Region:Middle East

Author(s):Shubham

Product Code:KRAA0946

Pages:100

Published On:August 2025

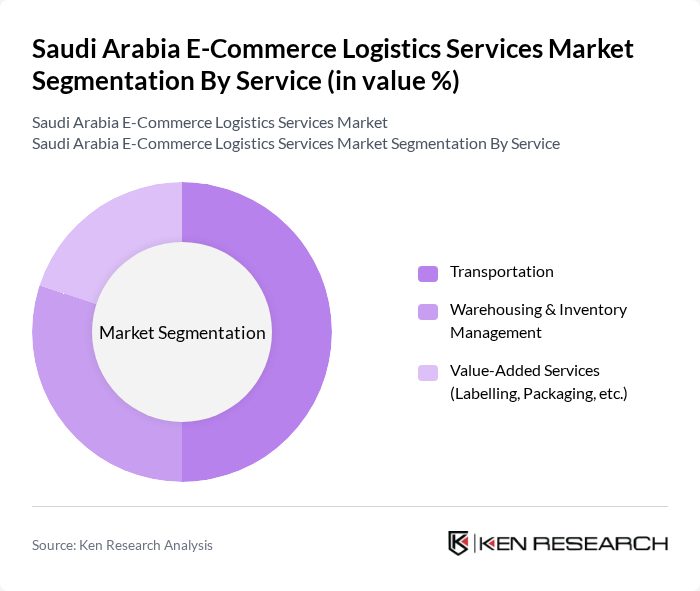

By Service:The market is segmented into three primary services: Transportation, Warehousing & Inventory Management, and Value-Added Services (Labelling, Packaging, etc.). Transportation is the most significant segment, driven by the increasing demand for fast and reliable delivery options. Warehousing & Inventory Management is expanding rapidly as businesses seek efficient storage solutions to manage growing inventories, with cold chain and specialized warehousing seeing heightened demand for food, pharmaceuticals, and electronics. Value-Added Services are gaining traction as companies look to enhance customer experience through personalized packaging, labeling, and last-mile innovations .

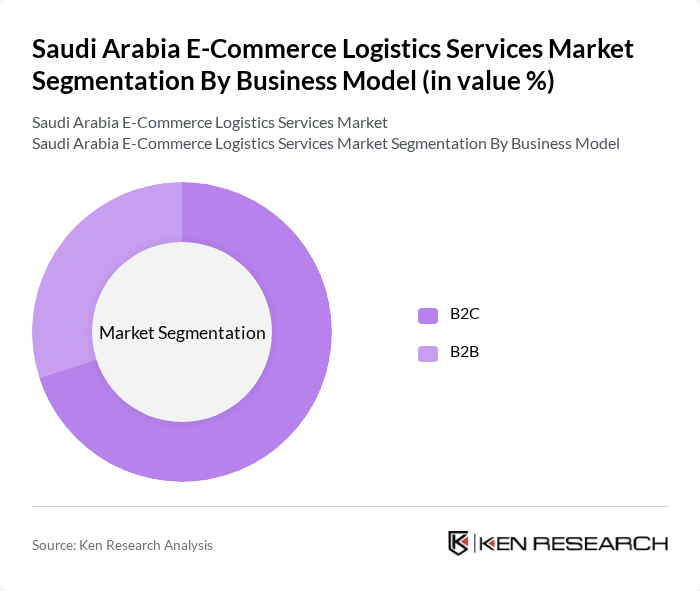

By Business Model:The market is divided into B2C and B2B models. The B2C segment is the leading model, driven by the surge in online shopping and consumer demand for convenience. B2B logistics is also significant, as businesses increasingly rely on e-commerce platforms for procurement and supply chain management. The growth of both models reflects the evolving landscape of commerce in Saudi Arabia, with B2C dominating due to the rapid expansion of online retail and last-mile delivery services .

The Saudi Arabia E-Commerce Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Express, FedEx Express, UPS, Saudi Post (SPL), Naqel Express, SMSA Express, Zajil Express, Shipa Delivery, ESNAD Express, Barq Express, AJEX Logistics, J&T Express, Fetchr, First Flight Couriers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia e-commerce logistics services market appears promising, driven by technological advancements and evolving consumer preferences. The integration of AI and automation in logistics operations is expected to enhance efficiency and reduce costs. Additionally, the growing emphasis on sustainability will likely lead to innovative practices in logistics, aligning with global trends. As the market matures, companies that adapt to these changes will be well-positioned to capitalize on emerging opportunities and meet consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Service | Transportation Warehousing & Inventory Management Value-Added Services (Labelling, Packaging, etc.) |

| By Business Model | B2C B2B |

| By Destination | Domestic International (Cross-Border) |

| By Product Category | Fashion and Apparel Consumer Electronics Home Appliances Furniture Beauty and Personal Care Products Other Products (Toys, Food Products, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 60 | Logistics Coordinators, Delivery Managers |

| Warehousing Solutions for E-commerce | 50 | Warehouse Managers, Operations Directors |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

| Returns Management in E-commerce | 45 | Customer Service Managers, Returns Specialists |

| Technology Integration in Logistics | 40 | IT Managers, Logistics Technology Specialists |

The Saudi Arabia E-Commerce Logistics Services Market is valued at approximately USD 2 billion, reflecting significant growth driven by increased online shopping and government initiatives aimed at enhancing digital transformation and logistics infrastructure.