Region:Asia

Author(s):Dev

Product Code:KRAA2192

Pages:85

Published On:August 2025

By Type:The fertilizers market can be segmented into various types, including nitrogen-based, phosphorus-based, potassium-based, compound/complex, organic, specialty fertilizers, and others. Each type serves specific agricultural needs, with nitrogen-based fertilizers being the most widely used due to their essential role in plant growth and development. Nitrogen fertilizers, such as urea and ammonium sulfate, are critical for staple crops, while phosphorus and potassium fertilizers support root development and plant resilience. Compound/complex fertilizers (NPK blends) provide balanced nutrition, and organic fertilizers are increasingly adopted for sustainable farming. Specialty fertilizers, including micronutrients and slow/controlled release formulations, address specific crop requirements and soil deficiencies.

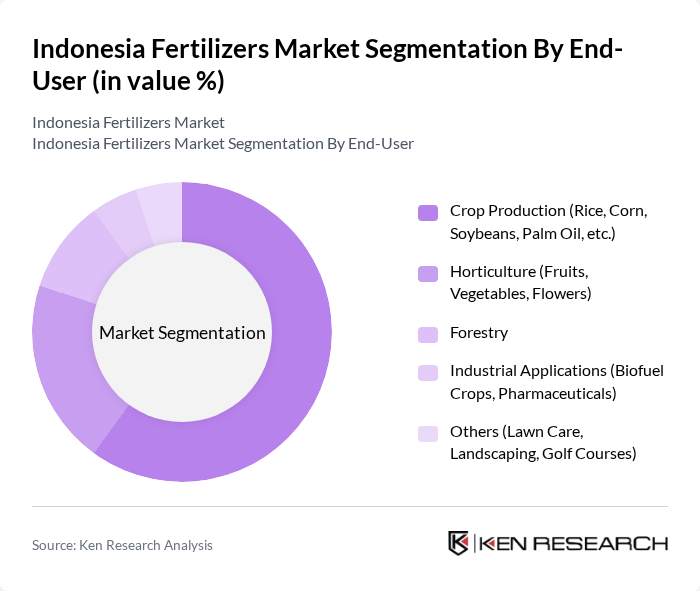

By End-User:The end-user segmentation includes crop production, horticulture, forestry, industrial applications, and others. Crop production is the leading segment, driven by the high demand for staple crops such as rice, corn, soybeans, and palm oil, which are essential to Indonesia's economy and food security. Horticulture, including fruits, vegetables, and flowers, is expanding due to rising consumer demand and export opportunities. Forestry and industrial applications, such as biofuel crops and pharmaceuticals, represent niche segments, while lawn care and landscaping are emerging end-users in urban areas.

The Indonesia Fertilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Pupuk Indonesia (Persero), PT Petrokimia Gresik, PT Pupuk Kalimantan Timur (Pupuk Kaltim), PT Pupuk Sriwidjaja Palembang (Pusri), PT Pupuk Kujang, PT Yara Indonesia, PT Hextar Fertilizer Indonesia, PT Indorama Fertilizer, PT Sumber Cahaya Sukses, PT Saraswanti Anugerah Makmur Tbk, PT Multi Nitrotama Kimia, PT Meroke Tetap Jaya, PT Agrifert Lestari, PT Pupuk Iskandar Muda, PT Cipta Agro Nusantara contribute to innovation, geographic expansion, and service delivery in this space. These companies are investing in production capacity, distribution networks, and research & development to address evolving market demands and sustainability requirements.

The Indonesia fertilizers market is poised for significant transformation as it adapts to evolving agricultural practices and regulatory frameworks. With a strong emphasis on sustainable agriculture, the adoption of precision farming techniques is expected to rise, enhancing efficiency and productivity. Additionally, the integration of digital platforms for sales and distribution will likely streamline operations, making fertilizers more accessible to farmers. These trends indicate a shift towards a more resilient and innovative market landscape, fostering growth and sustainability in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen-Based Fertilizers (Urea, Ammonium Nitrate, Ammonium Sulfate) Phosphorus-Based Fertilizers (Superphosphates, MAP, DAP) Potassium-Based Fertilizers (Potash, SOP, MOP) Compound/Complex Fertilizers (NPK Blends) Organic Fertilizers (Compost, Manure, Biofertilizers) Specialty Fertilizers (Micronutrients, Secondary Nutrients, Slow/Controlled Release) Others (Secondary Nutrient Fertilizers, Micronutrient Fertilizers) |

| By End-User | Crop Production (Rice, Corn, Soybeans, Palm Oil, etc.) Horticulture (Fruits, Vegetables, Flowers) Forestry Industrial Applications (Biofuel Crops, Pharmaceuticals) Others (Lawn Care, Landscaping, Golf Courses) |

| By Application | Soil Application Foliar Application Fertigation Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Others |

| By Packaging Type | Bulk Packaging Bagged Packaging Liquid Packaging Others |

| By Price Range | Low Price Mid Price High Price |

| By Brand Loyalty | Brand Loyal Customers Price Sensitive Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 150 | Retail Managers, Store Owners |

| Agricultural Input Suppliers | 100 | Supply Chain Managers, Procurement Officers |

| Farmers' Fertilizer Usage | 150 | Smallholder Farmers, Commercial Farmers |

| Government Agricultural Policy Impact | 80 | Policy Makers, Agricultural Economists |

| Fertilizer Manufacturers Insights | 70 | Production Managers, R&D Directors |

The Indonesia Fertilizers Market is valued at approximately USD 8.95 billion, driven by increasing agricultural productivity demands and government initiatives aimed at enhancing food security and sustainable farming practices.