Region:Central and South America

Author(s):Rebecca

Product Code:KRAA0361

Pages:96

Published On:August 2025

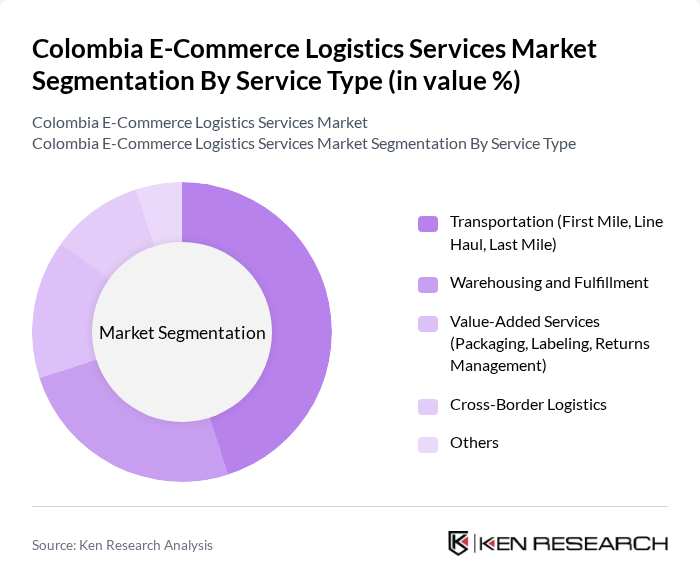

By Service Type:The service type segmentation includes categories such as Transportation (First Mile, Line Haul, Last Mile), Warehousing and Fulfillment, Value-Added Services (Packaging, Labeling, Returns Management), Cross-Border Logistics, and Others. Transportation remains the leading sub-segment, driven by the increasing demand for efficient, timely delivery solutions as e-commerce expands. Reliable transportation is critical for businesses to meet customer expectations in a competitive market .

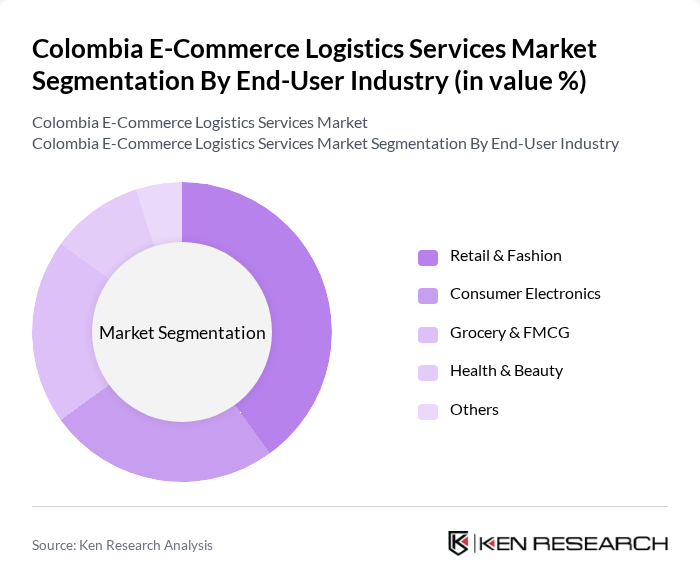

By End-User Industry:The end-user industry segmentation encompasses Retail & Fashion, Consumer Electronics, Grocery & FMCG, Health & Beauty, and Others. Retail & Fashion is the dominant segment, reflecting a significant shift toward online shopping, particularly during and after the pandemic. This trend has increased demand for logistics services capable of handling high order volumes efficiently and reliably .

The Colombia E-Commerce Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Servientrega, TCC, Coordinadora, DHL Express Colombia, FedEx Express Colombia, Envía, Interrapidísimo, Deprisa, Rappi, Mercado Libre (Mercado Envíos), Cargamos, J&T Express Colombia, Grupo Logístico TCC, DHL Supply Chain Colombia, and 99Minutos contribute to innovation, geographic expansion, and service delivery in this space.

The future of Colombia's e-commerce logistics services market appears promising, driven by technological advancements and evolving consumer preferences. As the demand for faster delivery options grows, logistics providers are likely to invest in innovative solutions such as automated warehouses and AI-driven route optimization. Additionally, the expansion of e-commerce into rural areas will create new logistical challenges and opportunities, necessitating adaptive strategies to meet diverse consumer needs while enhancing service efficiency.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation (First Mile, Line Haul, Last Mile) Warehousing and Fulfillment Value-Added Services (Packaging, Labeling, Returns Management) Cross-Border Logistics Others |

| By End-User Industry | Retail & Fashion Consumer Electronics Grocery & FMCG Health & Beauty Others |

| By Delivery Mode | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Others |

| By Transportation Mode | Road Air Rail Sea Others |

| By Technology Adoption | Real-Time Tracking Automated Warehousing Route Optimization Inventory Management Systems Others |

| By Customer Type | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) Others |

| By Geography | Bogotá Antioquia Valle del Cauca Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 100 | Logistics Coordinators, Delivery Managers |

| Returns Management in E-commerce | 60 | Customer Experience Managers, Operations Directors |

| Warehouse Management Solutions | 50 | Warehouse Managers, Supply Chain Analysts |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

| Technology Integration in Logistics | 50 | IT Managers, Logistics Technology Specialists |

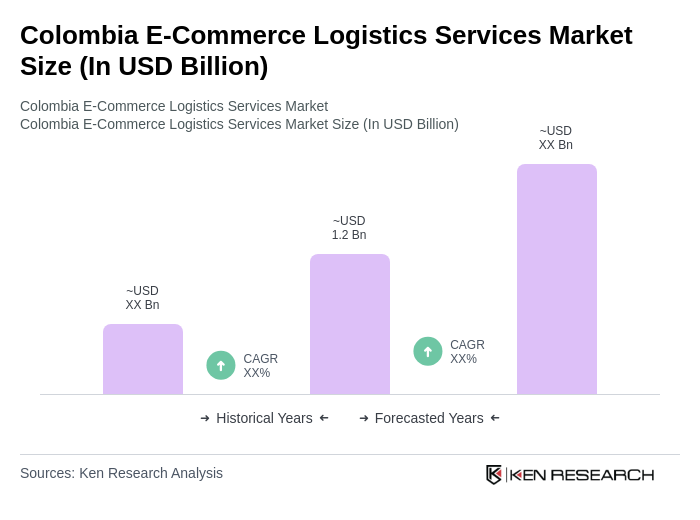

The Colombia E-Commerce Logistics Services Market is valued at approximately USD 1.2 billion, reflecting its significant role within the broader Latin American market, which is valued at around USD 6.3 billion.