Region:Europe

Author(s):Dev

Product Code:KRAA0470

Pages:93

Published On:August 2025

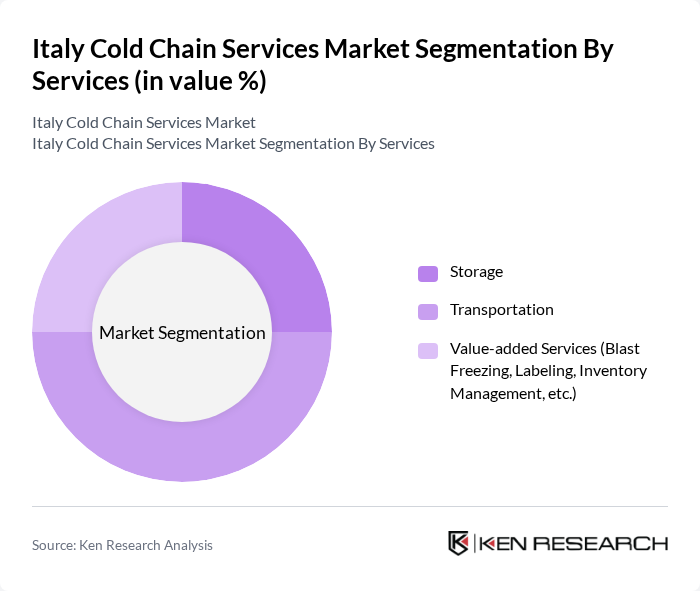

By Services:The services segment includes Storage, Transportation, and Value-added Services (such as Blast Freezing, Labeling, Inventory Management, etc.). Among these, Transportation is the leading sub-segment due to the increasing demand for efficient delivery of perishable goods. The rise of e-commerce and direct-to-consumer channels has further accelerated the need for reliable transportation solutions, making it a critical component of the cold chain services market .

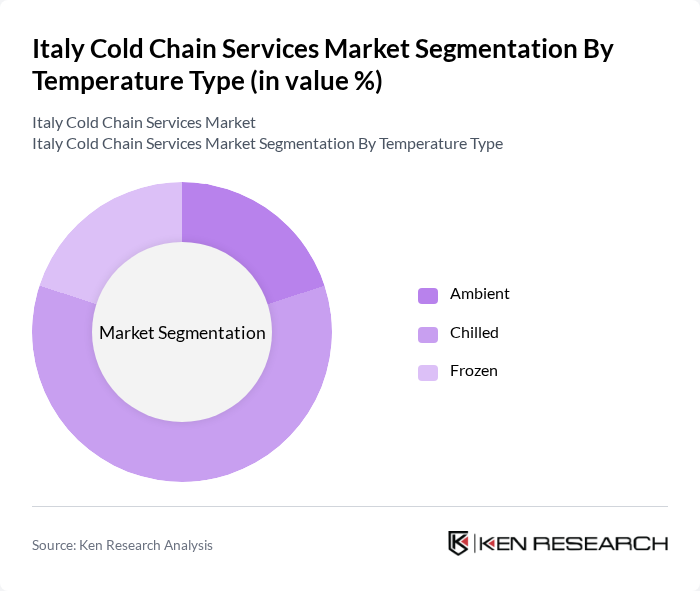

By Temperature Type:The temperature type segment includes Ambient, Chilled, and Frozen. The Chilled sub-segment dominates the market, driven by the high demand for fresh produce, dairy products, and other perishable items that require specific temperature controls. The growing consumer preference for fresh and organic food options, as well as increased pharmaceutical shipments requiring chilled logistics, have significantly contributed to the expansion of the chilled segment .

The Italy Cold Chain Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as STEF Italia, DHL Supply Chain, Kuehne + Nagel, DB Schenker, Gruppo Marconi Logistica Integrata, Number1 Logistics Group, Geodis, Italtrans, Fercam, CEVA Logistics, Lineage Logistics, Frigoricambi Srl, Maersk, Arcese Trasporti, and Savino Del Bene contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain services market in Italy appears promising, driven by increasing consumer demand for high-quality perishable goods and the expansion of e-commerce platforms. As technology continues to evolve, companies are likely to invest in automation and IoT solutions to enhance operational efficiency. Furthermore, sustainability initiatives will play a crucial role in shaping the market, as businesses seek to reduce their carbon footprint while maintaining compliance with stringent regulations. Overall, the sector is poised for significant transformation and growth.

| Segment | Sub-Segments |

|---|---|

| By Services | Storage Transportation Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.) |

| By Temperature Type | Ambient Chilled Frozen |

| By Application | Horticulture (Fresh Fruits and Vegetables) Dairy Products (Milk, Ice-cream, Butter, etc.) Meats and Fish Processed Food Products Pharma, Life Sciences, and Chemicals Other Applications |

| By Region | Northern Italy Central Italy Southern Italy Islands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 120 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Storage | 60 | Logistics Managers, Compliance Officers |

| Retail Cold Chain Operations | 50 | Operations Managers, Inventory Control Specialists |

| Transport and Distribution Services | 40 | Fleet Managers, Cold Chain Supervisors |

| Technology Solutions in Cold Chain | 40 | IT Managers, Technology Implementation Leads |

The Italy Cold Chain Services Market is valued at approximately USD 8.7 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with advancements in logistics and technology.