Region:Central and South America

Author(s):Shubham

Product Code:KRAA0927

Pages:100

Published On:August 2025

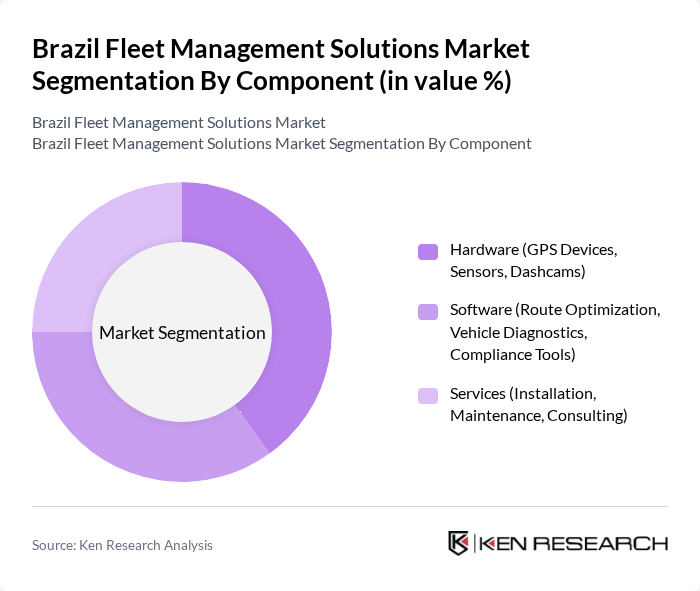

By Component:The components of fleet management solutions include hardware, software, and services. Hardware encompasses GPS devices, sensors, and dashcams, while software includes route optimization, vehicle diagnostics, and compliance tools. Services cover installation, maintenance, and consulting, which are essential for effective fleet management .

The hardware segment, particularly GPS devices and sensors, holds a leading share in the market due to the increasing need for real-time tracking and monitoring of vehicles. Fleet operators are investing in advanced hardware to enhance operational efficiency and ensure safety. The growing trend of data-driven decision-making in fleet management further propels the demand for sophisticated hardware solutions. Software solutions, while significant, are often integrated with hardware to provide comprehensive fleet management capabilities, making hardware the leading subsegment .

By Solution Type:The solution types in fleet management include GPS tracking solutions, fuel management systems, driver behavior monitoring, route optimization tools, vehicle maintenance management, regulatory compliance solutions, and others. Each solution type addresses specific challenges faced by fleet operators, enhancing overall efficiency and safety .

GPS tracking solutions lead the market due to their critical role in enhancing fleet visibility and operational efficiency. Fleet operators prioritize real-time tracking to optimize routes, reduce fuel consumption, and improve delivery times. Fuel management systems are also gaining traction as companies seek to control costs and monitor fuel usage effectively. The integration of driver behavior monitoring and route optimization tools further supports the trend towards data-driven fleet management, making GPS tracking the most significant solution type .

The Brazil Fleet Management Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Golsat, Sascar (Michelin Connected Fleet), Omnilink, Autotrac, Pointer by PowerFleet, Geotab, Gurtam, Verizon Connect, Fleet Complete, Trimble, Webfleet (Bridgestone), Omnicomm, OnixSat, Cobli, TomTom Telematics contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's fleet management solutions market appears promising, driven by technological advancements and evolving consumer preferences. As companies increasingly prioritize sustainability, the adoption of electric vehicles is expected to rise, supported by government incentives. Additionally, the integration of AI and machine learning into fleet management systems will enhance operational efficiency and safety. These trends indicate a shift towards more innovative and eco-friendly solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (GPS Devices, Sensors, Dashcams) Software (Route Optimization, Vehicle Diagnostics, Compliance Tools) Services (Installation, Maintenance, Consulting) |

| By Solution Type | GPS Tracking Solutions Fuel Management Systems Driver Behavior Monitoring Route Optimization Tools Vehicle Maintenance Management Regulatory Compliance Solutions Others |

| By End-User Industry | Transportation and Logistics Construction Mining Retail & Distribution Public Sector (Government, Municipal Fleets) Healthcare Others |

| By Fleet Size | Small Fleets (Less than 100 vehicles) Medium Fleets (100-500 vehicles) Large Fleets (500+ vehicles) |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Mode of Transport | Heavy Commercial Vehicles Light Commercial Vehicles Passenger Cars |

| By Vehicle Type | Internal Combustion Engine Vehicles Electric Vehicles |

| By Lease Type | On-Lease Without Lease |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Light Vehicle Fleet Management | 100 | Fleet Managers, Operations Directors |

| Heavy-Duty Fleet Solutions | 60 | Logistics Coordinators, Fleet Supervisors |

| Telematics and Tracking Systems | 50 | IT Managers, Technology Officers |

| Fleet Maintenance Services | 40 | Maintenance Managers, Procurement Specialists |

| Fuel Management Solutions | 70 | Finance Managers, Sustainability Officers |

The Brazil Fleet Management Solutions Market is valued at approximately USD 1.0 billion, reflecting a significant growth driven by the demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.