Region:Global

Author(s):Rebecca

Product Code:KRAB0271

Pages:96

Published On:August 2025

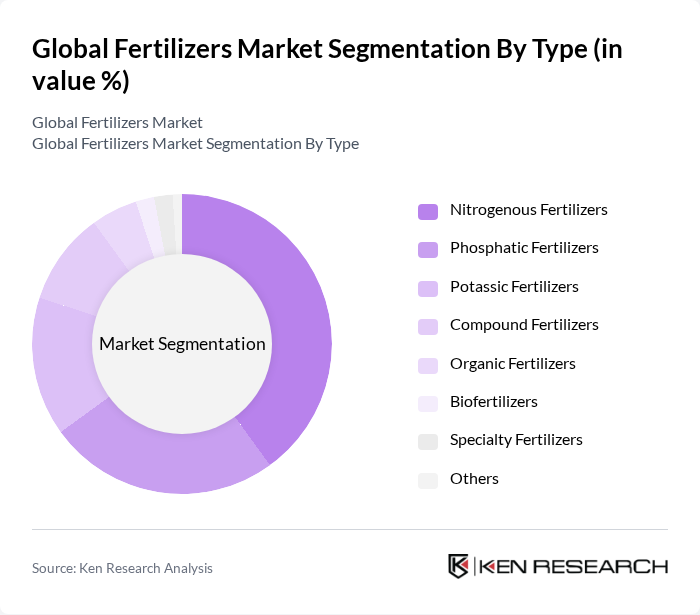

By Type:The fertilizers market is segmented into nitrogenous fertilizers, phosphatic fertilizers, potassic fertilizers, compound fertilizers, organic fertilizers, biofertilizers, specialty fertilizers, and others. Nitrogenous fertilizers dominate the market due to their essential role in enhancing crop yields and their widespread application in various agricultural practices. The increasing focus on food security, the need for higher agricultural productivity, and the adoption of advanced fertilizer technologies have led to a significant demand for nitrogenous fertilizers, making them the leading segment in the market.

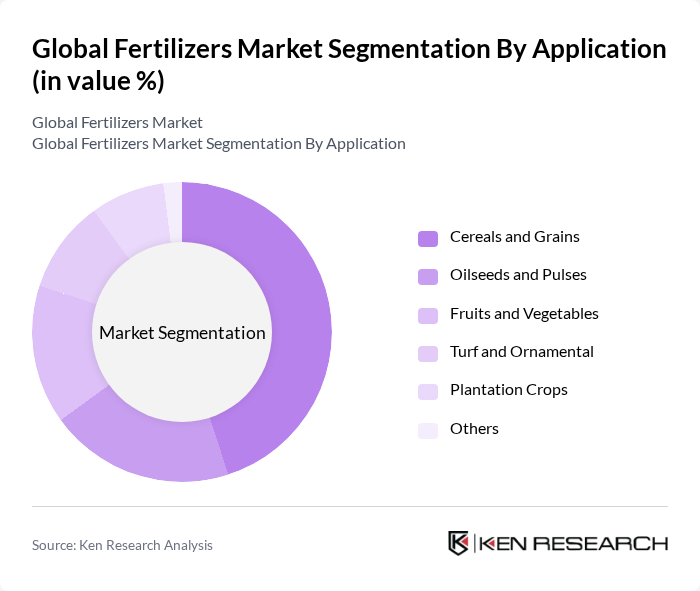

By Application:The application segment of the fertilizers market includes cereals and grains, oilseeds and pulses, fruits and vegetables, turf and ornamental, plantation crops, and others. Cereals and grains are the leading application segment, driven by the global demand for staple foods. The increasing population and changing dietary preferences have led to a surge in the cultivation of cereals, necessitating the use of fertilizers to enhance yield and quality. The adoption of precision agriculture and specialty fertilizers is also supporting the growth of this segment.

The Global Fertilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutrien Ltd., Yara International ASA, CF Industries Holdings, Inc., The Mosaic Company, OCP Group, ICL Group Ltd., K+S Aktiengesellschaft, EuroChem Group AG, Sinochem Holdings Corporation Ltd., Haifa Group, Acron Group, Sociedad Química y Minera de Chile S.A. (SQM), Uralchem JSC, PhosAgro PJSC, Coromandel International Limited, OCI N.V., Shandong Hualu Hengsheng Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fertilizers market in None is poised for transformation, driven by a shift towards sustainable agricultural practices and technological integration. As farmers increasingly adopt precision agriculture, the demand for customized fertilizer solutions is expected to rise. Additionally, the focus on eco-friendly fertilizers will likely create new market segments, fostering innovation and collaboration among industry players. These trends will shape the market landscape, ensuring resilience and adaptability in the face of evolving agricultural challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers Phosphatic Fertilizers Potassic Fertilizers Compound Fertilizers Organic Fertilizers Biofertilizers Specialty Fertilizers Others |

| By Application | Cereals and Grains Oilseeds and Pulses Fruits and Vegetables Turf and Ornamental Plantation Crops Others |

| By End-User | Agriculture (Commercial Farming) Horticulture Landscaping & Turf Management Home Gardening Others |

| By Distribution Channel | Direct Sales Retail Stores Online Sales Distributors/Dealers Cooperatives Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing Subsidized Pricing Others |

| By Packaging Type | Bulk Packaging Bagged Packaging Liquid Packaging Flexible Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Fertilizer Usage | 120 | Farmers, Agronomists |

| Fertilizer Distribution Channels | 90 | Distributors, Retail Managers |

| Fertilizer Innovation and R&D | 60 | Research Scientists, Product Development Managers |

| Government Policy Impact | 50 | Policy Makers, Agricultural Economists |

| Sustainability Practices in Fertilizer Use | 70 | Sustainability Officers, Environmental Consultants |

The Global Fertilizers Market is valued at approximately USD 200 billion, driven by factors such as increasing global food demand, advancements in fertilizer technology, and a focus on sustainable agricultural practices.