Region:Central and South America

Author(s):Dev

Product Code:KRAB3054

Pages:89

Published On:October 2025

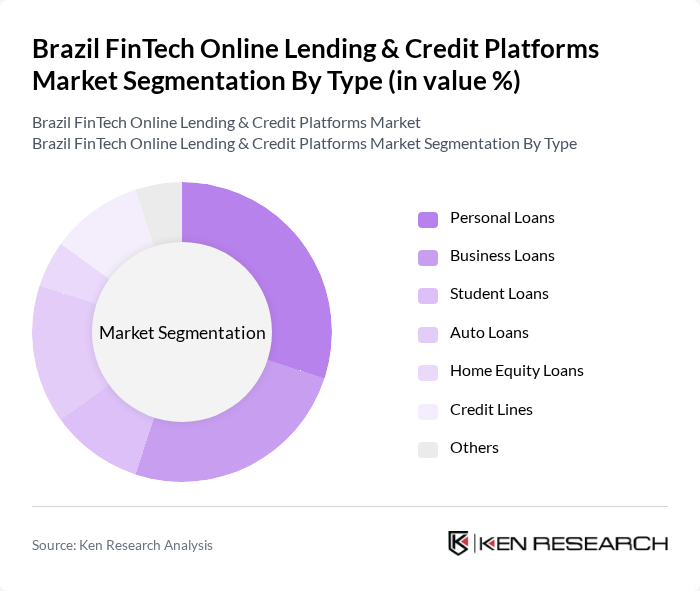

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Equity Loans, Credit Lines, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse financial requirements of the Brazilian population.

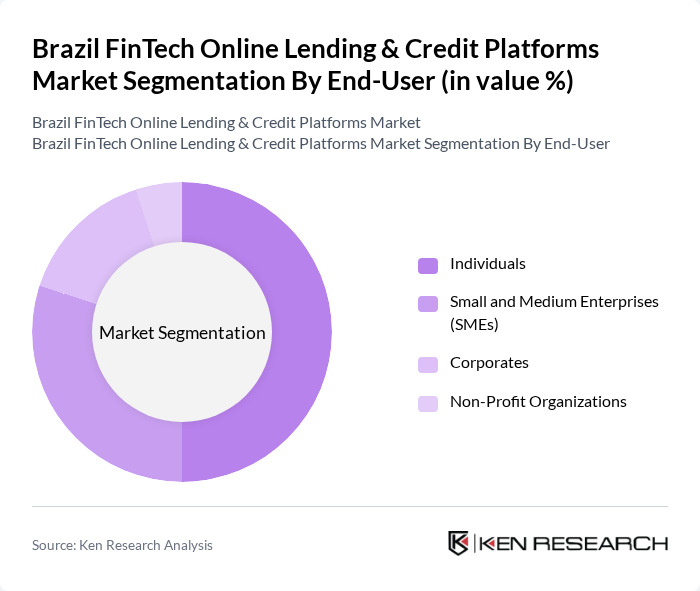

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, and Non-Profit Organizations. Each segment has unique financial needs, with individuals seeking personal loans and SMEs looking for business financing to support their growth.

The Brazil FinTech Online Lending & Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nubank, Creditas, Geru, Banco Inter, B2W Digital, Lendico, Simplic, Kiva, PagSeguro, PicPay, Banco Original, Acesso, FinanZero, Olé Consignado, C6 Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's FinTech online lending market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more consumers are likely to embrace online lending solutions. Additionally, the integration of artificial intelligence in credit scoring will enhance risk assessment, allowing lenders to offer tailored products. The ongoing development of regulatory frameworks will also support innovation while ensuring consumer protection, fostering a more stable lending environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Equity Loans Credit Lines Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Loan Purpose | Debt Consolidation Home Improvement Medical Expenses Travel Expenses |

| By Credit Score Range | Low Credit Score Medium Credit Score High Credit Score |

| By Loan Amount | Micro Loans Small Loans Medium Loans Large Loans |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions |

| By Customer Segment | Millennials Gen X Baby Boomers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Online Lending Usage | 150 | Individual Borrowers, Credit Users |

| Small Business Lending Insights | 100 | Small Business Owners, Financial Managers |

| Regulatory Impact on FinTech | 80 | Regulatory Officials, Compliance Officers |

| Investment Trends in FinTech | 70 | Venture Capitalists, Financial Analysts |

| Consumer Attitudes Towards Credit Platforms | 120 | General Consumers, Financial Advisors |

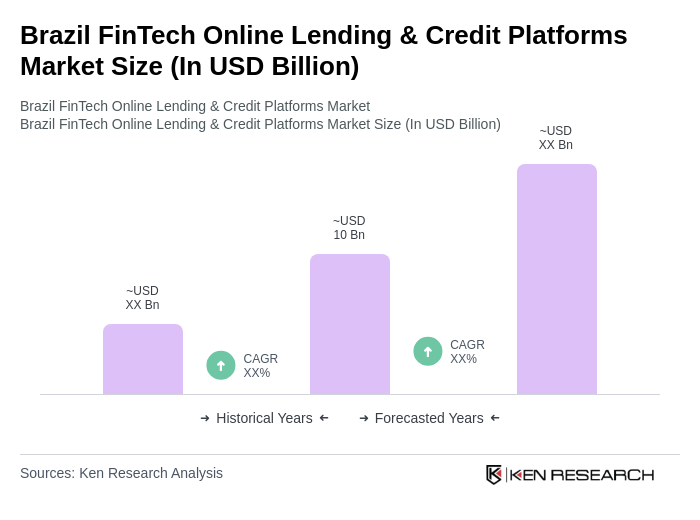

The Brazil FinTech Online Lending & Credit Platforms Market is valued at approximately USD 10 billion, reflecting significant growth driven by the demand for accessible credit solutions and the rise of digital banking in the country.