Region:Central and South America

Author(s):Shubham

Product Code:KRAA1766

Pages:95

Published On:August 2025

By Type:The fertilizers market in Brazil is segmented into various types, including nitrogen fertilizers, phosphate fertilizers, potassium fertilizers, blended and compound NPK, specialty fertilizers, organic and biofertilizers, and lime and soil conditioners. Among these, nitrogen fertilizers, particularly urea and ammonium nitrate, dominate the market due to their essential role in enhancing crop yields. The increasing adoption of high-yield crop varieties and the need for efficient nutrient management have further propelled the demand for nitrogen fertilizers.

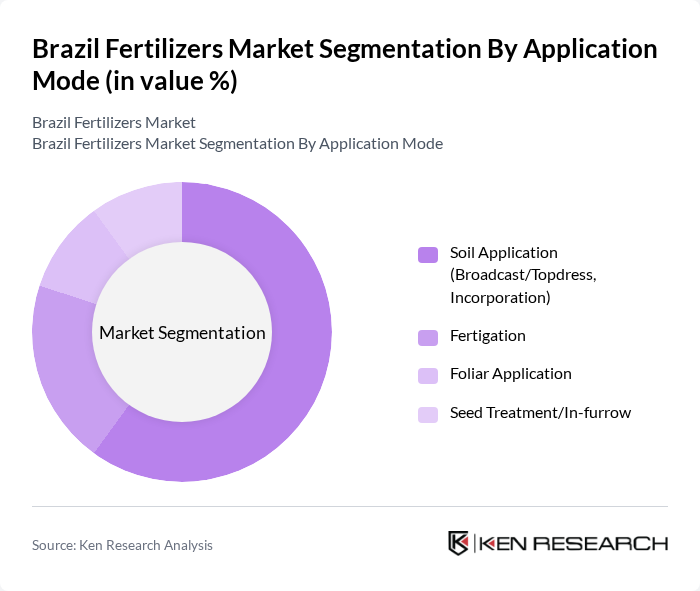

By Application Mode:The application modes for fertilizers in Brazil include soil application, fertigation, foliar application, and seed treatment/in-furrow. Soil application remains the most widely used method due to its simplicity and effectiveness in delivering nutrients directly to the root zone. The increasing adoption of advanced fertigation techniques, particularly in high-value crops, is also gaining traction, driven by the need for precision agriculture and efficient water use.

The Brazil Fertilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, Nutrien Ltd., The Mosaic Company, EuroChem Group AG, ICL Group Ltd., K+S Aktiengesellschaft (K+S AG), OCP Group, Compass Minerals América do Sul (ex-Heringer assets), Fertipar Fertilizantes, AgroGalaxy Participações S.A., Heringer (Indústria de Fertilizantes Heringer S.A.), EuroChem Fertilizantes Tocantins S.A., Yoorin Fertilizantes (Grupo Curimbaba), Timac Agro Brasil (Groupe Roullier), Fertilizantes Santa Helena (FSH) contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil fertilizers market is poised for significant transformation, driven by technological advancements and a shift towards sustainable agricultural practices. As precision agriculture gains traction, farmers are increasingly adopting data-driven approaches to optimize fertilizer use, enhancing efficiency and reducing waste. Additionally, the rising popularity of biofertilizers is expected to reshape the market landscape, offering eco-friendly alternatives that align with consumer preferences for sustainability. These trends indicate a dynamic future for the fertilizers sector in Brazil, with opportunities for innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen Fertilizers (Urea, Ammonium Nitrate/Ammonium Sulfate) Phosphate Fertilizers (MAP, DAP, SSP/TSP) Potassium Fertilizers (MOP/KCl, SOP) Blended and Compound NPK Specialty Fertilizers (Water-Soluble, Liquid, Controlled/Slow Release, Micronutrients) Organic and Biofertilizers Lime and Soil Conditioners |

| By Application Mode | Soil Application (Broadcast/Topdress, Incorporation) Fertigation Foliar Application Seed Treatment/In-furrow |

| By Crop Type | Soybean Corn (Maize) Sugarcane Coffee Cotton Fruits & Vegetables Pasture & Forage Others |

| By Distribution Channel | Direct Sales to Large Growers/Co-ops Regional Distributors and Retailers Online and Digital Platforms Others |

| By Region | North Region Northeast Region Central-West Region Southeast Region South Region Others |

| By Form | Conventional (Straight and Blended) Specialty (Water-Soluble, Controlled/Slow Release, Liquid) |

| By Packaging Type | Bulk (Big Bags, Loose) Bagged (25–50 kg) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 120 | Retail Managers, Store Owners |

| Agricultural Cooperatives | 100 | Cooperative Leaders, Procurement Officers |

| Crop-Specific Fertilizer Usage | 90 | Farmers, Agronomists |

| Fertilizer Distribution Channels | 80 | Logistics Managers, Supply Chain Coordinators |

| Government Policy Impact | 60 | Policy Makers, Agricultural Economists |

The Brazil Fertilizers Market is valued at approximately USD 3.1 billion, reflecting significant growth driven by the increasing demand for agricultural productivity, particularly for key crops like soybeans and corn.