Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1948

Pages:89

Published On:August 2025

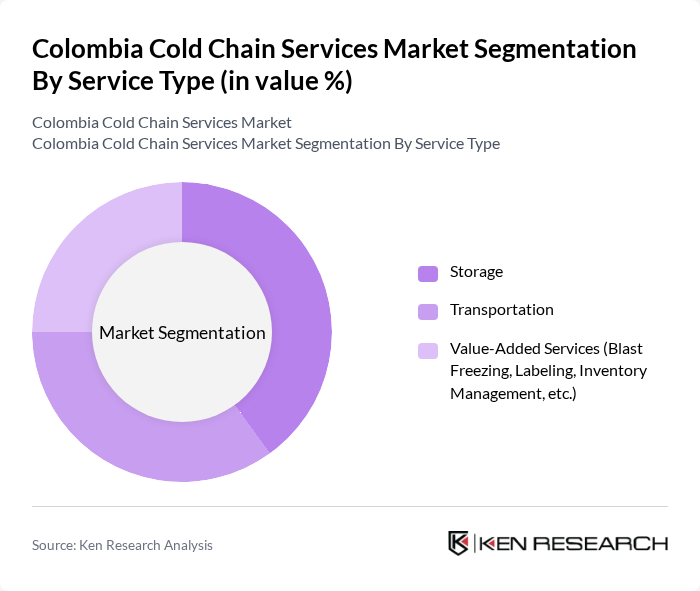

By Service Type:The service type segmentation includes Storage, Transportation, and Value-Added Services. Storage is essential for maintaining the integrity of temperature-sensitive products, ensuring compliance with regulatory standards. Transportation covers refrigerated vehicles and multimodal logistics, enabling timely and safe delivery across urban and rural regions. Value-Added Services, such as blast freezing, labeling, and inventory management, are increasingly adopted to optimize operational efficiency and enhance customer satisfaction .

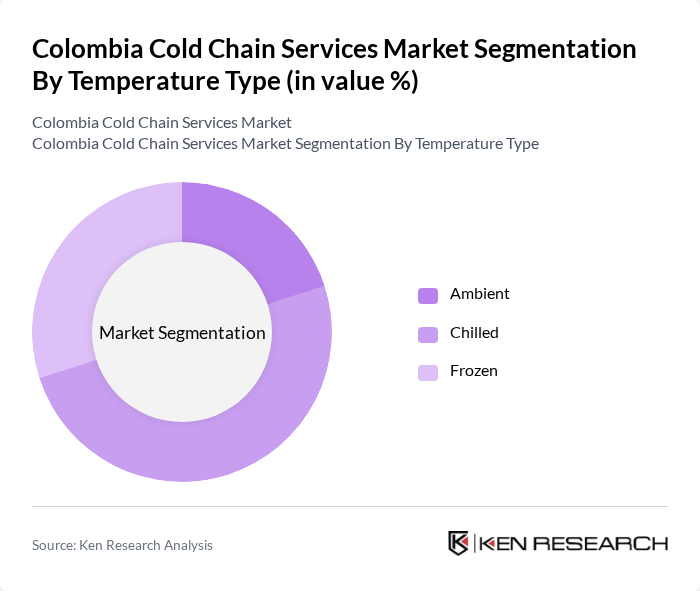

By Temperature Type:The temperature type segmentation includes Ambient, Chilled, and Frozen. Chilled products hold the largest market share, driven by strong demand for fresh produce, dairy, and beverages. Frozen products are critical for meats, seafood, and processed foods, supporting export and domestic consumption. Ambient storage, while important for certain goods, represents a smaller portion of the market due to Colombia’s focus on perishables and regulated food safety standards .

The Colombia Cold Chain Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Megafin Logística Para Alimentos S.A.S., Frigometro S.A.S., Apix Logística Especializada S.A.S., TCC S.A.S., Servientrega S.A., Kuehne + Nagel Colombia S.A., DHL Supply Chain Colombia S.A.S., Logística de Frío S.A.S., Frío Aéreo S.A., Alianza Team S.A., Grupo Éxito, Nestlé Colombia S.A., Unilever Andina Colombia Ltda., Cargill de Colombia S.A., ProColombia contribute to innovation, geographic expansion, and service delivery in this space .

The future of Colombia's cold chain services market appears promising, driven by technological advancements and increasing consumer demand for quality food products. As the government continues to invest in infrastructure and food safety initiatives, the market is expected to see enhanced efficiency and reliability. Additionally, the rise of e-commerce will further necessitate robust cold chain solutions, creating a dynamic environment for growth and innovation in the sector, particularly in urban areas.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Storage Transportation Value-Added Services (Blast Freezing, Labeling, Inventory Management, etc.) |

| By Temperature Type | Ambient Chilled Frozen |

| By Application | Horticulture (Fresh Fruits and Vegetables) Dairy Products (Milk, Ice-cream, Butter, etc.) Meats and Fish Processed Food Products Pharma, Life Sciences, and Chemicals Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By End-User | Food and Beverage Pharmaceuticals Agriculture Retail Others |

| By Customer Type | B2B B2C Government Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 100 | Supply Chain Managers, Quality Assurance Officers |

| Food and Beverage Cold Storage | 90 | Operations Managers, Logistics Coordinators |

| Agricultural Product Distribution | 80 | Procurement Managers, Distribution Supervisors |

| Retail Cold Chain Solutions | 60 | Retail Operations Managers, Supply Chain Analysts |

| Technology Providers in Cold Chain | 40 | Product Development Managers, IT Specialists |

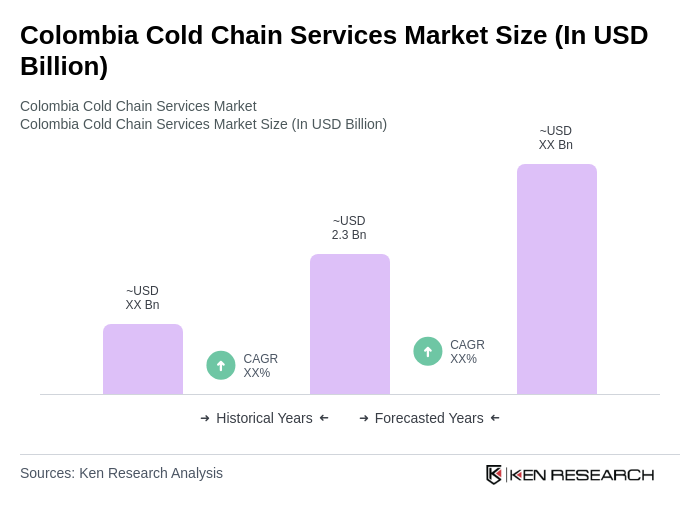

The Colombia Cold Chain Services Market is valued at approximately USD 2.3 billion, driven by the increasing demand for temperature-sensitive products in sectors such as food, pharmaceuticals, and life sciences, along with advancements in cold chain infrastructure and technology.