Region:North America

Author(s):Shubham

Product Code:KRAA0829

Pages:87

Published On:August 2025

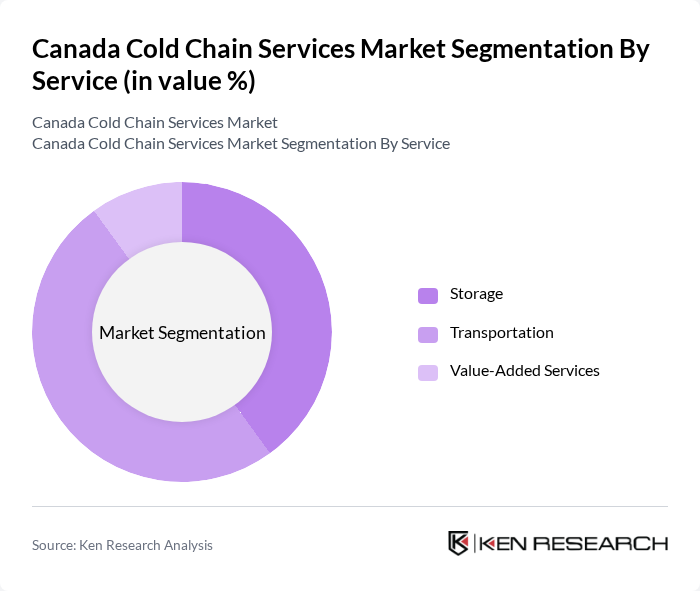

By Service:The cold chain services market can be segmented into three primary services: Storage, Transportation, and Value-Added Services. Each of these services plays a crucial role in maintaining the integrity of temperature-sensitive products throughout the supply chain .

The Transportation segment is currently dominating the market due to the increasing demand for efficient logistics solutions that ensure timely delivery of perishable goods. With the rise of e-commerce and consumer expectations for fresh products, companies are investing heavily in refrigerated transportation fleets. This segment's growth is also supported by advancements in technology, such as real-time tracking and temperature monitoring systems, which enhance operational efficiency and customer satisfaction .

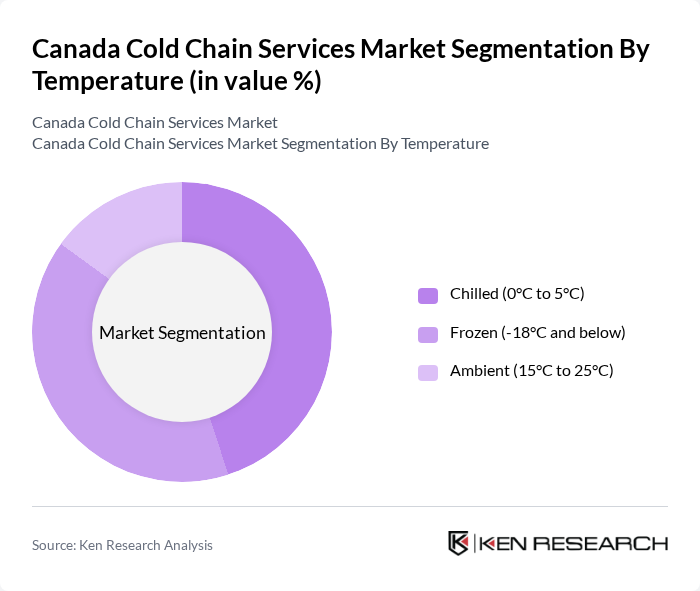

By Temperature:The market can also be segmented based on temperature requirements into Chilled (0°C to 5°C), Frozen (-18°C and below), and Ambient (15°C to 25°C). Each temperature category is essential for different types of products, influencing the logistics strategies employed by companies .

The Chilled segment is leading the market, driven by the high demand for fresh produce, dairy products, and ready-to-eat meals. Consumers are increasingly seeking fresh and healthy food options, which necessitates efficient cold chain solutions to maintain product quality. The growth in this segment is also supported by the expansion of grocery delivery services and the rising popularity of meal kits, which require strict temperature control during transportation .

By End User:The market can be segmented by end users into Horticulture (Fresh Fruits & Vegetables), Dairy Products (Milk, Ice-cream, Butter, etc.), Meats, Fish, Poultry, Processed Food Products, Pharma, Life Sciences, and Chemicals, and Other End Users. Each of these segments has unique requirements for cold chain services .

The Horticulture segment is currently the largest end user in the market, driven by the increasing consumer demand for fresh fruits and vegetables. The trend towards healthy eating and organic produce has led to a surge in the need for efficient cold chain logistics to ensure product freshness and quality. Additionally, the growth of local and organic farming initiatives has further bolstered this segment's prominence in the cold chain services market .

The Canada Cold Chain Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americold Logistics, Lineage Logistics, Congebec Logistics, Confederation Freezers, Conestoga Cold Storage, VersaCold Logistics Services, DHL Supply Chain, Kuehne + Nagel, FedEx Supply Chain, UPS Supply Chain Solutions, DB Schenker, C.H. Robinson, Maersk, Metro Supply Chain Group, Tippet-Richardson contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Canada cold chain services market appears promising, driven by technological innovations and increasing consumer demand for fresh and safe food products. As e-commerce continues to expand, companies are likely to invest in automated solutions and real-time monitoring systems to enhance efficiency. Additionally, the focus on sustainability will push businesses to adopt eco-friendly practices, ensuring compliance with evolving regulations while meeting consumer expectations for environmentally responsible operations.

| Segment | Sub-Segments |

|---|---|

| By Service | Storage Transportation Value-Added Services |

| By Temperature | Chilled (0°C to 5°C) Frozen (-18°C and below) Ambient (15°C to 25°C) |

| By End User | Horticulture (Fresh Fruits & Vegetables) Dairy Products (Milk, Ice-cream, Butter, etc.) Meats, Fish, Poultry Processed Food Products Pharma, Life Sciences, and Chemicals Other End Users |

| By Geography | Canada (National Coverage) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Cold Chain | 120 | Supply Chain Managers, Quality Assurance Officers |

| Pharmaceutical Cold Storage | 90 | Logistics Coordinators, Compliance Managers |

| Temperature-Sensitive Chemical Transport | 60 | Operations Managers, Safety Compliance Officers |

| Retail Cold Chain Management | 50 | Inventory Managers, Distribution Center Supervisors |

| Cold Chain Technology Solutions | 40 | IT Managers, Technology Implementation Specialists |

The Canada Cold Chain Services Market is valued at approximately USD 13.1 billion, driven by the increasing demand for temperature-sensitive products, particularly in the food and pharmaceutical sectors, alongside the growth of e-commerce and consumer preferences for fresh goods.