Region:Africa

Author(s):Shubham

Product Code:KRAA1029

Pages:80

Published On:August 2025

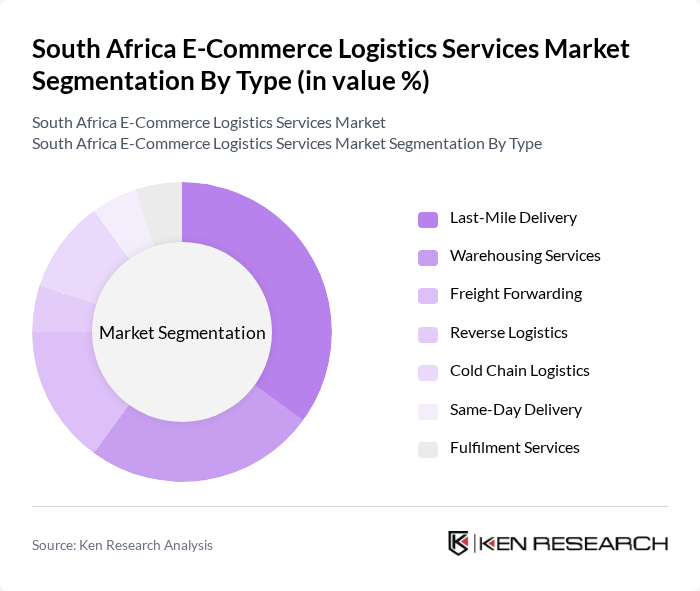

By Type:The logistics services market is segmented into various types, including Last-Mile Delivery, Warehousing Services, Freight Forwarding, Reverse Logistics, Cold Chain Logistics, Same-Day Delivery, and Fulfilment Services. Each of these segments plays a crucial role in ensuring efficient delivery and customer satisfaction. Last-Mile Delivery is particularly significant due to the increasing demand for quick and reliable delivery options, driven by consumer expectations for faster service and the expansion of domestic logistics networks into rural and township areas .

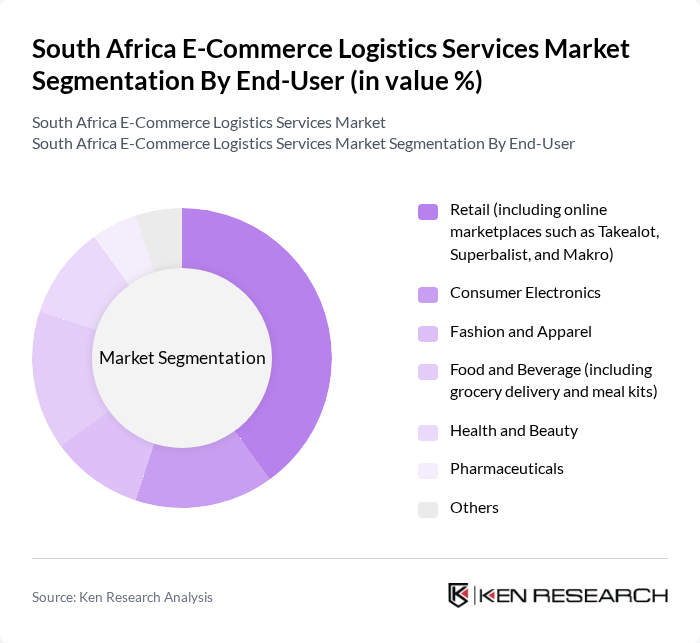

By End-User:The end-user segmentation includes Retail (including online marketplaces such as Takealot, Superbalist, and Makro), Consumer Electronics, Fashion and Apparel, Food and Beverage (including grocery delivery and meal kits), Health and Beauty, Pharmaceuticals, and Others. The retail sector, particularly online marketplaces, is the dominant segment, driven by the increasing number of consumers shopping online and the convenience offered by e-commerce platforms. Growth is further supported by rising mobile-only shoppers, expansion of digital payment options, and the entry of global fast-fashion marketplaces .

The South Africa E-Commerce Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, DPD Laser, The Courier Guy, Aramex South Africa, FedEx Express South Africa, MDS Collivery, Takealot Delivery Team (Mr D Logistics), Bidvest International Logistics, Imperial Logistics, RAM Hand-to-Hand Couriers, DSV South Africa, Barloworld Logistics, Kargo National, RTT Group, CourierIT contribute to innovation, geographic expansion, and service delivery in this space.

The South African e-commerce logistics market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As automation and AI integration become more prevalent, logistics efficiency is expected to improve, reducing operational costs. Additionally, the focus on sustainability will shape logistics strategies, with companies adopting eco-friendly practices. These trends will create a more agile and responsive logistics environment, catering to the evolving demands of consumers and enhancing overall service delivery in the e-commerce sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Warehousing Services Freight Forwarding Reverse Logistics Cold Chain Logistics Same-Day Delivery Fulfilment Services |

| By End-User | Retail (including online marketplaces such as Takealot, Superbalist, and Makro) Consumer Electronics Fashion and Apparel Food and Beverage (including grocery delivery and meal kits) Health and Beauty Pharmaceuticals Others |

| By Sales Channel | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) D2C (Direct-to-Consumer) Others |

| By Distribution Mode | Road Transport Air Transport Rail Transport Sea Transport Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Dynamic Pricing Subscription-Based Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Individual Consumers |

| By Service Level | Standard Delivery Express Delivery Scheduled Delivery Value-Added Services (e.g., installation, assembly, white-glove delivery) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 80 | Logistics Coordinators, Delivery Managers |

| Warehouse Management Solutions | 60 | Warehouse Supervisors, Operations Managers |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

| Returns Management Strategies | 40 | Customer Experience Managers, Returns Analysts |

| Technology Integration in Logistics | 50 | IT Managers, Logistics Technology Specialists |

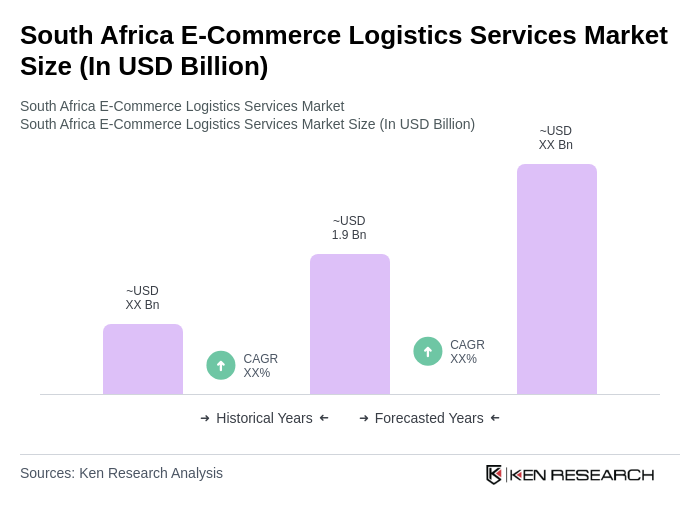

The South Africa E-Commerce Logistics Services Market is valued at approximately USD 1.9 billion, driven by the rapid growth of online retail, consumer demand for convenience, and advancements in logistics technology.