Region:Asia

Author(s):Rebecca

Product Code:KRAA2126

Pages:91

Published On:August 2025

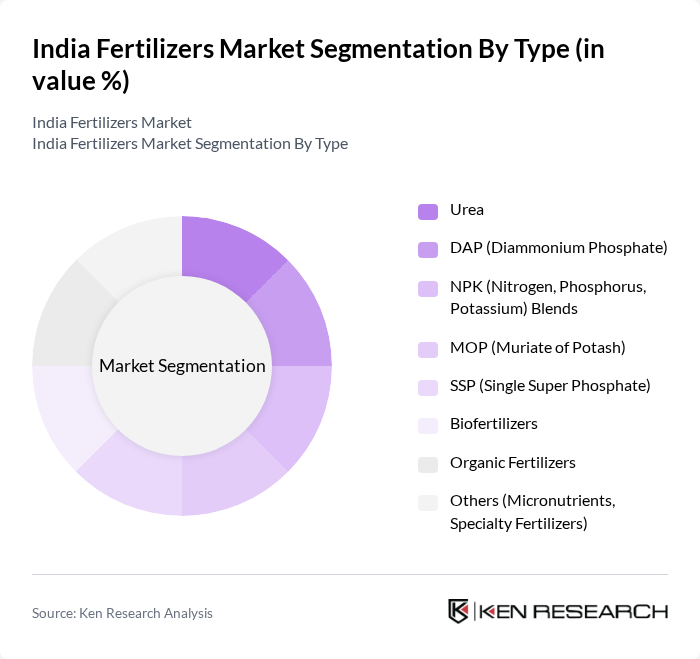

By Type:The market can be segmented into various types of fertilizers, including Urea, DAP (Diammonium Phosphate), NPK (Nitrogen, Phosphorus, Potassium) Blends, MOP (Muriate of Potash), SSP (Single Super Phosphate), Biofertilizers, Organic Fertilizers, and Others (Micronutrients, Specialty Fertilizers). Among these, Urea remains the most widely used fertilizer due to its high nitrogen content, which is essential for plant growth and is heavily subsidized by the government. The adoption of NPK blends is increasing, driven by the need for balanced nutrition in horticulture and cash crops. Biofertilizers and organic fertilizers are witnessing rising demand, particularly in organic farming clusters and for export-oriented production .

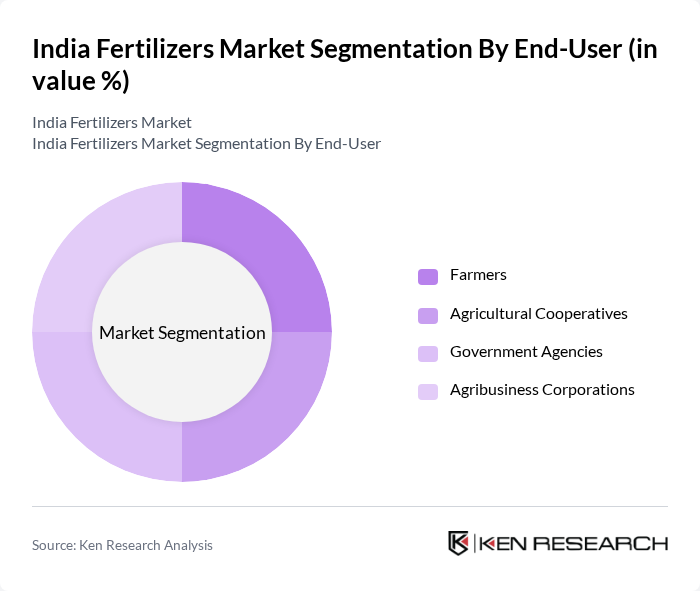

By End-User:The end-user segmentation includes Farmers, Agricultural Cooperatives, Government Agencies, and Agribusiness Corporations. Farmers represent the largest segment, accounting for the majority of fertilizer consumption due to their direct involvement in crop production. Agricultural cooperatives facilitate bulk purchases and distribution among local farmers, while government agencies play a key role in policy-making and subsidy allocation. Agribusiness corporations are increasingly involved in contract farming and supply chain management, driving demand for specialty and value-added fertilizers .

The India Fertilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Indian Farmers Fertiliser Cooperative Limited (IFFCO), National Fertilizers Limited (NFL), Rashtriya Chemicals and Fertilizers Limited (RCF), Tata Chemicals Limited, Coromandel International Limited, Chambal Fertilisers and Chemicals Limited, Zuari Agro Chemicals Limited, Deepak Fertilisers and Petrochemicals Corporation Limited, Gujarat State Fertilizers & Chemicals Limited (GSFC), Nagarjuna Fertilizers and Chemicals Limited, Paradeep Phosphates Limited, Madras Fertilizers Limited, Mangalore Chemicals & Fertilizers Limited, Fertilizers and Chemicals Travancore Limited (FACT), Rallis India Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India fertilizers market appears promising, driven by increasing agricultural productivity and government initiatives. The shift towards precision agriculture and sustainable practices is expected to reshape the industry landscape. In future, the adoption of digital platforms for sales and marketing is projected to increase by35%, enhancing farmer engagement. Additionally, the growing demand for biofertilizers and eco-friendly products will likely create new avenues for growth, aligning with global sustainability trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Urea DAP (Diammonium Phosphate) NPK (Nitrogen, Phosphorus, Potassium) Blends MOP (Muriate of Potash) SSP (Single Super Phosphate) Biofertilizers Organic Fertilizers Others (Micronutrients, Specialty Fertilizers) |

| By End-User | Farmers Agricultural Cooperatives Government Agencies Agribusiness Corporations |

| By Region | North India South India East India West India |

| By Application | Crop Production Horticulture Gardening and Landscaping Others (Plantation Crops, Floriculture) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms Distributors/Dealers |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 150 | Retail Managers, Store Owners |

| Agricultural Input Suppliers | 100 | Supply Chain Managers, Procurement Officers |

| Farmers' Fertilizer Usage | 140 | Smallholder Farmers, Large-scale Farmers |

| Government Policy Impact | 80 | Policy Makers, Agricultural Economists |

| Fertilizer Manufacturing Insights | 70 | Production Managers, Quality Control Analysts |

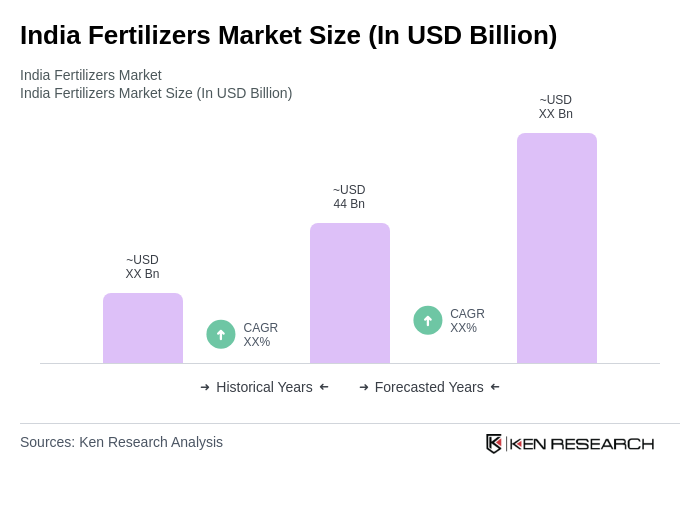

The India Fertilizers Market is valued at approximately USD 44 billion, driven by increasing food production demands due to population growth, urbanization, and dietary changes, alongside government support and technological advancements in agriculture.