Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0176

Pages:91

Published On:August 2025

By Type:The market is segmented into various types of logistics services that cater to the diverse needs of e-commerce businesses. The subsegments include Standard Delivery, Express Delivery, Same-Day Delivery, International Shipping, Reverse Logistics (Returns Management), Fulfillment Services, and Others. Each of these subsegments plays a crucial role in ensuring that products reach consumers efficiently and effectively. Standard Delivery remains the most utilized service due to its cost-effectiveness and broad reach, while Express and Same-Day Delivery are growing rapidly as consumers increasingly demand faster shipping options. International Shipping and Reverse Logistics are essential for cross-border e-commerce and returns management, respectively. Fulfillment Services are gaining traction as e-commerce platforms outsource warehousing and order processing to specialized providers .

The Standard Delivery subsegment is currently dominating the market due to its cost-effectiveness and reliability. Many consumers prefer this option for non-urgent purchases, as it balances affordability with reasonable delivery times. Express Delivery is also gaining traction, particularly among businesses that cater to time-sensitive needs. The increasing demand for faster shipping options is driving innovation in logistics, with companies investing in technology to enhance their delivery capabilities. The rise of dark-store networks and improved cold-chain logistics is also accelerating the growth of rapid delivery services, particularly in food and grocery categories .

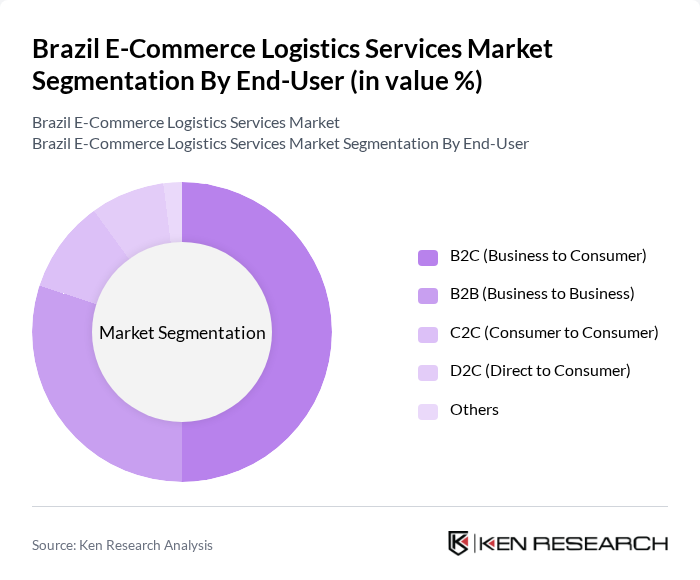

By End-User:The market is segmented based on the end-users of logistics services, which include B2C (Business to Consumer), B2B (Business to Business), C2C (Consumer to Consumer), D2C (Direct to Consumer), and Others. Each segment has unique requirements and preferences that influence logistics strategies and service offerings. B2C dominates due to the high volume of individual online purchases, while B2B logistics are essential for wholesale and supply chain management. C2C and D2C are growing as peer-to-peer and brand-direct sales channels expand in the Brazilian e-commerce ecosystem .

The B2C segment is the largest in the market, driven by the increasing number of online shoppers and the growing popularity of e-commerce platforms. Consumers are increasingly seeking convenience and speed in their purchases, leading to a surge in demand for logistics services tailored to B2C transactions. The B2B segment is also significant, as businesses require efficient logistics solutions to manage their supply chains and fulfill orders from other businesses. The rapid adoption of mobile commerce and digital payment systems, such as Pix, is further accelerating the growth of e-commerce logistics in Brazil .

The Brazil E-Commerce Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Livre (Mercado Envios), Correios (Empresa Brasileira de Correios e Telégrafos), DHL Supply Chain Brazil, FedEx Express Brazil, JADLOG, Loggi, Sequoia Logística e Transportes, Total Express, Azul Cargo Express, GOLLOG (Gol Linhas Aéreas), Amazon Logistics Brazil, Rappi Brasil, iFood Logística, BBM Logística, Intelipost contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's e-commerce logistics services market appears promising, driven by technological advancements and evolving consumer preferences. The increasing adoption of automation and AI in logistics operations is expected to enhance efficiency and reduce costs. Furthermore, the growing emphasis on sustainability will likely lead to innovative logistics solutions that minimize environmental impact. As the market matures, collaboration between local retailers and logistics providers will be crucial in meeting consumer demands for faster and more reliable delivery services.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Delivery Express Delivery Same-Day Delivery International Shipping Reverse Logistics (Returns Management) Fulfillment Services Others |

| By End-User | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) D2C (Direct to Consumer) Others |

| By Delivery Method | Ground Shipping (Road/Rail) Air Freight Sea Freight Click & Collect / Pickup Points Others |

| By Packaging Type | Standard Packaging Eco-Friendly Packaging Custom Packaging Temperature-Controlled Packaging Others |

| By Technology Utilization | Automated Warehousing Real-Time Tracking Systems AI and Machine Learning Applications Robotics and Drones IoT-Enabled Logistics Others |

| By Customer Segment | Small and Medium Enterprises Large Corporations Startups Individual Consumers Others |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas North Northeast Central-West Southeast South Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 100 | Logistics Coordinators, Delivery Managers |

| Warehouse Management Solutions | 80 | Warehouse Supervisors, Operations Managers |

| Returns Processing in E-commerce | 60 | Customer Service Managers, Returns Analysts |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

| Technology Integration in Logistics | 50 | IT Managers, Logistics Technology Specialists |

The Brazil E-Commerce Logistics Services Market is valued at approximately USD 12.5 billion, reflecting significant growth driven by the expansion of online retail, consumer demand for faster delivery, and advancements in logistics infrastructure and technology.